Crofting Agricultural Grant Scheme (CAGS) – English

Is Your Common Grazing Maximising CAGS?

(Crofting Agricultural Grant Scheme)

The following article intends to highlight situations where CAGS could potentially be used more efficiently by a common grazing committee.

How much grant is available to common grazings committees?

Common grazings can draw up to £125,000 in CCAGS grants in any two year period. The grant rate is 80%. This article proposes some ideas of how co-operation within a crofting township could decrease capital costs for several crofting businesses.

Is going through the common grazing too much hassle?

This very much depends on the members of your particular grazing! The CAGS grant regulations mean that you have to be a grazing committee or constable registered with the Crofting Commission.

In order to undertake works of improvement grazings regulations specify that you have to notify shareholders of the proposed improvement and the proposed allocation of expenditure. In reality, for fixed equipment like a shed then agreement about who is going to contribute should be decided and then only the contributors can use the new equipment. Only the participant’s successors or transferee of their grazing share will have the rights and responsibilities of being part of the improvement scheme.

Should We Apply as a Common Grazing to get Bigger and Better Sheds?

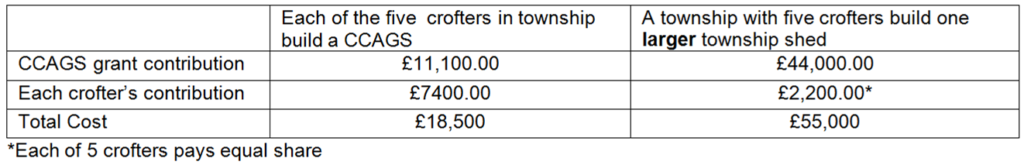

It is quite common for common grazings to have invested together for one larger animal handling facility than for all crofts to have their own smaller systems. This principle could be used to reduce many other capital investments, for example sheds; instead of a township with five crofters wanting to build a shed each and applying separately, if they pooled their resources and built one larger shed they could still save money (see table below).

On top of the reduced initial capital cost, with some planning a township shed could be used to make further efficiencies. For example full artic loads of hay could be bought and stored when prices are lower. The common grazings could then divide the load up by the needs of individual crofters and sell them each an agreed number of bales. This larger shed would enable crofters to order in tonne bags of concentrates which would be cheaper than buying in smaller bags. When individual crofters undertake reseeding under CCAGS they could get a cheaper price if they co-ordinated their applications and ordered full artic loads of lime and fertiliser. The bulk order could be stored on a hard-core area with covers beside the shed. Bulk ordering of lime between several people could also enable maintenance dressings of lime, to address pH issues, out-with a reseeding programme.

Once you have begun to think laterally other diversification opportunities become possible. If you are installing electricity into your township shed, why not see if small scale renewables can be included?

Are inbye parks on the common grazing in need of rejuvenation?

Many common grazings have bull and horse parks which have lost condition and often become rushy. This is likely due to poor drainage and low pH. In this case, CCAGS grant could be used to drain the inbye parks. If the grassland swards are in a tired condition, then a soil sample should be taken and brought into your local office. CCAGS can be used to apply for re-seeding, either surface or full, of inbye parks within the common grazings.

If the feeding value of the park is improved, the following production benefits are possible:

- Tighter calving period if cows are on good grazing during the first service

- Higher daily live weight gains for breeding hoggs if wintered on improved grassland. This has knock-on effects for lifetime breeding success

- Allows more flexibility if sheep need to be kept at hand, for example waiting for contract shearers/scanners

Common Grazings – a way forward

If any of the above has prompted you to consider new opportunities within your township but you need further direction why not consider a government supported ‘Integrated Land Management Plan‘?

If this article has prompted other questions please call the FAS helpline on 0300 323 0161.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service