How should I sell my grain?

26 August 2021How should I sell my grain?

When selling grain, growers have a range of different options – with much depending on the individual’s attitude to risk. Growers are always keen to increase their technical efficiency and reduce their growing costs to improve their margin- whether it be sprays, fertilisers, machinery costs or maximising yield; yet this good work can be undone by selling at the wrong time. Reducing input costs and pushing yield will help reduce cost of production figures per hectare or tonne but the reality is that, if your selling price is below this, then you are into loss making territory.

There are no right or wrong ways to market grain – the saying “You are better to be lucky than good” may even apply! But can you make your own luck? Grain marketing shouldn’t just be treated as simply another task that goes with arable cropping – the difference between doing it well and poorly can be hugely significant. Price volatility is here to stay, and while there will be a number of troughs to navigate, making sure you take advantage of the peaks can make a huge difference to your profit margin.

Keeping up to date with the latest market information is key – some will dismiss this as they don’t have time to watch the markets, but the advent of smart phones means that keeping up to date with the market is only a swipe away- and not very intrusive to your day-to-day work. There are a number of sources – AHDB and most merchants and grain marketing brokers will have some sort of market update service.

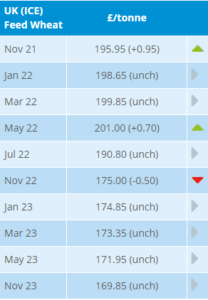

The latest market information should not be limited to the price today, next month or a few months down the line. For some commodities like wheat, oilseed rape or indeed commodities that are linked to the wheat futures price, there is effectively a three-year window to market the grain, not only the year that the crop is in the ground or the year that it may be in store but also the year before it is planted. The latest prices can be found on the AHDB website by clicking here and take the following format.

From this, it can be seen that a grower can receive a price and sell wheat (or a commodity linked to wheat futures) for crops grown for harvest 2021, 2022 and 2023. Where there is a futures price listed; it should be able to have this price translated into an ex-farm value from your merchant.

As can be seen in the graph from AHDB below, the November 2022 futures have swung from a low of £134.70 in August 2020 to a high of £177.15 in August 2021. No one will ever get it 100% “right” but the variation in this scenario between selling at the low point and the high point for an 9t/ha crop equates to £382 per hectare. With that sort of variation within the last 12 months, where will the price go before the position is closed in another year’s time? Can it rise further, stay around the same or come crashing back down? Understanding and taking opportunities is key.

The grain trade and experts talk about grain marketing strategies. These range in complexity, risk, and the requirement for input from the grower. Common include:

- selling little and often,

- splitting sales between forward and spot selling,

- setting minimum prices,

- selling at set points in the year,

- pool marketing,

- using futures or options

- using a broker / internet platform

- or a mix of the above.

Some farmers will also enter barter or contra agreements whereby for cashflow reasons that year’s inputs are paid for from grain sales to that merchant. There can even be local markets that offer good premiums which sometimes can’t be ignored.

article looks to give an overview of some of the different types of selling and the pro’s and the con’s associated with each. As for the actual selling, that depends on the individual, their attitude to risk, their requirements including space on farm and cashflow although hopefully this guide helps readers make more informed decisions going forward and allows them to perhaps consider alternatives.

So, what are the different options?

Spot selling

Selling grain on the spot market is where the grower sells his grain and takes the going price on the day. The grower will know what he/she has in terms of tonnages and quality and can sell as much or as little as they wish, knowing the price they will receive. For some, waiting until the crop is safely harvested before selling provides piece of mind and avoids any potential defaults. The downside is that the marketing period is limited to the period after harvest, while in some years, this may actually be when prices are at their highest, if prices are struggling following harvest and falling, you are completely exposed to this with limited opportunity for an upside.

While spot selling removes the risk of not being able to supply the grain when it comes to price, the risk of not receiving the best price is greater due to the marketing window being much shorter.

Forward selling

This is where a grower will lock into a futures based price in the period prior to harvest. There will be a commitment to supply the goods at a specified point in time for the agreed price. However, if the prices subsequently rise, the farmer will still only receive the price agreed pre-harvest. Any grain sold after this will however benefit from any price rises. Conversely, if the prices start to fall, the buyer will honour the forward contract price previously agreed.

