Milk Manager News May 2023 – Straights Update

10 May 2023Straights Update

Global News

- Global wheat prices continue their decline with the main driver being the volume of Russian wheat exports and favourable weather conditions being reported across wider Northern Hemisphere crops (the US winter wheat crop is reported as showing improvement, up 2 points at 28% good to excellent). In April, Russian wheat exports were approximately 5mT, with their season total so far being just over 37mT. It is thought that the end of season total by 30th June will be over 44 mT. All this is weighing on prices longer term with domestic futures following global price movements down of late. For the w/e 5th May, London wheat futures for old crop were nearly half the peak price seen in May 2022.

- It is not yet known whether the Ukraine Black Sea export agreement will be extended from the 18th May. With Russia blaming the recent Kremlin drone attack on Ukraine, the outlook for extension is not looking promising. The most recent news that Russia is now blockading vessels inbound for loading Ukrainian grain could spike the markets over the coming days.

- As of 26th April, grain exports from Ukraine have dropped by 9% year-on-year to 41.6mT. Wheat and barley exports were down 22% (to 14.4mT) and 57% (to 2.5mT) respectively, while maize exports were up 15% (to 24.4mT). Their grain harvest is estimated at 44mT this year, which is 9mT less than in 2022 and nearly half of their record grain harvest of 86mT in 2021, according to an Ag Ministry official.

- The 2022/23 soyabean production estimate for Brazil is 157.7mT - a record crop for the country. Their exports continue to saturate the oilseed markets, with April exports reported at 14.34mT (2.87mT higher than April 2022), resulting in falling soyabean meal prices. As of the end of April, their harvest was 94% complete.

UK and Scottish News

- As we head further into the growing season with increasingly warmer days and nights, crops are accelerating through the growth stages and we are gaining a clearer picture of this year’s crops yield potential. AHDB’s most recent GB crop development report puts winter cereal crops current potential ahead of that perceived. The winter wheat crop was rated 88% good/excellent condition up to the w/e 25th April, above the 84% reported this time last year. However, recent wet weather means that Septoria and other diseases of cereals could be more prevalent, especially in areas where fungicide applications were late. Winter barley crops have also rated well, with 90% in good/excellent condition (up from 84% this time last year).

- Spring plantings have been delayed across all regions of Great Britain, with unsettled weather conditions throughout March and April. It is estimated that plantings have been delay by one month on average.

- Oilseed rape ratings have not fared quite so well as cereals, with 66% of the winter crop in good/excellent condition, down from 70% last year for the w/e 25th April. The main problem has been from cabbage stem flea beetle and some pigeon damage in certain regions. In the worst affected areas, these crops have been replaced with spring beans, barley or oats.

- Domestically we are seeing more home-grown grain still on farm and held in stock by merchants, co-ops and ports compared to last year; in the case of barley, 22% more. The reduction in compound animal feed manufacture over the last nine months remains 6% lower compared to 2021/22 levels and will invariably have a part to play here. Trade reports another slow week for feed barley markets, with consumers seemingly well covered for old crop and uninterested in engaging on new crops just yet. Likewise, farmer selling is reported as slow for both crop seasons. Export interest has also been lacking as the UK struggles to compete against other EU origins, particularly for the harvest position.

- European oat markets have seen a slight rise in buying activity of the past few weeks. Spain has been the main buyer following concerns over the effect of dry weather on the coming harvest. Sales from the UK and Baltics have filled the Spanish buying demand but here in the UK milling and feed markets remain hard to find for both old and new crop positions as feed oats look expensive compared to other feed grains.

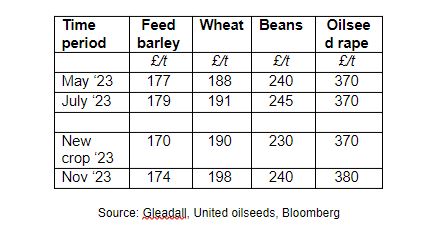

- Ex farm prices for cereals and proteins are as follows:

lorna.macpherson@sac.co.uk; 07760 990901

mark.bowsher-gibbs@sac.co.uk; 0131 603 7533

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service