Agribusiness News September 2023 – Cereals

1 September 2023Tentative firming of markets

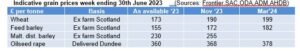

Whilst the wheat Futures market has recently reflected escalations in the Black Sea region conflict, notably the drone attacks in the Danube and Odessa regions and the consequential risk to sea freight, latterly the focus has turned to US weather and its potential impact on global prices. The markets have managed to firm over the last fortnight on the back of these dry weather concerns particularly relating to US spring crops and speculation of lower Australian and Canadian production has also provided some buying impetus to the market. London feed wheat Nov 23 Futures stood at £190.85 on 24th August, up 2.11% since the 16th of August.

The EU markets followed the trend trading slightly higher week on week. EU wheat exports have got off to a slow start this season, down 20% at just over 4Mt as demand for EU supplies remains limited. Russian crop estimates continue to rise and so therefore does the export potential, which may be pertinent as there is increased talk of an Indian / Russian trade deal due to a weather-related lower crop on the Indian sub-continent.

The EU wheat harvest tonnage output has been cut to 124.73Mt which is 5Mt lower than previous estimates due to weather issues, especially in France. Germany has some sprouting problems in fields still to be cut due to the ongoing wet weather and they normally export a lot of bread making wheat to the UK. These two countries along with Canada accounted for nearly 70% of UK imports last season and consequently could bolster milling premiums for UK growers that do manage to meet specification.

Scotland’s harvest progress

A frustrating and difficult harvest so far; any milling wheat is reported as very variable with 12% protein and sub 10% protein common in Group 1 & 2 varieties respectively and Hagberg’s struggling where crops have been lodged. Distilling wheats need high starch levels relative to protein so good grain specific weight is desirable, some may struggle at 72kg/hl. The spring barley crop is proving troublesome too, with secondary tiller growth resulting in uneven ripening and desiccation will be delayed into September for some as a result.

So far there has been mixed feedback for any spring barley harvested; screenings are ranging from 5-20%, skinning is in evidence and there are concerns over grain germination capacity.

However, maltsters are reluctant to change their specifications for quality before the bulk of the spring barley harvest is in the shed and can be assessed. In summary premiums are very strong and look overvalued amid low demand and at these levels the market is quickly finding the flexibility to fill in any supply side issues, the EU for example, sourcing 6 -row varieties from France into northern Europe. For UK growers it’ll be essential, going forward, to ascertain quality before marketing, both to optimise premiums on the upside and protect against claims on the downside.

UK oilseed rape yields are being reported as below the 5-year average (3.3t/ha) at between 2.7-3t/ha. Europe appears to have fared better both on yield and oil content and prices have drifted lower as a result, longer term values will build in the output achieved from Australia and Canada’s harvests. The EU supply side will however remain underpinned by high opening stocks and substantial imports continuing from Ukraine.

Food & Agriculture Organisation

Over the next decade, the FAO report that cereal production is expected to increase by 12%. Almost half of this production increase will come from maize, while wheat (and rice) account for about 20% (each) and other coarse grains account for the remaining 10%. More than half of the increase in wheat will come from India, Russia, and Canada. The United States, China, and Brazil will account for more than half of the increase in maize production. For other coarse grains including barley and oats, the major increase in production will be in India, Sub-Saharan Africa, Ethiopia, and Canada. World cereal trade is projected to increase by 15% by 2031. Wheat will contribute about 40% to this increase while maize, rice and other coarse grains account for 30%, 16% and 8%, respectively. Russia will remain the largest wheat exporter, accounting for 22% of global exports by 2031. The United States will remain the leading exporter of maize, followed by Brazil, Argentina and Ukraine.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service