Forward selling is a good way of spreading the price risk – you will never be right all the time but marketing the grain over a longer period should see you more likely to take advantage of any highs in the markets. When prices are high, it is always worth looking forward as following years tend to move in the same direction. Forward prices will fluctuate as weather conditions and plantings around the world influence the markets.

Pool marketing

Common with grain co-operatives, this is where an agent or merchant will market the grain on behalf of a group, with varying degrees of influence from members or customers. These can take various forms depending on the commodity and the marketing period. For example, there can be short term pools looking to sell the grain over a short period or longer term pools looking to market over the course of the year. In some cases, part payments may be made through the year with a final payment once the all the grain is sold.

Pool marketing is attractive to growers who perhaps don’t have their own storage and don’t want to have to sell their grain at harvest, when prices are usually lower, although there can be marketing and storage costs, which should be agreed beforehand. Alternatively, it can be used by growers with their own storage who are happy for a merchant to market their grain in a certain way.

Brokers / Online marketing

The advent of online trading in recent years has added a new dimension. While grain brokers to the trade and farmers have been around for decades; growers can now take this a stage further and sell their grain on online platforms where parties will bid for their grain. In many cases the broker will only act as an agent and not the principal with the buyer paying the farmer directly and the broker or trading platform receiving a commission. Costs will vary, with some brokers offering bespoke marketing services to growers all the way down to the basic listing of commodities on a website.

Futures and Options

The use of futures and options is more common in the wider grain trade where purchases and sales will be hedged off to reduce exposure to market fluctuations. The wheat futures market is used as a starting point for pricing a number of commodities for example – malting barley, milling oats, where growers can sell to a premium over – for example, the November wheat futures of that harvest year.

The futures market will react to sowing, harvest and weather reports from around the world with prices moving accordingly. While generally not used directly by farmers, futures markets are used by merchants, processors, and shippers as risk management tools. Traders require significant deposits and proof of liquidity to be allowed to trade. Essentially, futures contracts are the right to sell or buy the physical goods at a specified price at a specified time in the future. As this date approaches the trader must buy or sell futures to close out their position or supply the physical good. They are also a binding contract which traders are obligated to honour. Traders are liable for any gains and losses, which can be substantial where large volumes are traded and when there is volatility in the market.

While linked to the Futures market, Options offer the right to buy or sell at a specific price (the strike price) and time on the Futures market. Depending on how the market moves relative to the strike price will determine if the “option” is exercised. It is only if this right is exercised that that the contract becomes binding. If the owner chooses not to exercise the option, it is allowed to expire with no loss other than the cost of the premium.

Options are often used in minimum price contracts, effectively acting as an insurance against falling prices for unsold grain or allow growers to “remain” in the market when their grain has been sold or moved. The cost of the option is called the premium and will vary depending on the length of time before expiry, the volatility in the market and the difference between the strike price and the value of the commodity.

A “Put” option is used where futures values are expected to decrease so can be used as a means to lock into current values and conversely “Call” options are used where values are expected to increase so may be used where grain has been sold and a grower wants to take advantage of price rises. Should the futures markets move as expected then the option can be exercised with the grower receiving the difference between the futures price and the strike price. This would see the owner of the “Put” option receive extra money to make up the reduction in the physical price received later in the year and the owner of “Call” option receive extra money after selling his grain at a lower price earlier in the season.

While in futures trading, participants are liable any losses incurred as discussed earlier, one of the key differences with options is that losses are limited to the cost of the option premium. For more details on Options click here.

Which is right for me and my ?

Some growers enjoy grain marketing, it brings out their competitive nature as they try to better previous sales or previous years prices or even their friends. For others, there can be a sense of dread that the price will rocket as soon they are off the phone to their merchant and the feeling that they never get a decent price.

Information is key – follow the market and not just the current price – crops have a long marketing window.

How can you take advantage of high crop prices on futures markets and conversely how can you protect yourself against falling prices? Speak to your merchant about alternative marketing arrangements, your own and your businesses requirements are unique to you so make sure these are met. While there may appear to be an upside to different methods, always make sure you are aware of any downsides.

Finally, know your costs of production- without knowing that how do know you the price you need to make a profit?

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service