Common Grazings Dilemmas

Common grazings are areas of land used by a number of crofters and others who hold a right to graze stock on that land. There are over 1000 common grazings covering over 500,000ha across Scotland.

Here we look at 12 common dilemmas facing common grazings and what the options are if you're dealing with this in your grazings.

If you've got further questions about how to manage your own common grazings, visit our common grazings page or call our advice line on 0300 323 0161 or email advice@fas.scot.

The Common Grazings has no money in their bank account

OPTIONS AND CONSIDERATIONS

No action required. This is possible in an inactive or minimally active grazings with very little fixed equipment to maintain.

If the only expenditure is the 3 yearly public meeting to appoint a new grazings committee and fence maintenance as required. Money to cover costs and administration could be gathered at the time of the event.

Where the clerk is being paid to monitor and deal with correspondence or stock on the grazings, a grazings fund could be established by writing to (contacting) all shareholders with a statement of the required funds and a date by which the sum due by each shareholder should be paid to the clerk.

If minimum funds are being retained in the bank account any exceptional maintenance cost or proposed improvements could be dealt with as they arose.

Shareholders are ignoring the common grazing regulations

OPTIONS AND CONSIDERATIONS

The committee are responsible for managing the grazings, basically this requires avoidance of over or under grazing.

If the total stock numbers on the grazings do not exceed the combined maximum souming the committee could opt to do nothing.

If the maximum souming is being exceeded the committee could ask the clerk to write to the owner of the cattle requesting the excess are removed.

It is also possible for the owner of the extra cattle to be asked to pay a fee for using another shareholder’s unused souming with the fee being used for committee expenses or passed to the other shareholder. It is within the remit of most committees through their regulations to take this action.

In the event that a shareholder refuses or fails to remove stock when formally requested by the committee they may report the matter to the Crofting Commission.

The Commission’s authority allows it to suspend or (in extreme circumstances only) terminate a shareholders rights in the grazing after it has carried out an investigation and usually allowed the shareholder time to remedy the situation.

It may be considered good practice to re-allocate unused souming as an annual function of the committee.

