Agribusiness News October 2022 – Cereals

30 September 2022Global grains consumption set to fall

At 2,256Mt, the forecast for 2022/23 world total grains (wheat and coarse grains) output has lifted by 8Mt, month-on-month, as increases for wheat and barley (mainly for Russia, Canada and Australia) more than compensate for a downgraded US maize output. Production is forecast 2% below the previous season’s record, with year-on-year declines for maize (-51Mt) contrasting with increases for wheat (+10Mt) and barley (+3Mt).

With the global consumption outlook still projecting to decline for the first time since 2015/16, and larger than previously estimated carry-ins pairing this with the upgraded production figure, expectation is currently for a 10Mt uplift to closing stocks mostly relating to a revision for Russia. This ‘record-breaking’ Russian crop, now estimated to be in the region of 99Mt (47Mt of which is exportable), will have the potential to weigh on the global market going forward, especially if demand subdues substantially due to recession and subsequent demand-destruction.

Total grains: Supply and demand summary (source ICG).

There is still a lot to play out for this marketing year from a supply point of view with Southern Hemisphere crops still developing.

Although UK feed wheat futures (Nov-22) have come down from the highs seen in May, they have found a foundation at a level that hasn’t dropped below £250.00/t since July. The political and economic sentiment demonstrated by UK government in recent weeks has fuelled increased volatility; UK feed wheat futures (Nov-22) have traded within a £35.00/t range in just 60 days, and Nov-22 futures closed at £292.50/t, (29th Sept) currently the highest closing price recorded for the contract since the start of July.

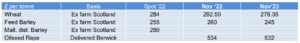

Scottish malt barley suits distillers

Whilst there have been many positives reported surrounding the Scottish wheat harvest buyers have indicated that on reflection the winter barley harvest has been a little disappointing, with nitrogen levels slightly higher than expected. Retention, too, has provided some issues with screenings 5.0% higher than normal. Yield reports from growers have been favourable though, with slightly above average yields although movement off farm has been slow in the face of subdued consumer demand. Malting barley crops in general have produced ideal nitrogen levels for the distilling market. Yields too have been pleasing for many growers with an ‘above average’ consensus holding. There has been very little demand for feed or malting barley either in the domestic or export markets and there seems to be ample malting supplies for the rest of this year which is seeing the discount between feed wheat and feed barley widening again.

UK malting barley is at a premium over Scandinavian barley. This is due to Danish malting barley being perceived to be too low in nitrogen and the UK’s quality deemed more suitable for brewing demand.

The oat market is struggling to follow the price increases seen in other grain markets due to the strong bounce in global oat production. Canada is forecasting the second-largest crop on record and Europe is seeing a wide availability of good quality milling oats. The UK oat market remains flat for the moment.

Matif rapeseed continues to make gains, with the Nov ’22 contract gaining €4.50 to settle at €607.25, and the Feb ’23 contract at €613. With ample global supply of rapeseed/canola this season and relatively in-elastic demand, the soyabean market will have a greater influence on rapeseed prices once again this season and heads will be turned to the US and South American crops over the next 6 months.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service