Milk Manager News January 2023 – Straights Update

12 January 2023Straights Update

Global News

- Competitive Russian exports are adding downward pressure to the global and European wheat futures market. With a record sized crop and a combination of a weaker rouble and high global prices, Russian wheat exports have been very competitively priced, and exports are expected to continue to be above average levels until the end of the season. On 30th December, Sovecon increased its Russian wheat export forecast to 44.1MT (up by 200,000t).

- Grain exports from Ukraine are back 32% year- on-year as of 2nd January, reaching just 22.8MT. While maize exports were up 9%, wheat and barley exports were back 48% (to 8.4MT) and 70% (to 1.6MT) respectively. There is likely to be continued volatility in the cereal markets going forward with the ongoing conflict in Ukraine, and the lack of insurance for ships going into the Black Sea region may also impact exports.

- It is yet unknown what the impact will be of the extreme sub-zero temperatures experienced in the US over the Christmas period on their 2023 winter wheat crop, although it is expected to be minimal. However, crop condition scores for several states have fallen since the end of November. US weather remains a critical influencing factor on global wheat prices going forward, with dryness continuing in the southern plains.

- Australia is set for another record year with its wheat harvest now estimated at a massive 42MT, up from the previous estimate of 36.6MT on the back of high rainfall boosting yields. Record volumes of wheat will likely be exported, with ports currently fully booked until the end of April.

- Maize markets are also being supported by drought in Argentina, which is thought to be one of the worst droughts in 30 years. However, a large Brazilian crop is expected and so South America is anticipating overall a sizable maize crop.

- Soyabean prices have been firming in response to dry conditions in Argentina (and a decrease in UK currency which has increased the UK price considerably), with plantings at 82% complete by the end of the 1st week in January. At the same time last year plantings were 94% complete and the 5-year average was 93%.

UK and Scottish News

- After a lift in wheat prices over the festive holiday period, the New Year has so far seen a reversal with prices declining and futures markets dropping back down toward multi-month lows. With domestic production pegged at 15.5MT from the 2022 harvest (+10% on 2021 production), there is an exportable surplus of feed wheat still to move and the associated price pressure to remain competitive abroad is also being exacerbated by the slow export pace. The situation is compounded too by the ample supply of grain continuing to come out of Russia at very low prices. Come March, we may see a lift in prices as domestic surplus stocks are cleared and particularly if Russia decide to limit exports to third world countries thereafter. Further upsides may well develop out of the Argentinian drought (wheat production already cut by 50%) and the ongoing surging demand for biofuels. January and February might therefore be the months to consider locking into forward livestock compound supply contracts. The feed barley market remains quiet; demand is slow across Europe, and North Africa markets are opting for maize and wheat over barley. Ireland is favouring maize, and France is the cheapest option for the Low Countries. Domestic markets in the UK are currently only notable by their absence.

- The results of AHDB’s Early Bird Survey for cropping intentions show that the wheat area for the 2023 harvest is very similar to last year at 1,821kha, while the total barley area is estimated to be 2% less at 1,082kha due to indications of less spring plantings. While the UK winter barley area is 4% higher than in 2021, the decline in Scotland’s winter barley area is 13% and its spring barley area is estimated to be down 10kha on the previous year. The UK area for oilseed rape is expected to be 52kha up on last year to 416kha, due to favourable conditions for drilling the crop and high prices. However, it is still well below historic levels (756kha in 2012).

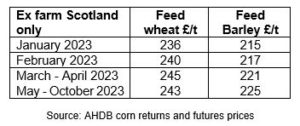

- Ex farm prices for cereals are as follows:

- The protein markets have been firming on the back of the rise in soya prices and the lack of distillers dark grains from Vivergo. It may be worth looking to take cover for protein required in the short-term, especially soya, due to risk to supply from Argentina.

lorna.macpherson@sac.co.uk; 07760 990901

mark.bowsher-gibbs@sac.co.uk; 0131 603 7533

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service