Business Skills for New Entrants

Agricultural business (agribusiness) management is essential when building or developing an agricultural business. By using tools such as cashflows, accounts, record keeping, and benchmarking, enterprises and business performance can be analysed. This can lead to reducing costs, increasing efficiency and profitability.

Business skills aid informed business decisions and equip people with the skills for applying for tenancies, joint ventures, borrowing finance, preparing for interviews, etc.

We have numerous resources on the following topics:

- Getting Started & Business Planning

- Taxation

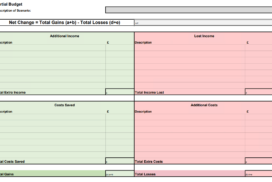

- Funding & Budgeting

- Bookkeeping

We also have recorded webinars on our New Entrants Introduction to Finance Series. Click here to jump to the webinar section.

Jump to sections:

Getting Started

Starting Out in Arable Agriculture

New Entrants Finance Course Webinars

Watch our new entrants webinar series which has been designed to demystify and develop key concepts you will need to succeed. This course will help you establish systems and processes that you will use until you retire.

Funding & Budgeting

Taxation, VAT & Bookkeeping

Tax Basics for New Entrants

Watch our webinar recording where George Gauley and Chloe McCulloch from SAC Consulting cover the basic points surrounding business structure and income tax for new entrants to farming. This meeting was hosted in January 2020. This webinar contains reference to trading/financial years which is now outdated following basis reform.

Crofting Matters Podcast - Tax and VAT for Crofters

It might not sound that interesting, but, especially these days, understanding what you can and should be doing with accounts and tax is important to save unnecessary expense and keep within the law. Margi Campbell, an expert in tax and vat, gives some insight into what crofters can do to improve their finances. It’s a confusing topic, but in this podcast we chat about the different terms, and what they mean in practice for crofters who are self-employed or employed, or vat registered or not. Read more >>

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service