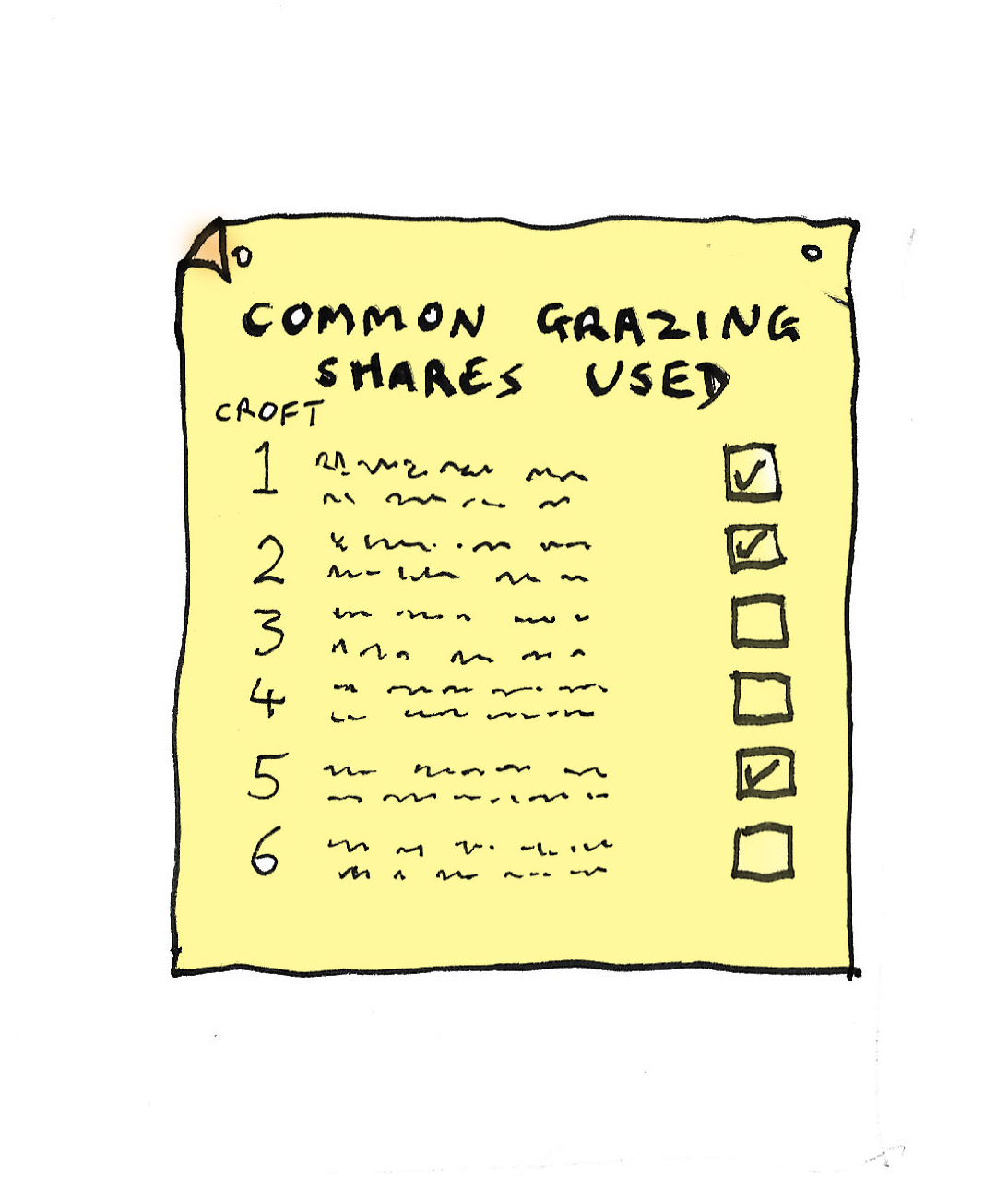

Inactive shareholders not willing to contribute to improvements on the common grazing

OPTIONS AND CONSIDERATIONS

In the first instance the committee should instruct the clerk to circulate a notice showing the breakdown of the expenditure and allocation of it for each shareholder to all shareholders.

In the situation above a second notice should be circulated showing the reallocation of the cost across the reduced number of participating shareholders, again this should go to all shareholders and should also include the costs of buying in to the improvement at a later date.

The notice should also include the schedule for collecting the money from the participants, carrying out the work, claiming the grant and reimbursing participants.

A copy of the finally agreed proposal should be sent to the Crofting Commission at the same time as it is circulated to shareholders. This allows the Commission to assess the proposal in the event that a shareholder decides to challenge the content of the proposal.

In the event of a challenge the Commission will confirm the proposal is acceptable, amend it or apply conditions or reject the proposal.

Care is required in considering how sub-tenants of grazing shares can participate in improvements.

There are a lot of shareholders not using their shares

OPTIONS AND CONSIDERATIONS

The committee have the authority to allocate the unused souming to another shareholder or to any person on an annual basis on whatever terms they determine. Any charge made for the souming can be offset against administrative costs or passed to the principle shareholder.

A shareholder not wishing to utilise their grazing right can sublet it to a person of their choosing, subject to the approval of the Crofting Commission. It is beneficial to ensure the grazing committee are aware of any sublet and particularly in longer sublets a provision is made for the participation of the sub tenant in any income or expenditure relating to the grazing.

It is possible that a share is not being used due to a vacant croft or failed succession arising. In this situation the committee may wish to encourage the landlord to let the croft and consequently bring the share back into use.

The new Duty to Report may have an influence on the number of shareholders not using or subletting crofts and grazings shares.

