Agribusiness News November 2022 – Cereals and Oilseeds

1 November 2022World Stocks to Use Ratio Falling

World grain production is forecast to fall below consumption for the fifth year in a row. This has resulted in global grain stocks to use ratios falling to the lowest levels in 10 years. Stocks as a share of supply are expected to fall by 4 days to 96 days of supply – representing a fall of 18 days since the highs in 2016. On an historic basis, these stocks:use ratios are not particularly low with values in the 70 days being seen in the past. However, the big difference now is in the countries holding these stocks; and today it is China that is responsible for an unprecedentedly high share of global grain stocks. The stocks left with major exporters are at a low level, and it these that drive pricing.

The global stocks:use ratio above all else is the most important factor underpinning price direction in global grain markets. While day to day supplies may be sufficient, the market becomes very sensitive to:

- Adverse weather in major producing regions,

- The planting decisions of farmers at key points – the next major one being US spring sowings,

- Political or economic shocks.

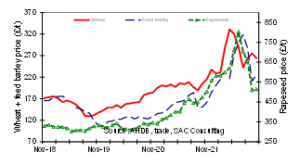

This all means volatility – witnessed by big swings in global and UK grain prices in response to the escalation of the war in Ukraine earlier in October.

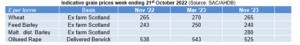

For farmers, this creates risks and opportunities – large price swings will occur and during the highs there are currently, and will soon be, more opportunities to sell grain at a profitable level, both crops in the shed and in the ground. Just be aware that these opportunities come and go, and it is important to recognise profitable sales opportunities and sell a proportionate % as the year develops. Winter crops in the ground can be sold for November 2023 at similar prices to current markets; this is an unusual situation and indicates market concern about future supply. Current forward wheat prices in Scotland are the same as spot values at around £265/t ex-farm for wheat. Forward rapeseed prices are around £20/t lower at £535/t ex-farm.

Key drivers and decisions

The level of UK grain exports – the UK has an increased surplus of wheat and barley this season for export – weakness in sterling has got the season off to a good start – global market direction key.

Russia / Ukraine – Russia has a large wheat surplus and needs cash to fund its war – the UN agreement to allow Ukraine wheat exports ends on 20 November – will the Russians renew? If not, expect a sharp rise in grain prices as this would also jeopardise Russian exports – as shipping and insurance agreements also benefit Russian exports.

Canada has a large cereal crop – this is putting pressure on oat and other markets.

South American weather – dry conditions causing difficulties for spring crops in Argentina, but more favourable in Brazil. The next few months will be crucial in deciding output and soya and maize prices.

US spring planting window – while this is nearly 6 months away, what US farmers decide to plant is the single biggest crop decision the world’s farmers make. Markets will increasingly focus on this period and the absolute and relative price of maize and soya. Anything short of a record soya and maize crop in South American in the spring will cause market tensions to rise. Keep a close eye on this as it may create selling opportunities before US planting is completed.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service