Business and Policy December 2025 – Milk

2 December 2025Milk production data

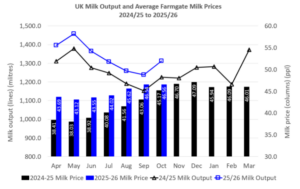

Domestic milk output is still on the rise as we head into the winter months; with a daily GB production figure of 35.74mlitres for the week ending 15th November. This is 0.1% higher than the previous week and 5.1% more than the same week in 2024 equating to an extra 1.82mlitres daily.

AHDB estimated that the 2025/26 milk year will produce 12.83 billion litres, which would be a record high. The estimate for GB milk volume for October was 1,100 million litres; the realised production figure was 1,312mlitres which is a 7.2% increase on the previous month.

Farm gate prices

The Defra farm-gate milk price for October was 46.56ppl, up 0.51ppl from the September price and 2.4% higher than 12 months ago. At the time of writing, milk price drops are still happening thick and fast. From the 1st of December, First Milk has announced a 6ppl drop for suppliers, Lactalis a drop of 3 ppl and a drop of 1.5ppl has been announced for Müller Direct suppliers. From the 1st of December, First Milk has announced a 6ppl drop for suppliers, Lactalis and Grahams a drop of 3 ppl and a drop of 1.5ppl has been announced for Müller Direct suppliers. It is a similar story south of the border, with a drop of 2ppl to 34ppl for Freshways suppliers and Meadow foods reducing their price to 31 ppl.

Looking to next spring, while Muller has announced that if their producers produce more than 102.5% of their 2025 March-June volumes in March-June 2026, they will only be paid 1ppl for the excess milk; Grahams are looking to add 5% to their A milk volume from 1 June 2026 due to their increased demand for high protein products. Graham’s are looking to add 5% to their A milk volume from 1 June2026 due to their increased demand for high protein products. Going forward, we may see more companies changing their pricing structures, with ‘A’ and ‘B’ milk contracts being seen as a solution to managing fluctuations in milk supply.

Going forward, we may see more companies changing their pricing structures, with A & B milk contracts being seen as a solution to managing fluctuations in milk supply.

| Milk Prices for Nov/Dec 2025 Scotland | Standard Ltr ppl | |||

|---|---|---|---|---|

| First Milk2 | Dec | 35.85 | ||

| Müller - Müller Direct - Scotland 1, 3 | Dec | 40.00 | ||

| Grahams1 | Dec | 39.00 | ||

| Arla Farmers2 | Dec | 39.21 | ||

| Lactalis / Fresh Milk Co.2 | Dec | 34.00 | ||

| 1 | Liquid standard litre – annual av. milk price based on supplying 1m litres at 4.0% butterfat, 3.3% protein, bactoscan = 30, SCC = 200 unless stated otherwise. | |||

| 2 | Manufacturing standard litre - annual av. milk price based on supplying 1m litres at 4.2% butterfat, 3.4% protein, bactoscan = 30, SCC = 200 unless stated otherwise. | |||

| 3 | Includes 1.00ppl Müller Direct Premium. Haulage deducted depending on band for 2023 vs 2021 litres, ranging from -0.25 to -0.85ppl. | |||

Dairy commodities & Market indicators

The markets continue to react to the rising milk volume, globally and domestically, with processing and storage capacity struggling to handle the high levels of built-up stock. Demand for products has not been reported to be overly weak but cannot keep up with the volume being supplied.

The average price of butter fell by another £390/t in October, with the average price of cream sitting £234/t lower in November, when compared to the October price. Butter and cream are trapped in a cycle with the price drop in one commodity driving a price drop in the other.

Mild cheddar continues to decline in price but at a slower rate, falling £150/t; with skimmed milk powder also back £20 on the month. As a result, both MCVE and AMPE have moved down again from last month, by 1.16ppl and 2.26ppl, respectively. The Milk Value Indicator also continued its downward trajectory, dropping by 1.75ppl to 33.14ppl for November. This indicator usually has a strong correlation to movements in the farmgate milk price in three months’ time.

The GDT auction had another significant drop of 3.0% at the latest auction on the 18th of November. The average price across all products fell to $3,678/t. The biggest fall was in butter, down 7.6% to $5,886/t and anhydrous milk fat down 5% to $6,543/t.

| UK dairy commodity prices (£/tonne) | Nov | Oct | May |

|---|---|---|---|

| 2025 | 2025 | 2025 | |

| Butter | 4,290 | 4,680 | 6,060 |

| Skim Milk Powder (SMP) | 1,800 | 1,820 | 1,970 |

| Bulk Cream | 1,752 | 1,986 | 2,538 |

| Mild Cheddar | 2,960 | 3,110 | 3,950 |

UK milk price equivalents (ppl) Nov Oct May

2025 2025 2025

AMPE 33.61 35.87 44.60

MCVE 33.03 34.64 44.70

© AHDB [2025]. All rights reserved.

Increase in UK exports

The Agricultural and Horticultural Board (AHDB) has conducted and released the Dairy Trade Review for this year’s third quarter. It has been noted that milk powders have seen the largest year-on-year increase and the total export volumes of dairy products from the UK are up.

Exports to the EU have increased by 12,000t, with an increase of 3,400t to non-EU-nations reported. The main drivers being a rise in milk powder, cheese, butter, and whey exports. Cheese exports to Spain have increased by 500t, Belgium by 600t, the Netherlands by 700t and Germany by 1,100t, making Q3 exports of cheese the highest seen in that quarter for six years. Overall, exports of cheese increased by 3.1% (+1,500 t) year-on-year. While yoghurt, milk and cream exports have declined; their value has increased 6.3% in terms of value year-on-year.

Winter lighting systems can boost herd productivity

During the winter months when days are shorter, milking herds can often experience a drop in milk yield. Research has shown that the drop in milk yield could be reduced by using innovative lighting systems to extend the photoperiod experienced by the herd. This can help influence the cow’s metabolism, productivity levels and some key hormones such as melatonin, prolactin, and insulin-like growth factor-1.

DairyLight has developed a lighting system which has been specifically designed for dairy cattle. The Long Day Photoperiod (LDPP) system provides 16 hours of blue-enriched white light to mimic daylight, followed by 8 hours of red light at night to allow the cows time to rest. As dairy cows are influenced by day length and light intensity, Alltech E-CO2 found that DairyLight luminaires increased milk yield on farms by 9%. In addition to which, upgrading to an LED lighting system could also reduce energy consumption and costs on farm.

While, with the significant milk price drops being announced this autumn, boosting overall milk production will not be a priority for many conventional milk producers, achieving the same milk volume from less cows will help to reduce overall costs of production over the winter period.

Organic Milk

Akin to the strong growth in total GB milk production this year, AHBD have report that for the week ending the 15th November 2025 although GB Organic milk deliveries decreased 1.2% compared to the previous week, Organic GB milk deliveries are now running at 7% above the same week last year; equivalent to 73.3 thousand litres.

Volumes have shown year-on-year growth since March 2025, with the latest GB organic delivery estimates up to 8 November showing a 11.6% year-on-year increase in the milk year to date. This is equivalent to an additional 24.6 million litres of organic milk. However, despite the increases this year, volumes remain significantly below (-7.8%) the 4-year average, which goes some way to explain why, at the time of writing, no price cuts have been announced for organic producers.

Keira Sannachan, keira.sannachan@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service