MMN November 2023 – Milk Market Update

10 November 2023UK Wholesale Dairy Commodity Market

- Fonterra’s latest on-line GDT auction (7th of November) resulted in a 0.7% decrease in the weighted average price across all products, reaching US $3,255/t. Given that the last four auctions showed a positive movement in price, this small decline was perhaps unexpected. Only butter and whole milk powder were down on the previous auction, with butter back 1.6% (to $4,890/t) and whole milk powder back 2.7% (to $2,971/t). The biggest price rise was seen in lactose (+19.2% to $718/t) and cheddar was also up 4.5% (to $4,042/t). Full results are available at https://www.globaldairytrade.info/en/product-results/

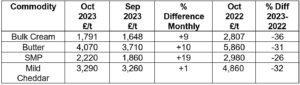

- All dairy commodities showed an increase in average price for October on the back of milk supplies in decline and demand increasing slightly. Butter, cream and SMP were up 10%, 9% and 19% respectively, while mild cheddar was only up 1%. These price movements are in line with EU commodity prices for October, where butter and SMP swiftly increased by 6.9% and 10.3% respectively, while the cheddar price did not change.

Source: AHDB Dairy – based on trade agreed from 25th Sep – 22nd Oct 2023. Note prices for butter, SMP and mild cheddar are indicative of values achieved over the reporting period for spot trade (excludes contracted prices and forward sales). Bulk cream price is a weighted average price based on agreed spot trade and volumes traded.

- The UK butter market moved up on average £360/t, following the rise in cream price. With milk supplies easing both here and on the continent, cream exports to the EU have increased. Prices have also been supported by the volatility in exchange rates.

- Positive movements in the recent GDT auctions have helped support the SMP price. The average price increase from September was £380/t and this was also helped by greater demand for SMP exports to the Middle East and southeast Asia.

- Cheese markets have not been fairing as well, with little trading activity and the average price up by only £30/t from September. Cheese makers are struggling with continued subdued demand on the back of retail inflation and reduced consumer spending. Global demand has also been weak, with a stagnant export market.

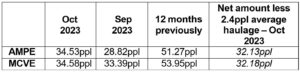

- On the back of rising wholesale prices, the market indicators AMPE and MCVE have risen in October, with AMPE up significantly more than MCVE (+5.72ppl versus 1.19ppl). The Milk Market Value (MMV) for October was 34.57ppl, up by 2.09ppl from September, which gives an indication that farmgate prices may start to rise in three months’ time.

Source: AHDB Dairy

- Defra put the UK average farm-gate milk price at 36.36ppl for September, which was up 0.16ppl from August. The UK volume for September was 1,136 million litres, which was 4.5% less than the previous month and 1.3% less than September 2022. With milk supply currently contracting, the markets have been responding and the decline in October milk production looks set to continue. It is a similar picture globally in some of the main dairy exporting regions and this should help to exert upward pressure on the milk price.

GB Milk Deliveries and Global Production

- For the week ending 28th October deliveries were up just 0.1% on the previous week with a daily average of 32.48 million litres/day. Deliveries are now 3.1% below the same week in 2022, equating to 1,030,000 litres/day less, partly due to the deterioration of grazing conditions with the very wet weather. For the 2023/24 milk year, recent revised estimates for GB milk production is forecast to be 0.5% down on the previous year, reaching 12.32 billion litres.

- The main global exporting regions are also seeing a slowdown in growth. AHDB data for August show that global daily deliveries were back 0.3% on August 2022 (2.4 million litres/day less). The biggest declines in milk output were in the US (-0.8%) and New Zealand (-2.1%) due to tighter margins and farmers responding to lower milk prices by reducing purchased feed and fertiliser use. However, growth in milk production was seen in the UK, EU and Australia in August. The graph below shows the annual change in global milk deliveries, which have been falling over the last few months.

Other News

- Data released from Promar International on their Milkminder monthly dairy costings revealed that for August 2023, margin over purchased feeds was 24.27ppl, back almost 11ppl from August 2022 (MOPF 35.37ppl). While the average concentrate cost fell only by £10/t, the milk price dropped 11.77ppl, accounting for the lower margin. Yield from forage was just over 8 litres/day and concentrate use was 0.32kg/day for an average daily yield of 25.33 litres.

- The Digital Dairy Chain has recently named the winners of an Innovate UK grant competition to support collaborative research and development work. The Digital Dairy Chain is a 5-year project which offers a range of services to improve productivity in the dairy sector right across the supply chain in the geographical area of southwest Scotland and Cumbria. One project that received support was for the development and testing of an innovative, cost-effective, ventilated environment for calves. Galebreaker Ltd will design, build and test the system in collaboration with dairy farmer Ross Vance, High Skeog Farm, Whithorn, and researchers from SRUC. Another successful application was to create a new model with the use of genomics and IVF to accelerate the breeding of lower methane producing, more sustainable cattle. For more information on the Digital Dairy Chain see: https://www.digitaldairychain.co.uk/

Monthly Price Movements for November 2023

Lorna MacPherson, lorna.macpherson@sac.co.uk; 07760 990901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service