Milk Manager News September 2022 – Market Update

13 September 2022Market Update

UK Wholesale Dairy Commodity Market

- Fonterra’s latest on-line GDT auction (6th September) resulted in a 4.9% rise in the weighted average price across all products, reaching US $4,007/t. This is the first price rise since the 21st of June, with five out of the six products on offer returning positive price movements since the last auction. Butter milk powder bucked the trend with the price down 5.1% to $3,537/t. The biggest increases were seen in anhydrous milk fat (+13.9% to $5,677/t) and whole milk powder (+5.1% to $3,610/t). Full results are available at https://www.globaldairytrade.info/en/product-results/

- Lower UK wholesale prices of dairy commodities were partly down to lower demand during the summer holiday period and all commodities were slightly back on their average price compared to the July reporting period.

| Commodity | Aug 2022 £/T | Jul 2022 £/T | % Difference Monthly | Aug 2021 £/T | % Diff 2022-2021 |

|---|---|---|---|---|---|

| Bulk Cream | £2,774 | £2,850 | -3 | £1,563 | +77 |

| Butter | £5,850 | £5,940 | -2 | £3,290 | +78 |

| SMP | £2,990 | £3,290 | -9 | £2,130 | +40 |

| Mild Cheddar | £4,700 | £4,740 | -1 | £3,000 | +57 |

Source: AHDB Dairy – based on trade agreed from 25th July – 19th Aug 2022. Note prices for butter, SMP and mild cheddar are indicative of values achieved over the reporting period for spot trade (excludes contracted prices and forward sales). Bulk cream price is a weighted average price based on agreed spot trade and volumes traded.

- With better returns for cheddar, more milk was diverted from butter and powder production to cheese, helping keep butter supplies tight. SMP prices also fell due to lower global demand. The cheddar price only dropped on average by £40/t, with tight stocks, lower milk volumes and cheese manufacturers having increased the milk price to their farmers all helping to limit the drop in cheddar price.

- Defra put the UK average farm-gate milk price at 45.57ppl for July, up 2.45ppl from June and 50% higher than July 2021. The volume for July was 1,238 million litres, which was 2.7% less than the previous month and 0.9% lower than July 2021.

- The market indicators AMPE and MCVE both show a drop in price for August. AMPE reduced by 3.43ppl largely due to a 2.83ppl drop in the SMP component. MCVE only fell by 0.95ppl. The other indicator of interest – MMV or the Milk Market Value (the average market value based on typical utilisation of milk) also fell from 53.35ppl in July to 51.91ppl for August. Changes in MMV are closely linked to movements in the farm-gate milk price in three months’ time.

| Aug 2022 | Jul 2022 | 12 months previously | Net amount less 2.4ppl average haulage – Aug 2022 | |

|---|---|---|---|---|

| AMPE | 51.32ppl | 54.75ppl | 32.10ppl | 48.92ppl |

| MCVE | 52.06ppl | 53.01ppl | 33.46ppl | 49.66ppl |

Source: AHDB Dairy

- For the week ending 9th September, there was no change in the spot milk price from the previous week, trading at 55-59ppl delivered. Bulk cream firmed slightly to £2.82-£2.86/kg ex works and is expected to rise again the following week, possibly hitting £2.90/kg.

GB Milk Deliveries and Global Production

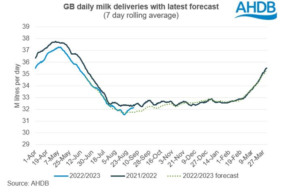

- GB milk production has shown a slight recovery since the end of August, with output now above forecasted levels but still just below this time last year. Daily average deliveries are up 0.5% on the previous week (for the week ending 3/9/22) and are now 0.6% below the same week last year, which equates to 0.21 million litres less/day.

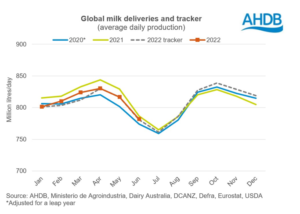

- Global milk production is also behind last year for the month of June. Average daily deliveries were 781.8m litres (back 4.8m litres or 0.6%).

- The biggest drop was seen in Australia (back 9.2%), with the UK, EU and US down 2.3%, 0.4% and 0.1% respectively compared to June 2021. Higher production costs and adverse weather have been the main drivers of reduced output in most regions.

Monthly Price Movements for September 2022

| Commodity Produced | Company Contract | Price Change From Aug 2022 | Standard Litre Price Sept 2022 |

|---|---|---|---|

| Liquid & Cheese | Arla Farmers UK | No change | 48.42ppl liquid 50.35ppl manufacture |

| Cheese, Liquid & Brokered Milk | First Milk | +2.14ppl | 48.64ppl manufacture |

| Cheese | Fresh Milk Company (Lactalis) | +0.92ppl liquid 0.95ppl manufacture | 47.32ppl liquid 49.2ppl manufacture |

| Liquid & Manufacture | Grahams | No change | 46.0ppl |

| Liquid & Manufacture | Müller Direct | +1.00ppl | 46.75ppl (includes 1ppl direct premium and -0.25ppl Scottish haulage charge) |

| Liquid & Manufacture | Müller (Co-op) | +0.67ppl | 47.0ppl |

| Liquid & Manufacture | Müller (Tesco) | +1.00ppl | 47ppl |

| Liquid, Powder & Brokered | Yew Tree Dairies | +2.0ppl | 48ppl Standard A litre price |

Other News

- The number of dairy herds in Scotland has dropped to 819, according to the Scottish Dairy Cattle Association. Latest figures released in July showed a net loss of 13 herds since the start of the year. Milking cow numbers are back by 897 in the last six months to 178,464 and average herd size has increased to 218.

- The Sainsbury’s Dairy Development Group (SDDG) have held their price for September, which stands at 47ppl. This is the same as the September price for Tesco (Müller) producers and Müller directs. The SDDG puts the current cost of production at 42.48ppl, which is very similar to the Tesco producers cost of 42.26ppl. The Tesco cost of production is based on the following and their producer’s price will rise 1ppl in October to 48ppl:

- variable costs – 23.03ppl

- overhead costs – 13.79ppl

- depreciation – 2.37ppl

- plus 3.07ppl adjustment for feed, fuel and fertiliser.

- Müller have announced a further 1ppl increase in their milk price from 1st October, bringing their liquid standard litre up to 48ppl (47.75ppl for Scottish suppliers). Their organic price also increases by 2ppl, up from 56 to 58ppl. In comparison, OMSCO’s milk price from 1st October increases from 49 to 50ppl.

- First Milk are adding a further 0.75ppl to their milk price from October, bring their manufacturing standard litre up to 49.39ppl.

- Arla have published strong financial performance figures for the first half of 2022, with revenue up 17% to £5.4 billion compared to the first half of 2021. The increase was attributed to price rises in their foodservice and retail divisions. To help their farmer suppliers with inflated production costs, Arla will pay out 1 eurocent/kg of milk produced in the first six months of this year: its first ever half year supplementary payment.

lorna.macpherson@sac.co.uk; 07760 990901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service