MMN January 2024 – Milk Market Update

12 January 2024UK Wholesale Dairy Commodity Market

- Fonterra’s latest on-line GDT auction (2nd of January) resulted in a 1.2% increase in the weighted average price across all products, reaching US $3,363/t. This was the 3rd consecutive rise since the beginning of December, with the biggest positive movements seen in whole milk powder (+2.5% to $3,290/t) and butter (+2.1% to $5,514/t). Full results are available at: https://www.globaldairytrade.info/en/product-results/

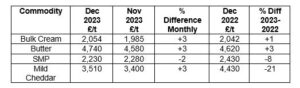

- UK wholesale prices for dairy commodities in December showed small positive increases for butter, cream and mild cheddar, with only SMP down 2%. Positive movements were generally down to the seasonal increase in demand coupled with limited availability of products. Stocks of both butter and cheddar are relatively tight. Strong prices for curd are helping support the cheese markets.

Source: AHDB Dairy – based on trade agreed from 27th Nov – 18th Dec 2023. Note prices for butter, SMP and mild cheddar are indicative of values achieved over the reporting period for spot trade (excludes contracted prices and forward sales). Bulk cream price is a weighted average price based on agreed spot trade and volumes traded.

- On the back of rising wholesale prices, the market indicators AMPE and MCVE have risen in December, with MCVE rising significantly more than AMPE (+1.54ppl versus +0.29ppl). While the butter component of AMPE rose, the SMP component fell due to the recent drop in SMP, and the mild cheddar and whey components of MCVE both showed positive movements. The Milk Market Value (MMV) for December was 38.05ppl, up 1.29ppl from November. This is the 3rd consecutive rise, which gives hope for increasing farm-gate prices in Q1 and into Q2 of 2024.

Source: AHDB Dairy

- Defra put the UK average farm-gate milk price at 37.03ppl for October, which was up 0.61ppl from September. The UK volume for October was 1,189 million litres, which was 4.4% more than the previous month and 2.2% less than October 2022.

GB Milk Deliveries and Global Production

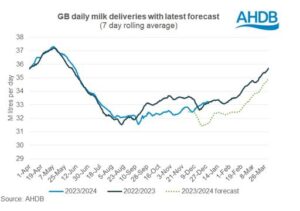

- For the week ending 30th December, GB milk deliveries were up 0.4% on the previous week, with a daily average of 33.23 million litres/day. Deliveries are now 0.3% above the same week in 2022, equating to 110,000 litres/day more.

- Milk deliveries for the month of December were only back 0.4% (or 3.5 million litres) to 1,021 million litres compared to the previous December, but volumes for November were 3% down on the previous year. The little difference between the December volumes is thought to be partly attributed to problems with milk collections during the very cold, snowy spell mid-December 2022 affecting on-farm collections. Also, the small increase in Autumn block calving herds, as incentivised by some processors, may have helped milk volumes from late Autumn calvers.

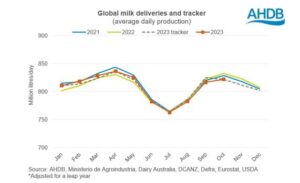

- Globally, milk deliveries are still running behind 2022 and 2021 levels. Production in the seven main milk producing regions was 10.4 million litres/day less in October 2023 compared to the previous year. Only Australia had a year-on-year volume increase for the month. There were significant declines in production in France (-4.5% or 86 million litres) and Ireland (-12.6% or 87.2 million litres). The reduction in output in the UK, US and EU-27 is mainly attributed to little margin, with high input costs in relation to milk price, and higher culling over the winter months in the US again on the back of lower margins, reducing herd sizes and milk output.

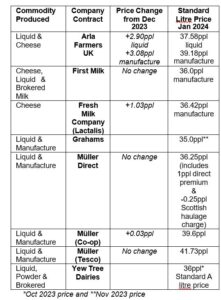

Monthly Price Movements for January 2024

Other News

- Nuffield Scholar, Miles Middleton (a farm vet in Yorkshire), has published the findings of his project titled ‘Counting Carbon; Does a Smaller Footprint Leave Less Impact? Defining Sustainability in the Dairy Sector’. As part of his studies Miles visited the US and several European countries to gain more of an insight into the definition of sustainability and how that is often seen as contradictory with higher output, more intensive dairies that tend to have a lower carbon footprint. The full report can be accessed here:

https://www.nuffieldscholar.org/sites/default/files/202312/Miles%20Middleton%20Report%20Nuffield.pdf

- The number of Bluetongue cases in England now stands at 49 infected animals on 27 holdings across Kent and Norfolk (as of 12th January). While the virus is mainly spread by biting midges (of the Culicoides species) and these will not be currently active until around April, there is still the risk of virus transmission to unborn offspring, which can then be a source of the virus once born. There is currently no vaccine for the new strain responsible for the UK cases (BTV-3). For more up to date information please visit:

https://ruminanthw.org.uk/bluetongue-virus/

- The methane-reducing feed additive Bovaer® is now authorised for use in cattle in the UK. Developed by Dutch Swiss company DSM-Firmenich the additive has been shown to reduce methane emissions in dairy cows across a number of studies by on average 30%. A new world-scale manufacturing plant in Dalry is currently under construction and aims to be operational in 2025.

- Did you know that you can now clean your parlour without any chemicals? The Pulse Oxidation system uses just water and low voltage electricity to disinfect the milking plant and is said to be more effective than commonly used chemicals to kill viruses and bacteria. For more information on this novel technology see:

https://www.oxitechsolutions.com/

Lorna MacPherson, lorna.macpherson@sac.co.uk; 07760 990901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service