Milk Manager News January 2023 – Market Update

13 January 2023Market Update

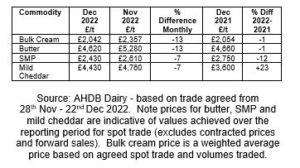

UK Wholesale Dairy Commodity Market

- Fonterra’s latest on-line GDT auction (3rd January) resulted in a 2.8% fall in the weighted average price across all products, reaching US $3,365/t. All products on offer returned negative price movements since the previous auction. Butter milk powder showed the biggest decline of -12.9% (to $2,556/t). Butter fell by 2.8% to $4,479/t and skim milk powder (SMP) by 4.3% to $2,838/t. Full results are available at https://www.globaldairytrade.info/en/product-results/

- Prices of domestic dairy products continue to decline, mainly driven by greater supply and less demand. UK prices are also influenced by the weaker markets in the EU due to higher milk volumes and several companies getting rid of year-end stocks.

- Despite the average cream price of £2,042/t for December, it was trading into the £1600’s/t just prior to the Christmas shutdown period. The butter price followed the trend in cream price, also falling by 13% over the trading period on the back of higher stocks, falling EU prices and the drop in currency from mid-December onwards (Sterling fell from 1.165 to 1.135 against the Euro from 14th to 22nd December).

- There was less of a drop in prices for SMP and cheese, with lower trade of both products over the reporting period.

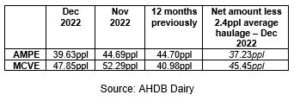

- The market indicator AMPE showed a 5.06ppl drop from November, mainly driven by the fall in the butter component from 24.94ppl to 21.63ppl. MCVE showed a less but still significant drop of 4.44ppl, with the mild cheddar component falling from 47.71ppl to 44.09ppl. The Milk Market Value of milk also plunged from its November price of 50.77ppl to 46.20ppl for December. MMV prices tend to closely compare with changes to the farmgate milk price in three months’ time.

- Defra put the UK average farmgate milk price at 50.44ppl for October, up 1.64ppl from September and 54% higher than October 2021. The volume for October was 1,222 million litres which was 5.6% more than the previous month and 2.2% higher than October 2021.

- For the week ending 6th January, cream prices ranged from £1.80 to £2.00/kg ex works, with the majority trading around £1.85/kg. There was a wide range of prices for milk on the spot market, fluctuating between the low 30’s to 42ppl delivered. This is up a good bit from the week ending 22nd December, where it was trading as low as 20 to 25ppl for those needing to find a quick home. In comparison, at the beginning of December cream was trading at £2.00 to £2.15/kg and spot milk was between 38 to 48ppl.

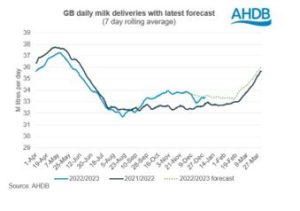

GB Milk Deliveries and Global Production

- For the week ending 31st December, deliveries were up 0.2% on the previous week with a daily average of 33.37 million litres. Deliveries are now 1.6% above the same week last year, equivalent to an extra 510,000 litres/day.

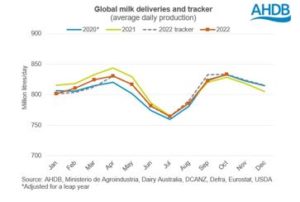

- Global milk production averaged 833 million litres/day for October across the key six producing milk regions (EU-27, UK, USA, Australia, New Zealand and Argentina). This is an increase of 4.5 million litres/day compared to October 2021 (+0.5%) but on par with the 2022 forecast. Increases in October production were seen in the EU-27, UK and USA, with substantial growth from Ireland (+7.5%), the Netherlands (+4.8%) and Germany (+2.3%). A reduction in output was seen in Australia (-6.6%) due to excessive rainfall and flooding, and New Zealand (-3.5%) on the back of a cooler spring and lower grass growth rates.

- Looking ahead, both AHDB and Rabobank expect a slight increase in milk production of around 1% from the key exporting regions in 2023. Increasing milk supply and declining commodity prices are currently impacting farmgate prices, and global markets could be further affected by the uncertainty around product demand with the recent relaxation of covid restrictions in China, along with the effects of food inflation on consumer spending.

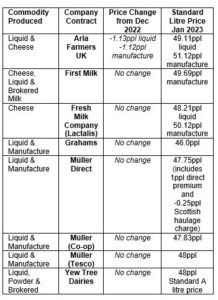

Monthly Price Movements for January 2023

- Despite the drop in commodity prices and the various milk market indicators, there is little change to January milk prices from the major Scottish milk buyers, although some price drops for February have already been announced. However, forward market indicators are predicting a sizable milk price drop with estimates of 10 to 12ppl less by the end of quarter 2 (milkprices.com).

Other News

- Of the main Scottish milk buyers detailed in the above table, only Arla has announced a price cut for January but still top the table for the best price. However, Yew Tree, Müller and TSDG have already announced a 1ppl price cut for February (with Lactalis cutting their price by 1.4ppl for February). Before Christmas, First Milk announced that it would hold its members price until 1st

- From 1st April Müller will implement an A/B pricing system for its Direct farm suppliers. On average, the A price will cover about 94% of Müller’s total direct milk supply and this will be on fresh milk and other processed products like yogurt and butter to supply retail contracts linked to various premiums and standards and paid for at a contracted price. The remaining 6%, which is mainly spring milk going into the drier and powder market will have a price based on global market indicators and will be independently audited by Steven Bradley (milkprices.com).

- First Milk has upgraded its Aspatria creamery following a £20 million investment. The facility is now able to process up to 1 million litres of milk a day and capacity has jumped by over 40% over the last four years. The investment includes five high-capacity cheese blockformers, which can pack cheese at 7t/hour, two new milk pasteurisers and two new whey pasteurisers, a robotic stacking and palletisation system and a 120t automated cooling store, along with an upgrade to the milk intake and milk storage facilities.

- The French Livestock Farming Institute (IDELE) has predicted that the number of dairy cows could decrease by 441,000 by 2030. This comes on the back of the French Ministry’s agricultural census showing a decline of 13,000 dairy farms (more than one quarter) between 2010 and 2020. According to IDELE, there were about 3.6 million dairy cows and 736,000 heifers in France in 2020, which was 82% and 15% less than 2015 respectively. Ten years ago only 32% of dairy farmers were over 50 years of age but that has increased to 48% in 2020, with the replacement rate for dairy farmers being only 45%, indicating a worrying trend for the future of French milk production.

lorna.macpherson@sac.co.uk; 07760 990901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service