Milk Manager News May 2023 – Milk Market Update

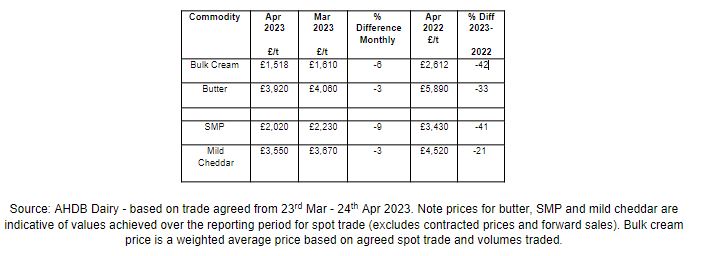

10 May 2023UK Wholesale Dairy Commodity Market

· Fonterra’s latest on-line GDT auction (2nd May) resulted in a 2.5% increase in the weighted average price across all products, reaching US $3,506/t. This follows a 3.2% increase at the previous auction on the 18th April. Prior to that, the last four auctions all returned negative results. At the most recent auction, whole milk powder (WMP) and cheddar were the biggest movers, with WMP up 5% to $3,230/t and cheddar up 4.5% to $4,561/t. Only anhydrous milk fat returned a negative price movement (-2.4%) from the previous auction. Full results are available at https://www.globaldairytrade.info/en/product-results/

· Domestic prices for dairy commodities fell over the last reporting period with prices back on average between 3-9% for butter, cream, skim milk powder (SMP) and mild cheddar. As the spring flush approaches, buyers are holding off, awaiting lower prices, and sellers are unwilling to discount price much further due to current high manufacturing costs, so trade has been fairly quiet. So far, the cold, wet spring has delayed grass growth and so there could be a delay to the timing of peak production.

Markets for butter and cream have been relatively quiet over the last few weeks, with domestic demand for cream diminishing, despite strong demand on the continent back in March. The drop in butter price has been relatively small (-£140/t) and issues with availability (due to cold storage availability) in March may have curbed production, which has perhaps prevented the price from falling further.

· SMP showed the biggest percentage price drop on the back of plentiful stocks and global demand remaining weak. With the spring flush approaching there are no concerns over product availability.

· Consumer demand is also affecting mild cheddar prices, with retail price inflation reducing customer spending on dairy products, and more consumers moving away from branded products to cheaper supermarket own-label products.

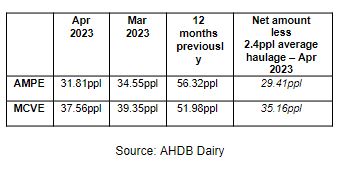

· The market indicators AMPE and MCVE continue to fall for April, with AMPE dropping 2.74ppl to 31.81ppl and MCVE by 1.79ppl to 37.56ppl. AMPE (Actual Milk price Equivalent) indicates the value of milk used for butter and SMP production is now considerably below the current liquid standard litre prices from the main processors, whereas the MCVE (Milk for Cheese Value Equivalent) price reflects the value of milk used for mild cheddar and whey powder/butter and is much closer to current prices dairy farmers are receiving with a manufacturing contract.

· The Milk Market Value (MMV) of milk fell a further 1.92ppl to 36.41ppl from March to April. As farm-gate prices tend to mirror MMV prices in 3 months time, milk prices could be set to fall further this summer.

· Defra put the UK average farm-gate milk price at 45.98ppl for March 2023, down 2.32ppl (4.8%) from February and 23% higher than March 2022. The UK volume for March was 1,320 million litres, 15% higher than February and 0.8% more than March 2022.

· For the week ending 5th May, cream was trading around £1.45-£1.48/kg ex works, with the export market returning £1.50/kg. Prices on the continent were slightly higher, with the EU cream price at £1.55-£1.60/kg ex. The price for spot milk was 20-21ppl to sell but 25-28ppl delivered to buy.

