MMN September 2023 – Milk Market Update

11 September 2023UK Wholesale Dairy Commodity Market

- Fonterra’s latest on-line GDT auction (5th of September) resulted in a 2.7% increase in the weighted average price across all products, reaching US $2,888/t. This is the first positive movement in the price index since the beginning of May and the previous auction in mid-August returned a whopping 7.4% fall in the price index. At the most recent auction, butter milk powder fell 6.5% but whole milk powder rose 5.3% (to $2,702/t) and butter was up 1.1% (to $4,588/t) Full results are available at https://www.globaldairytrade.info/en/product-results/

- Domestic wholesale prices for dairy commodities have continued to fall since June. Trade was quite over the reporting period, still being summer holiday season. While the wet weather has improved grass growth and milk output, it will have lessened demand and the 7.4% reduction in the GDT auction in August will have exerted further downward pressure on prices.

| Commodity | Aug 2023 £/t | Jul 2023 £/t | % Difference Monthly | Aug 2022 £/t | % Diff 2023- 2022 |

|---|---|---|---|---|---|

| Bulk Cream | £1,623 | £1,644 | -1 | £2,774 | -41 |

| Butter | £3,680 | £3,790 | -3 | £5,850 | -37 |

| SMP | £1,850 | £1,900 | -3 | £2,990 | -38 |

| Mild Cheddar | £3,330 | £3,470 | -4 | £4,700 | -29 |

Source: AHDB Dairy - based on trade agreed from 24th July - 21st Aug 2023. Note prices for butter, SMP and mild cheddar are indicative of values achieved over the reporting period for spot trade (excludes contracted prices and forward sales). Bulk cream price is a weighted average price based on agreed spot trade and volumes traded.

- Mild cheddar showed the biggest percentage decline in average price throughout the month, and although trade was slow, supply and demand are well in balance.

- Butter fell on average by 3% on the previous month, with prices varying by as much as £395/t. For cream, there was little change in average price and little demand over the reporting period.

- SMP price continues to decline on the back of good availability and weak demand. The continuing trend of falling prices in the GDT auction also give bearish sentiment to global SMP prices. Chinese imports of SMP were up 20.3% in June compared to June 2022, but compared to pre-COVID times, they remain by and large absent from the market, still processing local stocks.

- The market indicators AMPE and MCVE fell 1.05ppl and 1.73ppl respectively from July into August on the back of declining wholesale prices for butter, SMP and mild cheddar. The Milk Market Value (MMV) of milk has also declined steady, at 33.04ppl for August (34.63ppl for July and 36.60ppl for June).

| Aug 2023 | Jul 2023 | 12 months previously | Net amount less 2.4ppl average haulage - Aug 2023 | |

|---|---|---|---|---|

| AMPE | 28.61ppl | 29.66ppl | 51.31ppl | 26.21ppl |

| MCVE | 34.14ppl | 35.92ppl | 52.06ppl | 31.74ppl |

- Defra put the UK average farm-gate milk price at 36.11ppl for July, which was 23% lower than July 2022. The UK volume for July was 1,247 million litres, which was 2.2% lower than the previous month and 1.0% less than July 2022.

GB Milk Deliveries and Global Production

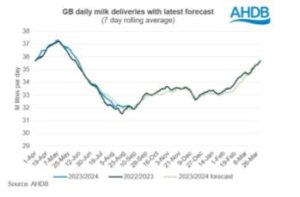

- For the week ending 2nd September deliveries were on par with the previous week with a daily average of 32.12 million litres/day. Deliveries are now 0.1% above the same week in 2022, equating to an extra 50,000 litres/day. For the 2023 calendar year, UK milk production is expected to be up 0.3% on last year, even with the low milk price and squeeze on margins.

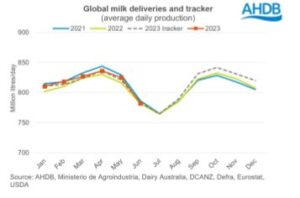

- In June, global milk deliveries were on average 782.2 million litres/day, up by 800,000 litres on June 2022. In the EU, German milk production for June was up 2.1% year-on-year, with cumulative milk production at 16.58mT (+2.6% year-on-year). June production in Poland was also up by 1.5% at 1.1mT. However, large drops were seen in France (-2.9%) and Italy (-5.3%). Irish milk collections were down 0.9% on the previous June to 1.08mT.

- Recent estimates on global milk production from AHDB suggests only 0.1% growth in 2023. Although production in the main milk producing regions is 0.8% ahead of last year, it is thought that the reduction in milk price and any adverse weather conditions will limit milk output in the second half of 2023. In the EU, milk production is expected to decrease in the second half of the year on the back of more cows being culled due to lower milk prices and continuing high input costs. Production is predicted to decline by 3% in both Australia and Argentina, with Argentina having struggled with hot, dry weather limiting forage availability.

Other News

- Dairy farmers in the Sainsbury’s Sustainable Dairy Group are to benefit from an additional £6 million annual investment. Farmers are to receive an extra 1ppl on top of their calculated cost of production milk price, amounting to £4.3 million. The remaining £1.7 million will be available as sustainability bonuses based on activities that help towards reducing their carbon emissions to enable the company to meet its “Plan for Better” targets. Activities include things like using sustainable feeds and strategic targeting of fertiliser applications.

- With most milk processors holding their milk price this month, there are further indications of stability in the dairy markets with First Milk and Müller announcing price holds for October.

- China is set to become the world’s 3rd largest producer of milk. While it is the biggest importer of dairy products, Rabobank estimates its own production could increase from 41.5mT in 2023 to 47.4mT by 2032. Chinese milk production has tripled over the last 20 years on the back of heavy investment in dairy processing and government support. By the end of 2025, 56% of their milk production is expected to come from herds with over 1000 cows.

Monthly Price Movements for September 2023

| Commodity Produced | Company Contract | Price Change from August 2023 | Standard Litre Price Sept 2023 |

|---|---|---|---|

| Liquid & Cheese | Arla Farmers UK | No change | 33.74ppl liquid 35.21ppl manufacture |

| Cheese, liquid & Brokered Milk | First Milk | No change | 36.85ppl manufacture |

| Cheese | Fresh Milk Company (Lactalis) | No change | 35.5ppl liquid 37.25ppl manufacture |

| Liquid & Manufacture | Grahams | No change* | 36.0ppl |

| Liquid & Manufacture | Müller Direct | No change | 36.75ppl (includes 1ppl direct premium & -0.25ppl Scottish haulage charge) |

| Liquid & Manufacture | Müller (Co-op) | +0.011ppl | 39.91ppl |

| Liquid & Manufacture | Müller (Tesco) | No change | 41.83ppl |

| Liquid, powder & Brokered | Yew Tree Dairies | No change* | 36ppl Standard A litre price |

*Price not confirmed at time of writing

lorna.macpherson@sac.co.uk; 07760 990901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service