Agribusiness News March 2025 – Inputs: Fertiliser Use Trends in Scotland

28 February 2025Fertiliser Use trends in Scotland

Is crop performance being compromised?

Thankfully fertiliser prices have returned to a more tolerable level than that of recent years; however, this extreme price spike has forced a change of attitude towards the use of inorganic fertilisers.

Farmers are actively looking at cheaper alternatives such as the use of organic manures or increasing the use of legumes for nitrogen fixation to supply major nutrients and bring down the annual fertiliser bill. Whilst fertiliser use in Scotland has been declining over the last couple of decades the high prices of 2021 and 2022 have sparked a more significant drop in application rates.

The British Survey of Fertiliser Practice in 2023 highlighted some interesting trends in fertiliser use across the United Kingdom. Table 1 shows a snapshot of fertiliser use in Scotland. The sharp drop is to be expected in response to dramatic price rises, but with another drop in use in 2023, we may be in danger of underapplying phosphate and potash.

Table 1. Total quantities of Nitrogen, Phosphate and Potash used in the UK. Extract from British Survey of Fertiliser Practice 2023. Figures are use in Scotland. Source: https://www.gov.uk/government/collections/fertiliser-usage.

| Harvest Year | Nitrogen | Phosphate 000t | Potash |

|---|---|---|---|

| 000t | 000t | ||

| 1966 | 76 | 81 | 61 |

| Peak Use | 194 (1990) | 75 (1980) | 77 (2017) |

| 2019 | 150 | 46 | 68 |

| 2020 | 131 | 39 | 63 |

| 2021 | 135 | 45 | 69 |

| 2022 | 118 | 32 | 55 |

| 2023 | 114 | 29 | 51 |

Optimal plant uptake of nutrients for growth and root development requires a balance across all major nutrients in the soil. Failure to maintain recommended soil fertility levels will impact the yield and quality of crops and grass but it also increases the potential of negative environmental impacts.

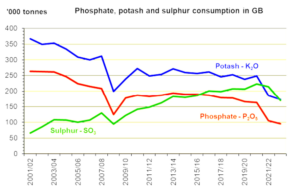

The following graph demonstrates the fluctuations in nutrient use in Great Britain as a whole (Source: AIC Fertiliser Statistics 2024).

Whilst infrastructure and technology mean we can use organic manures more effectively, soil testing is the only true way to measure if what is being applied is appropriate for crop offtakes and soil requirements. Scottish Government have announced that Preparing for Sustainable Farming (PSF) funding for soil sampling will continue in 2025, so it is an ideal opportunity to ensure your soil samples are up to date and identify any emerging patterns in soil fertility levels.

Fertiliser markets

Fertiliser markets have been fluctuating since the turn of the year, after what was a more settled market in 2024. Rises at this time of year are typical due to increased demand for gas and reduced supply. Storage levels of gas in the UK and EU are at lower levels than usual for this time of year. A combination of increased imports to boost stocks and the uncertainty of good tariffs from the United States would suggest we could see further rises in fertiliser prices.

| June ‘24 | Oct ‘24 | Jan ‘25 | Feb ‘25 | |

|---|---|---|---|---|

| Urea (46%) | 350 | 369 | 409 | 445 |

| AN (34.5% imported) | 330 | 334 | 352 | 370 |

| MOP | 365 | 341 | 325 | 345 |

| TSP | 449 | 455 | 472 | 485 |

Ensuring the right product is being used in the best possible conditions will provide the maximum return on fertiliser spend and should be considered before the price per tonne. For more advice contact a FACTS qualified advisor.

Lorna Galloway, Lorna.Galloway@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service