Milk Manager News May 2023 – Farm Business Survey Results

10 May 2023Every year the Scottish Government publishes the Farm Business Survey results which gives the latest economic picture of Scottish farming. The latest results are based on data from over 400 farms up to the end of May 2022. While these are now one year out of date, and do not take into account the period of sustained high input costs and rising farm-gate prices in 2022/23, these figures are important as they form the basis of economic evidence that Scottish Government uses for decision making on Agricultural policy. More detail can be found at: https://www.gov.scot/publications/scottish-farm-business-income-annual-estimates-2021-2022/

The key statistics for all farming businesses are:

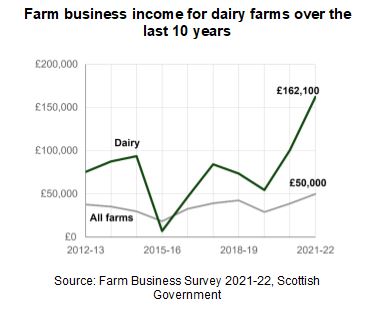

· Average farm business income (FBI - a measure of net profit after costs) is up to £50k from £39k in 2021.

· Scottish farming is profitable on an average basis for the first time in 10 years without subsidy (+£5,100 without support payments).

· These positive profitability results are driven by increases in income for dairy and cereal farms.

· The average income for commercial dairy farms was £162.1k, the highest income for 10 years.

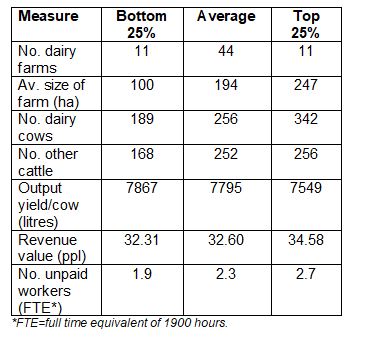

There were 44 dairy farms surveyed in these latest figures, with an average herd size of 256 dairy cows and an average milk yield per cow of 7,795 litres. The average milk price paid was 32.6ppl, which was higher than the previous year, contributing to the much higher income, even with a reduction in average yield. Output from milk and milk products was £73,500 higher (+13%) than the previous year. Output from cattle on dairy farms also increased by £27,800 (+37%).

For the top 25% of dairy farms (based on FBI as a % of output), their variable costs were 34% of their total farm output. Forage and concentrate costs accounted for 68% and veterinary medicine costs 6.4% of variable costs. On a pence per litre basis, total feed costs were 10.1ppl and veterinary medicine costs were 0.94ppl.

In terms of fixed costs, these accounted for 35.8% of total farm output, with paid labour and power and machinery accounting for 7.7% (3.3ppl) and 11.0% (4.8ppl) of total output respectively. These percentages are well below the recommended target of 15-18% of gross output for both labour and power and machinery.

Key statistics for the average, bottom 25% and top 25% of dairy farms surveyed are shown in the following table:

The Farm Business Survey is already recruiting farms to report on the 2022/23 year. Participating farms will receive a Farm Business Report detailing their management accounts, Whole Farm Benchmarks, allowing you to track your farm’s financial performance and a Whole Farm Carbon Audit. If you are interested in taking part, please contact: sascha.grierson@sac.co.uk

lorna.macpherson@sac.co.uk; 07760 990901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service