Agribusiness News November 2022 – Beef

1 November 2022Welcome lift in prices

The last few weeks of October have provided welcome news to many beef finishers as prices begin to rise as processors start to look a little bit harder for prime cattle to kill ahead of Christmas. With the main Christmas killing period being from early Nov to early Dec it is not unexpected that the prices have risen. It has been well documented that many processors kill numbers have been boosted in recent months by cull cows and now as they must fill their chills with prime beef for the festive period, the pressure is on to find enough prime cattle.

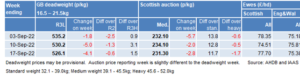

For the week ended 15th October 2022 the R4L price for Scotland was 457.2p/kg. Whilst it is good to see a lift in the beef price when producers are facing ever rising input prices, it is hard to remain optimistic that this rise in price will be sustained post-Christmas.

Shopping habits

Food inflation combined with energy cost rises and increasing interest rates are putting pressure on consumers budgets and this is resulting in shoppers buying less beef per shopping trip. This is borne out by the Kantar data for consumer spending for the 52 weeks ending 2nd October; although year on year consumer spending on beef appears to be up 1.1% year on year, factoring in the that the average price of beef has risen by 10.5%; in reality consumers have reduced the amount of beef they have bought over the past year by a staggering 11%.

Cull cow trade

Although still strong, the cull cow trade has started to dip back as Spring calving herds start to PD and house cattle resulting in more numbers becoming available, alongside, in the run up to Christmas, processors shifting towards prime beef.

While in the face of current economic pressures on consumers, the demand for manufactured beef is expected to remain strong into next year; the well documented challenge to this is the continued reduction in the Scottish breeding herd and the effect that has on overall critical mass. Looking at slaughter data for Scotland for January – September 2022, 7% more cows were slaughtered compared to the same period for 2021. More worryingly when we look at July, August, and September 2022, in those three months alone we have killed 14% more than those three months in 2021.

Store cattle and weaned calves

The common theme for both forward stores and weaned calves at the recent store sales is that well fed and well-bred cattle continue to be cashed easily, with prices at a similar level to last year and 10-15% above the five-year average, with weathered, leaner, and lighter cattle being more difficult as finishers weigh up the cost of feed to get those leaner types moving.

Those with stores to sell this backend need to weigh calves at weaning. In in some areas calf weaned weights may be lighter than last year due to the adverse summer weather. West coast weaned calf sales in recent weeks – Oban Bullocks averaged £673; heifers averaged £586. Dalmally bullocks averaged £708, heifers £615.

As weight of calves is driving demand in the sale ring; it is important to review feeds available and analyse silages to work out if there is potential to put weight on calves before selling, however, be mindful of costs and whether you may just be better off selling now.

Bull Sales

Autumn bull sales have passed with reasonable results for most breeds, with the continental breeds achieving higher clearance rates than some of the native breeds. Some top prices were being paid by pedigree breeders and there were strong prices for the best commercial bulls, showing a level of confidence from the commercial breeders. Compared to October 202, only 7 less bulls were sold between the four mains breeds at Stirling this year.

lesley.wylie@sac.co.uk , 01307 464033

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service