Agribusiness News May 2023 – Arable

1 May 2023World market outlook

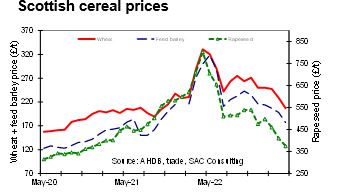

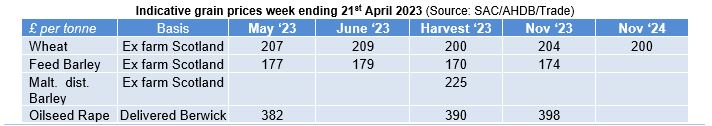

UK nearby wheat prices have dropped £12/t in the last month and £25/t in the last 3 months. This reflects bearish global factors and the slow pace of UK cereal exports and rising domestic grain stocks.

The Black Sea remains an important determinant of global wheat prices. Russia’s threat to block the grain export deal with Ukraine has combined with local import bans from Ukraine’s neighbouring EU states to put Ukraine grain exports at risk. Potentially reducing grain supply on the world market and supporting prices. Whether these issues are short lived or not remains to be seen. That aside, large cereal crops in Australia and Brazil have boosted nearby supply coupled to high stocks in other exporters have kept export competition strong and undermined prices. Market attention is increasingly turning to new crop potential for direction.

World harvest estimates for 2023

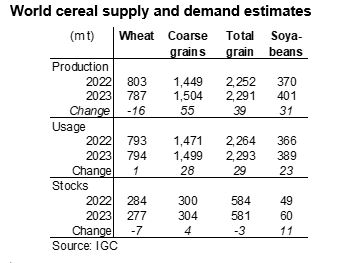

In their latest estimates, the International Grains Council (IGC) see a large increase in cereal production in 2023 (+55mt), a smaller increase in usage (+28mt) with stocks still set to decline marginally (-3mt). The big changes include a large increase in maize and coarse grain production and a fall in wheat output. A huge increase in soyabean output and rising soyabean stocks are expected to see a strong rise in oilseeds stocks.

Looking at global crop conditions, currently there are no major problems and spring sowings are going

well, but three to four months of key growing conditions remain in the Northern Hemisphere.

US - drought in the southern US Plains – but wheat area up 9% and conditions good in main regions further north with maize sowings going well.

Europe - dry winter and spring – but crop conditions ok so far, time remains for rain.

UK - crops in good conditions, dry winter but wet March means soil moisture levels good.

UK export focus in 2023

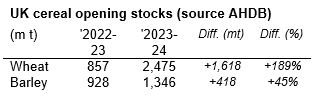

In their March UK cereal S&D estimate, AHDB increased UK cereal opening stocks for the new season 2023/24 by between 45% (barley) and 189% (wheat). Irrespective of UK cereal crop yields in 2023, the market will start the season well supplied and with the highest opening stocks since 2016.

While local factors could be over-ridden at any time by wider global weather and political events, it looks likely that the UK will have to achieve a strong level of exports next season for both wheat and barley.

- High stocks mean the UK will have to remain export competitive most of the time next season for both wheat and barley.

- Increased harvest price pressure expected - sell ahead grain you can’t store past harvest.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service