Employing People

Employing People in agriculture is becoming an increasingly complex situation. Many farms employ people on a self-employed basis to provide valuable extra resources at busy times – for example relief milking and tractor driving.

However HMRC are now starting to investigate the employment status of self employed workers by assessing their working obligations and payment terms. Problems arise when HMRC take the view that these workers are actually meeting all of the criteria of employees and should be ‘through the books’. In this situation the farmer is liable for the tax and national insurance bill which can be as much as a four figure sum!

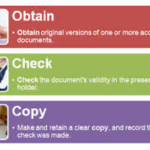

The materials on this section of our site will assist you in how to distinguish between self-employed contractors and employees while for those of you looking to employ; it will provide a toolkit of information and resources to allow you to get somebody onto your payroll.

For those who are employing or looking to employ, it is worth knowing that the Scottish Agricultural Wages Board sets minimum wages and conditions by way of Agricultural Wages Orders, enforcement functions are exercised by officials in the Scottish Government’s Agricultural Business Development Team rather than the Board.

Scottish Government enforcement officials use the Agricultural Wages (Scotland) Act 1949, the Agricultural Wages (Scotland) Order and the relevant edition of the Guide for Workers and Employers as their principal sources of guidance.

The links below will signpost you to more information on all of the key areas in relation to employing people and allow you to access electronic templates and checklists.

Employing people webinars

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service