Scottish Farm Business Survey – Good Technical Efficiency Pays

31 March 2023Every year, the Scottish Farm Business Survey (SFBS) produces National Group Average Datasets for you to benchmark your farm business. This allows you to investigate the financial strengths and weaknesses of your business. While these overall results include both technical and financial benchmarking data for all farm types, this article focuses on the importance of technical efficiency on income and net returns for livestock producers.

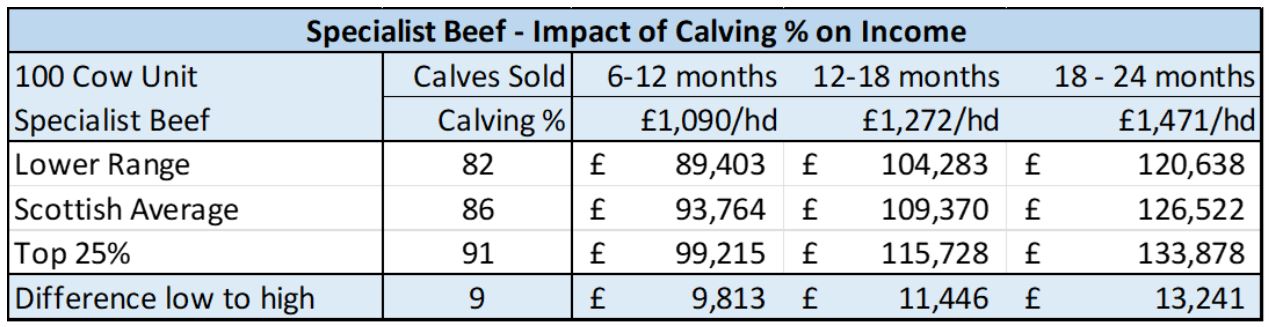

Specialist Beef

The table below details the range in calving percentages recorded for Specialist Beef Producers for the 2021/22 calving year and looks at the income differential based on QMS store cattle prices recorded for the week ending the 18 March 2023.

From these figures above, we see that the producers with the lower range of calving % are losing out on potential income by an average of £11,500 per annum. Allowing for variable costs (feed, vet & med & other livestock expenses) at an average of 34% of output, based on a 100-cow herd, the Top performing herds would have generated £7,500 more profit than the lowest performing herds which is a significant difference.

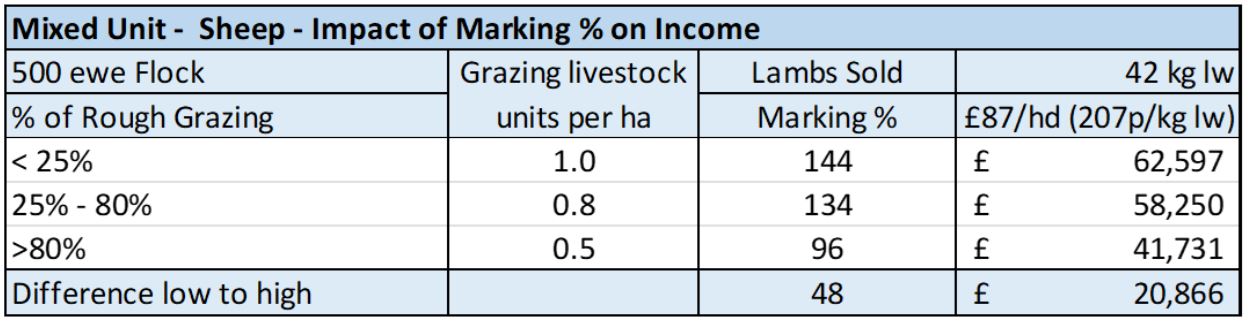

Mixed LFA Units - Sheep

The table below details the range in percentage of lambs marked on Mixed LFA units for the 2021/22 lambing year and looks at the income differential based on QMS finished lamb prices recorded for the week ending the 18 March 2023.

We note that not all sheep units can finish their lambs, but we can see from the figures above, there is a marked difference in income in relation to the % of rough grazing/stocking rate per ha on each unit. This highlights the significance of land type on a sheep unit’s potential earning capacity and that there is no such thing as a ‘typical’ sheep unit.