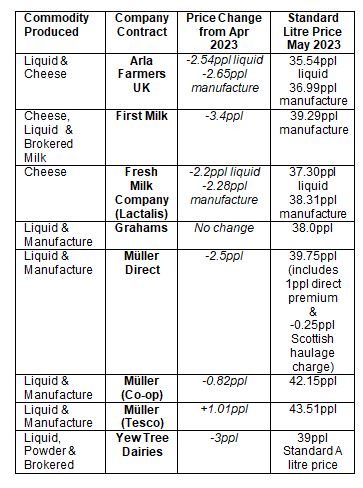

Monthly Price Movements for May 2023

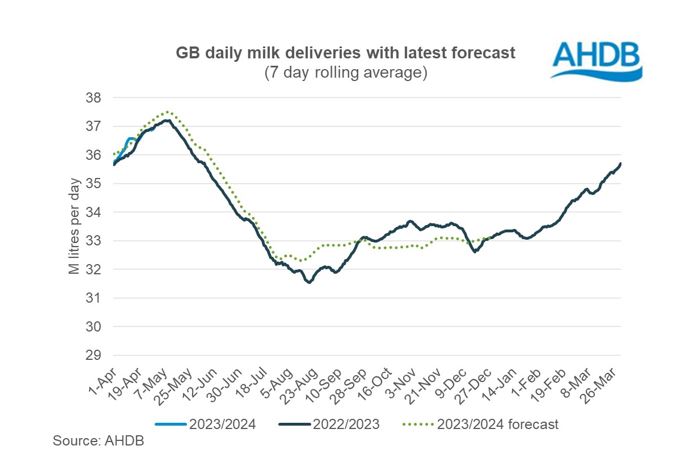

GB Milk Deliveries and Global Production

· For the week ending 29th April, deliveries were up 0.4% on the previous week with a daily average of 36.91 million litres/day. Deliveries are now 0.1% behind the same week in 2022, equating to 20,000 litres/day less.

Global milk production has also been increasing. Data for milk deliveries from the key seven producing regions show that February production was up 0.8% (to 816.6 million litres/day), equivalent to an extra 6.2 million litres/day compared to February 2022. Increases in production for February came from the UK (+2.1%), EU-27 (+0.9%), US (+0.8%) and New Zealand (+2.3%). Both Argentina and Australia showed production declines, with Australia back 5.3% due to wet weather and flooding in December affecting Victoria and New South Wales, with production in these states being the lowest in 10 years.

Other News

· A number of processors have already announced further price cuts for June:

o Yew Tree - 1ppl cut bringing their liquid standard liquid down to 38ppl.

o Lactalis - 1.5ppl cut bringing their liquid standard litre down to 35.8ppl and 1.56ppl cut to their manufacturing standard litre to 37.25ppl.

o First Milk - 1.4ppl cut, bringing their manufacturing standard litre down to 37.89ppl.

· Sainsburys producers are seeing their cost of production decline, with a further 0.77ppl cut from June, following a 0.99ppl cut in May. This takes their milk price down to 42.14ppl for a Müller supplier. Compared with May, the cost tracker put feed, fuel and fertiliser for June back 0.71ppl to 18.55ppl (feed 15.61ppl, fuel 1.21ppl and fertiliser 1.72ppl). This drop was mainly due to protein and cereal prices falling over the previous month. Looking forward, the forecast for July and August is for the cost of production to drop further by 0.7ppl and 0.5ppl respectively.

· Tesco are holding their current price of 43.51ppl for June and July with their next price move potentially from 1st August.

· The current rapid decline in milk price coupled with the strong beef price will not incentivise farmers to try and increase milk output, and any unfavourable weather events will likely reduce output further. Looking forward to the second half of 2023, the probability of falling feed prices post-harvest and lower fertiliser and energy prices, means that next winter will be more

encouraging for milk production than this summer. The futures market is currently indicating that milk prices will likely settle down around the mid-thirties within the next two months.

lorna.macpherson@sac.co.uk; 07760 990901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service