MMN January 2024 – Sourcing Finance

12 January 2024Whether you are looking for some funding to help tide you over a difficult financial period or you are looking to reinvest in the business, it is important to consider the various sources of finance available and the benefits and disadvantages of each. Sourcing the right type of finance can save you a lot of time and money.

Overdraft

An overdraft is a very common method of short-term finance which is typically used by businesses to manage cashflow over the short term. Banks typically do not require a business plan or cashflow budgets to open an overdraft. Banks typically charge an annual overdraft fee as well as charging interest monthly on the overdraft amount. In addition, the bank may request security for the overdraft, and this could restrict your ability to access finance from another lender.

An overdraft facility is crucial for most agricultural businesses to manage their cashflow due to their seasonal nature, allowing them to pay bills in months when little or no money is coming in. However, if the business is always in its overdraft and is just getting deeper and deeper into the overdraft it could be worth considering moving the debt from the overdraft into a short or long-term loan, which are typically cheaper.

Trade finance

Trade finance is another very common type of finance used in agriculture. This allows you to purchase machinery, livestock and other inputs and repay the cost over a longer period of time, spreading the cost over multiple years. However, interest rates for this type of finance are typically higher than longer-term loans. The main issue we see with trade finance is that individually they seem affordable, but we are increasingly seeing businesses that have multiple trade finance agreements running alongside one another, adding up to a significant cost and liability for the business. Having a lot of trade finance can also lead to issues with accessing other finance in future.

Short-term loans

Short-term loans typically run for a period of five years and are used to finance investments that have a short payback period. An example of this could be solar panels, which require a significant investment but will pay themselves off over a couple of years.

If you have an existing relationship with the lender a short-term loan is typically easy to access and may not require a business plan or cashflow budgets. However, if you do not have an existing relationship with the lender or have significant borrowing already you may need to complete a business plan and cashflow budgets.

Long-term loans

Long-term loans are typically used by agricultural businesses to finance large investments like land and buildings. Due to the level of finance required these loans have the highest level of affordability checks conducted by the lenders.

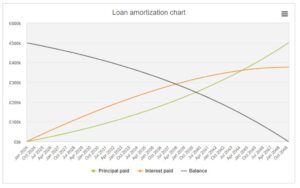

Typically as a minimum you will need to prepare a business plan, outlining the way in which the loan will be used and how this will affect your business. In addition, you will also need to prepare projected cashflows showing the financial impact this investment will have and demonstrate that you can afford to take on this debt. Figure 1 shows that even with a relatively low interest rate of 5%, the amount of interest paid over the term of the loan can be significant.

Figure 1: Repayment profile for a £500,000 loan at 5% interest over a period of 25 years

Conclusion

Providers of finance should conduct affordability checks to ensure that you can afford to repay the debt you are taking on, and some checks are more robust than others. Therefore, you need to be sure that you can afford any debt and the interest on that debt that you are taking on. You still need to be able to service your debts during difficult times, such as periods of low milk prices and while dealing with unexpected costs e.g. paying out family members. If you are struggling to service debt it is best to be proactive and talk to your lenders or an independent advisor and come up with a plan to manage the debt, rather than waiting until the debt burden on the business is unmanageable.

James Orr, james.orr@sac.co.uk; 01292 525252

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service