Financing Improvements on a Common Grazing

9 November 2023What do we mean by an Improvement?

'Improvements’ on a Common Grazing refer to new or substantial upgrades to fixed equipment items such as fanks, handling systems, dippers, fences to create new parks and so on. This is slightly different to items or works that are considered ‘maintenance’, such as clearing out ditches or replacement of old fences. If your Common Grazing is considering making an ‘improvement’ there are several steps to follow, to ensure that payments are collected and accounted for correctly.

Once the committee has decided on what improvement they wish to make, the first step is to collect quotes for the improvement, materials and labour if necessary (if using a CAGS grant be sure to get the correct number of quotes required, unless the improvement is a fence or shed, in which case, Standard Costs can be used).

Covering the Cost

The committee needs to decide who will contribute to the cost of the improvement. For example, if the improvement is a cattle handling system, perhaps shareholders without a cattle souming won’t have to pay. If the improvement is a shed, it could be possible that a crofter with a sublet with only one year left of it, may not be asked to contribute. If a new park is being fenced, it may be expected that all shareholders pay as it benefits all. Once this is decided the clerk should work out the allocation of the cost (and grant) based on each shareholder’s souming.

Dividing the Cost

So that everyone is compared on the same scale, the souming number of cattle, sheep and horses for each shareholder are converted into an equivalent number of just sheep. This figure is called Total Sheep Equivalents, or "TSEs". Details of shareholders and TSE numbers can be obtained from the Crofting Commission's Grazing Team or on the Register of Crofts.

The table below shows an example of a calculation for an improvement, using TSEs. This Common Grazing has 4 shareholders. Some have a croft that has been divided and some have crofts that were merged in the past. The Total TSE for the Common Grazing = 80.

| Cost: £16,000 | |||

|---|---|---|---|

| Croft | TSE | Calculation | Contribution |

| Croft 1a | 10 | £16,000 / 80 x 10 | £2000 |

| Croft 1b | 10 | £16,000 / 80 x 10 | £2000 |

| Croft 2 | 20 | £16,000 / 80 x 20 | £4000 |

| Croft 3 & 4 | 40 | £16,000 / 80 x 40 | £8000 |

| Total | 80 | £16,000 |

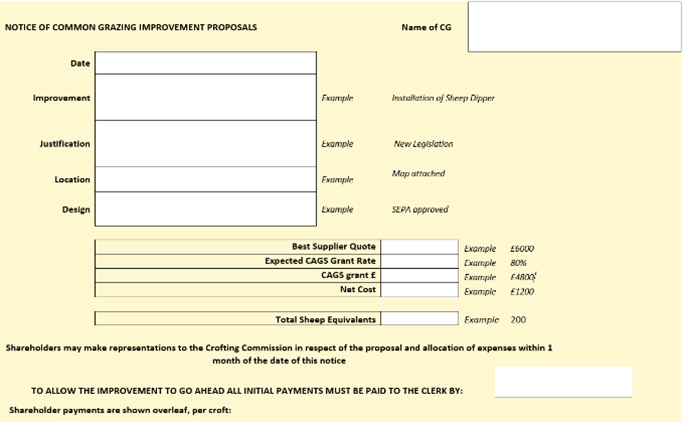

Informing Shareholders

The next step the committee should take is to produce a Notice informing each shareholder of the proposed improvement and the cost. If applying for CAGS funding they should also receive a copy of the CAGS application. The Crofting Commission has prepared a template Notice that can be used, you can find it on the FAS website here. This notice has to be done in writing, and be hand delivered to the shareholder, or sent to them by post using the recorded delivery service. The notice must state that the shareholders can write to the Crofting Commission if they wish to object or ‘make representation’ as to why they do not agree with the proposal, giving details of their concerns.

Objections

A shareholder has one month from the date of the notice to send an objection to the Crofting Commission.

The Crofting Commission may approve the proposal, modify it or reject it.

If a shareholder objected (officially or unofficially), the proposal could still go ahead but with the cost covered by the shareholders that agreed with the proposal.

Using Existing Funds

Sometimes the Common Grazing fund will have sufficient funds in the bank to cover the cost, but, as this money belongs to the shareholders, everyone still needs to agree on the spend. You still need to write a Notice to all shareholders if the Common Grazing has sufficient funds.

The Common Grazing Committee must keep a record of all financial transactions linked to the improvement.

Before paying out any of the proceeds of grant to a participant of the improvement, the committee may deduct any levies and costs which the participant is due to pay as their share of the running of the Common Grazing.

CAGS

CAGS grant may be available at 80% grant rate. The application must be approved by RPID before materials are purchased or work has started. Once approved, the improvement has to be paid upfront, and the grant amount is claimed and paid after completion of the work.

Top Tips

- Ensure every shareholder knows of the proposal.

- Keep a record of dates and payments.

- Send a copy of the Notice to the Commission.

- Use the FAS template for the calculation of TSEs.

- Call the free FAS Advice Line for guidance if needed.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service