Milk Manager News July 2023 – Milk Market Update

11 July 2023Milk Market Update

UK Wholesale Dairy Commodity Market

- Fonterra’s latest on-line GDT auction (4th of July) resulted in a 3.3% decrease in the weighted average price across all products, reaching US $3,334/t. There was no change in the GDT price index at the previous auction on the 20th of June. At the most recent auction, all products sold were back in price, with butter milk powder (BMP) and butter being the biggest movers. BMP was down 11.4% to $2,189/t and butter was down 10.3% to $4,842/t. Full results are available at https://www.globaldairytrade.info/en/product-results/

- Domestic ex-store prices for dairy commodities have rallied slightly, with no negative average price movement over the May/June reporting period.

Source: AHDB Dairy - based on trade agreed from 22nd May - 19th Jun 2023. Note prices for butter, SMP and mild cheddar are indicative of values achieved over the reporting period for spot trade (excludes contracted prices and forward sales). Bulk cream price is a weighted average price based on agreed spot trade and volumes traded.

- Cream showed the biggest increase in average price throughout the month, despite subdued demand from the continent on the back of the pound strengthening against the euro and adequate supplies on the continent. Since the end of April the domestic cream price has risen by 7%.

- Butter was up 2% on the previous month, even though availability was reported to be good with little demand, and Irish butter being sold cheaply on the back of storage problems.

- The domestic SMP price showed little movement from the previous month, despite SMP being down 6% at the latest GDT auction, due to weak global demand. However, milk powders in the EU are up by around 4% since the end of April on the back of little growth in milk output.

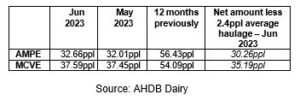

- The market indicators AMPE and MCVE have firmed slightly for June, up 0.65ppl and 0.14ppl respectively from May. AMPE (Actual Milk Price Equivalent) indicates the value of milk used for butter and SMP production and is on average just over 3ppl below the current standard liquid litre (non-aligned) prices from the main Scottish milk buyers. There is less of a difference between the MCVE (Milk for Cheese Value Equivalent) price and the current prices dairy farmers are receiving with a manufacturing contract (with MCVE being about 1.3ppl less).

- The Milk Market Value (MMV) of milk has remained fairly steady over the last three months, at 36.60ppl for June, 36.36ppl for May and 36.42ppl for April. As farm-gate prices tend to mirror MMV prices in three months’ time, this implies that milk prices have steadied and with the spring flush well past, are unlikely to fall much further.

- Defra put the UK average farm-gate milk price at 37.58ppl for May 2023, down 1.89ppl (4.8%) from April and 7.8% lower than May 2022. The UK volume for May was 1,379 million litres, which was 3.3% higher than the previous month and 0.3% less than May 2022.

- Based on current prices and market returns, The Dairy Group predicts that the Defra farm-gate milk price will remain stable over the summer months, to 37.5ppl in June, 37.3ppl in July and 37.7ppl in August. AMPE looks to remain stable in the short-term at 32-33ppl and so B litres should be in the region of 30-31ppl. Longer term, it is thought that milk prices will improve slightly for the coming winter. The milk price:feed price ratio is currently very low but should improve slightly in the winter period with lower feed prices, but this may not be enough to stimulate more milk output.

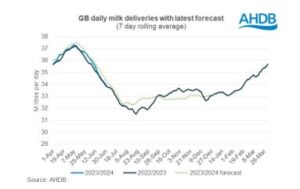

GB Milk Deliveries and Global Production

- For the week ending 1st July deliveries were down 1.1% on the previous week, with a daily average of 33.89 million litres/day. Deliveries are now just 0.2% above the same week in 2022, equating to an extra 60,000 litres/day but are still behind forecasted levels.

- Global milk production has been increasing, with an average 835 million litres/day produced in April compared to 815.8 million litres/day in March (up 2.4%). Out of the seven key producing regions, only Australia recorded a production decline in April compared to 12 months ago, with deliveries back 1.7%. The biggest increase was seen in New Zealand, up 6.8% on April 2022 but there was the seasonal decline on the previous month (back 16%) as they enter their winter period. Increases in milk output for the US and EU were modest at only 0.3% and 0.4% respectively compared to April 2022. Countries in the EU showing the biggest increases in production were Belgium (+3.8%), Germany (+3.3%) and the Netherlands (+3.3%).

Other News

- It is estimated that the breakeven price to produce milk is currently around 40-41ppl (Kite Consulting) and the majority of non-aligned milk contracts are paying well below this. However, it is thought that milk prices are not likely to rise significantly until the last quarter of the year in part due to low global demand for dairy products.

- Dairy farmers are being encouraged to complete the Dairy Production Intentions Survey recently launched by the NFU. The aim of the survey is to find out producers plans for milk production over the next two years to help predict future milk output in response to high input costs and low milk prices. The survey should be completed by 23rd July and can be found here:

https://www.nfuonline.com/updates-and-information/take-part-in-our-2023-dairy-production-survey/

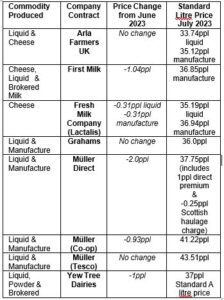

- A milk price cut has already been announced by Müller from 1st Direct suppliers will see their milk price fall by 1ppl to 37ppl (36.75ppl including the Scottish haulage charge).

- A recent survey by Arla has shown that 58% of dairy farmers are finding sourcing labour more challenging now compared to in 2019. Twelve percent of farmers surveyed said they were considering leaving the industry due to staffing concerns, despite wages having increased on average by 22% since 2019.

Monthly Price Movements for July 2023

lorna.macpherson@sac.co.uk; 07760 990901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service