Business and Policy July 2025 – Sheep

30 June 2025India Trade Agreement

An agreement was made at the start of May for a UK–India trade deal. This is likely to come into force at the start of 2026 but there is finer detail yet to be defined for this deal. How it currently stands, sheep meat from the UK will reduce from the current 33% tariff, to being tariff-free. This should reduce the price of sheep meat to the Indian customer and therefore increase demand for UK lamb and mutton.

India has a growing middle-class population, who are seeking high quality nutritious food e.g. Scotch Lamb. The reduction in trading tariff could potentially open up new opportunities for Scottish producers.

Trade

The week ending 21st June saw new season lamb prices rising to 749p/kg DW, which was 25p/kg DW up on the week, but 31p/kg DW down on the year. When we look around the world and modify to the Euro, the French product is currently on a high at €10.25/kg, (week ending 14/06) compared to Great Britian at €8.49/kg. On the lower side are Australia and New Zealand with €5.91/kg and €4.97/kg respectively. Of note, is how much this Australian and New Zealand price has risen on the year as shown below:

| 14/06/2025 | 15/06/2024 | Difference | |

|---|---|---|---|

| Australia | €5.91/kg | €4.42/kg | +€1.49/kg |

| NZ | €4.97/kg | €3.66/kg | +€1.31/kg |

Australian Intentions Survey

Meat and Livestock Australia and Australian Wool Innovation have launched their findings from their intentions survey which shows that 58% of Australian producers have indicated that they will reduce their breeding flocks. The largest reason for this stands out as the weather and seasonal changes, with the percentage of producers showing this as 50% compared to 31% in 2023. This is due to persistent droughts in some areas, low pasture availability and high feed costs, making it challenging to maintain the large flocks. Government changes were also a significant factor, with the impending live export ban in 2028 being a large reason, with almost a quarter of producers listing this.

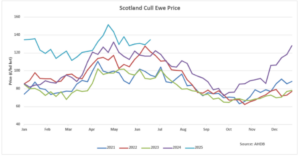

Mutton

The UK sheep meat trade has been very interesting to follow this year, with record prices being achieved. This is largely driven by the national flock decreasing, and less supply being available both domestically and globally. Another driver here is the ever changing and fluctuating price of lamb, and the larger ewe carcass offering better value for some markets.

With Australia and New Zealand being such large sheep producing countries, we look to see the trends in mutton for these countries:

Australia currently has a booming mutton market, with the price currently sitting 57% higher than it was in January at 674c/kg cwt. The reason here is due to an inconsistent supply of lamb with droughts etc. affecting growth and availability, the vulnerability of the climate and producers using strategies to steady supply in a challenging marketplace. Earlier, we showed how the lamb price is increasing, choosing mutton allows for a higher yield of meat and more affordable prices.

The New Zealand flock has seen large decreases in the flock size due to tree planting. With the decreasing flock, sales of cull ewes are currently high as producers cash in their breeding ewes following a downturn in the market in 2024. The increase in kill to the end of May showed a 13.6% increase on the year or 336,000 head. An example of how the price has increased is shown below:

| April 2024 | April 2025 | Difference | |

|---|---|---|---|

| NZ Mutton | 5.09/kg NZD | 7.06/kg NZD | 1.97/kg NZD |

Kirsten Williams; kirsten.williams@sac.co.uk 07798617293

| Week ending | GB deadweight (p/kg) | Scottish auction (p/kg) | Ewes (£/hd) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 16.5 – 21.5kg | Scottish | ||||||||

| R3L | Change on week | Diff over R2 | Diff over R3H | Med. | Change on week | Diff over stan. | Diff over heavy | All | |

| 07-Jun-25 | 748.1 | 34.4 | 0.6 | -3.3 | 364.00 | 13.3 | 3.2 | 29.0 | 130.77 |

| 14-Jun-25 | 724.7 | -23.4 | 1.1 | 4.4 | 366.50 | 2.5 | 0.6 | 20.5 | 129.27 |

| 21-Jun-25 | 747.4 | 22.7 | -2.7 | -3.5 | 373.40 | 6.9 | 7.0 | 11.1 | 134.67 |

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service