Business and Policy January 2026 – Milk

5 January 20262025 review: A tale of two halves

- Milk volumes increased in the second half of 2025 as there was a relatively attractive milk price to feed cost ratio. Following a dry spell, the grazing season for many was extended in 2025 after a period of rain allowed for both improved grass growth and quality in late summer/early autumn.

- Prices for butter, skimmed milk powder, cream and cheddar generally declined over the course of the year; the most noticeable price drops occurred from August onwards as milk production rose and demand diminished.

- Milk price was below cost of production for most of 2025.

Milk Volume

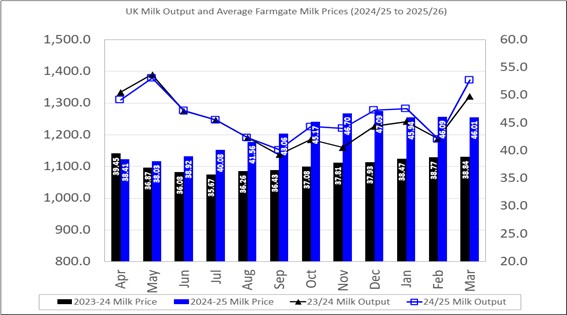

Milk volumes reflected the dry spring we experienced last year, which in Scotland allowed for good grass growth, and earlier turnout when compared to 2024. Improved grass growing conditions in the late summer and early autumn months coupled with more autumn calving cows contributed to the production continuing to increase during the later months of the year.

Overall, volumes were up and apart from February; monthly GB deliveries being more than in 2024. AHDB’s forecast is estimating GB production for 2025/26 to be 13.05 billion litres, 4.98% more than the previous milk year.

2025 Milk Price

Milk prices were relatively static for the first quarter of the year with the Defra average farm-gate price ranging from 45.94ppl to 46.01ppl from January through to March.

We had a historically dry spring in 2025, which allowed for good grass growth and cows were turned out earlier, which supported stronger yields in the spring and early summer. The average farm-gate price then dipped to 43.12ppl in May and then rose to a high of 46.56ppl in October, 1.39ppl more than the same time in 2024.

The general trend across the main processors in Scotland in 2025 was static pricing in the first 6 months, with prices falling gradually until the sharp price cuts in November linked to oversupply and falling demand.

| Milk Prices for Jan 2026 Scotland | Standard Ltr ppl | |||

|---|---|---|---|---|

| First Milk2 | Jan | 32.25 | ||

| Müller - Müller Direct - Scotland 1, 3 | Jan | 37.5 | ||

| Grahams1 | Jan | 37 | ||

| Arla Farmers2 | Jan | 38.5 | ||

| Lactalis / Fresh Milk Co.2 | Jan | 31.07 | ||

| 1 | Liquid standard litre – annual av. milk price based on supplying 1m litres at 4.0% butterfat, 3.3% protein, bactoscan = 30, SCC = 200 unless stated otherwise. | |||

| 2 | Manufacturing standard litre - annual av. milk price based on supplying 1m litres at 4.2% butterfat, 3.4% protein, bactoscan = 30, SCC = 200 unless stated otherwise. | |||

| 3 | Includes 1.00ppl Müller Direct Premium. Haulage deducted depending on band for 2023 vs 2021 litres, ranging from -0.25 to -0.85ppl. | |||

Milk: Feed Price Ratio

The milk to feed price ratio for 2025 was well within the expansion zone for the majority of the year which encouraged farmers to increase production. The monthly ratio figure rose from 1.46 in May to 1.60 in September.

As the ratio is normally provided 2-3 months in arrears, it is expected that there will be a sharp change in direction following the milk price drops.

Cost of Production

For the 2024/25 milk year, the average cost of production was calculated at 48.5ppl by The Dairy Group, with an estimated forecasted cost of 49.2ppl for the 2025/26 milk year, leaving a loss of 0.1ppl after accounting for family wages. As the production cost is well above the average farm-gate milk price from April to October last year, this is of significant concern given the significant fall in milk price in recent months.

Commodity Prices

With higher milk volumes, 2025 wholesale prices remained relatively static for fats, with small fluctuations for the vast majority of the year. Butter did, however, see a sharp decline in price towards the end of the year, falling from £6,050/t in August to £4,290/t in November.

Cream followed a similar trend falling from £2,730/t in August to £1,752/t in November, almost half of what it was in September 2024. With a build-up of stocks due to the increased milk volume; processing and storage capacity are coming under real pressure.

2026 Dairy Outlook

While the UK dairy industry faces uncertain times with the significant fall in milk price and lower returns for cast cows due to the increase in numbers being culled to help curb milk production; Rabobank Research predicts that global milk supply growth will slow to 0.44% year on year in 2026.

From a production perspective, New Zealand farmers have been setting new milk solid records each month from May to September 2025, peaking in October with the third highest output on record. South America is also shaping up to deliver a significant annual volume increase. However, the seven main exporting regions (New Zealand, Australia, the EU, the US, Uruguay, Brazil and Argentina) will see a modest estimated output increase of 0.12% in 2026, when compared to the 2025 figure of 2.2% year on year, due to margin pressure building.

From a demand perspective, the global dairy market is still facing reduced demand with low and middle-class consumers being the most impacted, coupled with diminishing consumer confidence in the US and China.

From a pricing perspective, the global dairy market is facing a period of weaker commodity pricing, in the face of increased milk supplies into 2026 and exportable surpluses. With a weaker demand, in the absence of supply shocks to impede surplus milk, the risk of extended periods of weak pricing increases through mid-late 2026, as surplus milk enters the market. Weaker prices should eventually support an uptick in demand towards the end of 2026, with prices returning to historical averages.

Keira Sannachan, keira.sannachan@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service