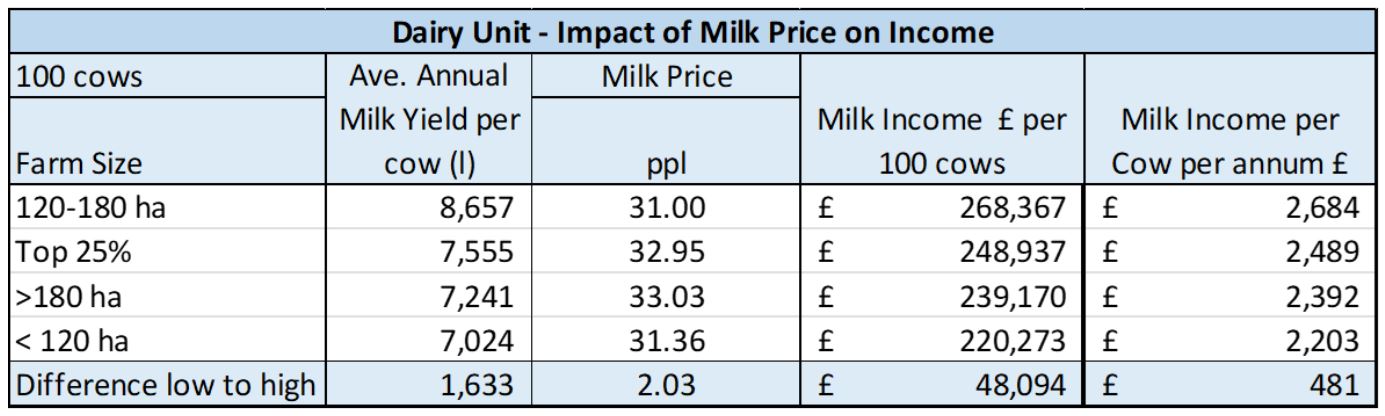

Dairy Units

While it is well documented the range in milk prices being paid to dairy farmers depending on their processing company and their individual milk contract and the range in yield across Scottish dairy units; the table below highlights the impact of both on the farm types split according to hectarage presented on a per 100 cow basis:

We see from the figures above that although the highest yielding group of SFBS recorded dairy units received the lowest average milk price in 2021/22, they achieved the highest milk income per annum and per cow. With regards to milk price, the differential of 2.03 ppl equates to an income differential of £15,225 per annum based on 100 cows, yielding an average of 7,500 litres per annum.

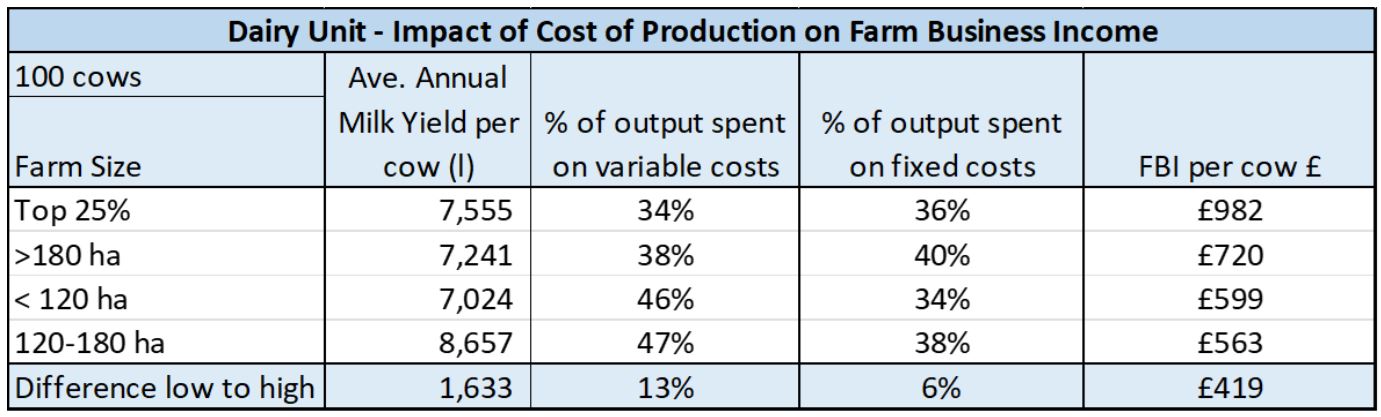

However, as milk output and milk price are only half the story in terms of Farm Business Income (FBI), or net profit, the table below highlights how an individual farm’s costs of production impacts on their FBI per cow, once variable and fixed costs are considered:

We see from the figures above that while the Top 25% of recorded herds did not have the highest milk yield per cow, their FBI on a per cow basis was significantly higher due to lower costs of production.

However, please note that part of the differential in terms of variable costs will be driven by whether producers forward bought fertiliser and/or forward bought feed on contract before they each started to rise significantly over the winter of 2021/22.

Useful Links

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service