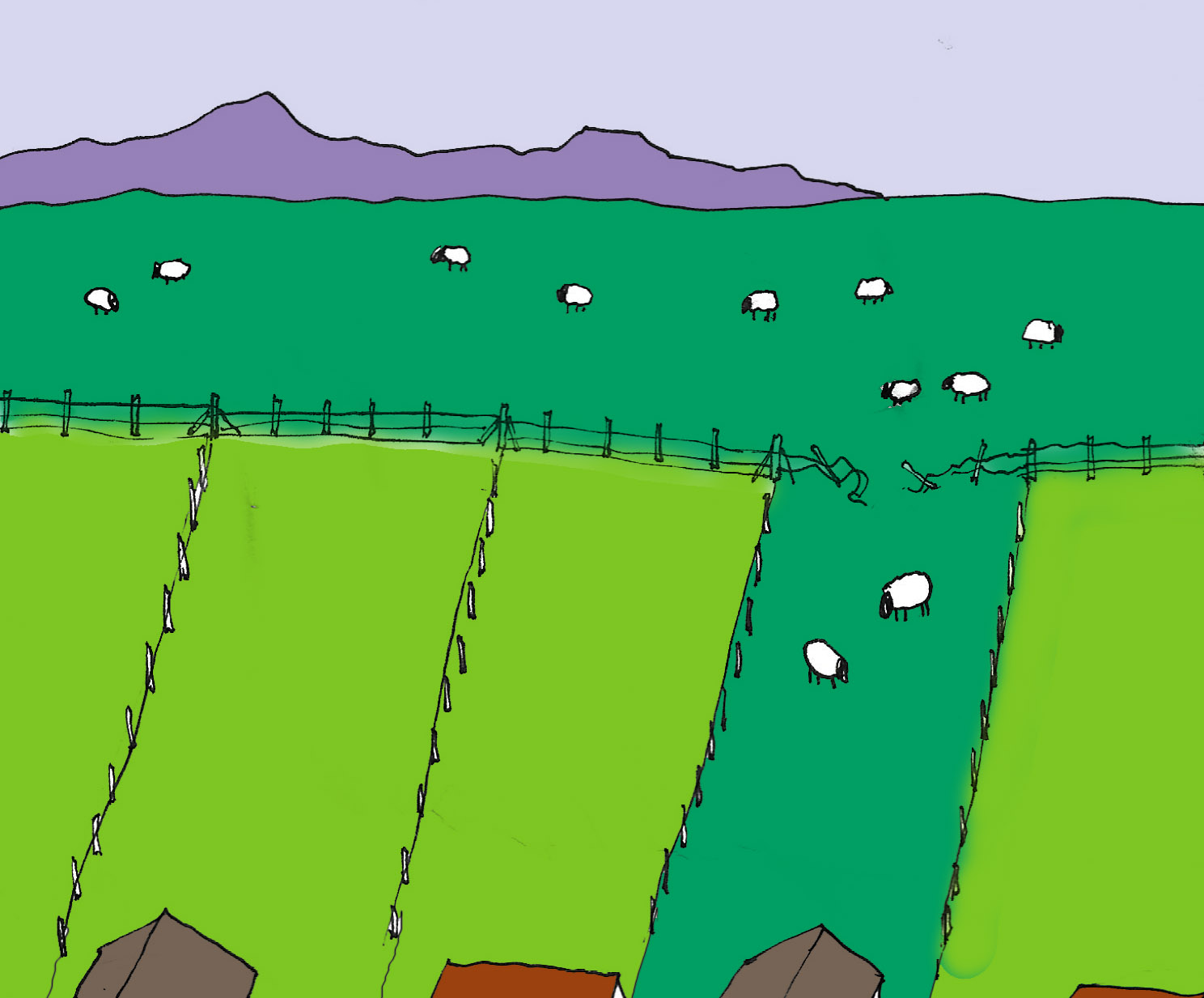

Who is responsible for fences bordering Common Grazings

OPTIONS AND CONSIDERATIONS

It is the responsibility of the committee to manage and maintain the common grazing and in order to do this effectively there is usually a fence between the crofts and the grazing consequently this fence is the responsibility of the committee.

The committee can require funding from all shareholders (or sub tenants) for the maintenance of this fence.

If a shareholder does not pay their share of the cost following proper notification of the requirement they can be reported to the Crofting Commission for breach of regulations. The Commission’s authority allows it to suspend or (in extreme circumstances only) terminate a shareholders rights in the grazing after it has carried out an investigation and usually allowed the shareholder time to remedy the situation.

What is the correct process for changing Grazing Regulations

OPTIONS AND CONSIDERATIONS

If it is a considerable time since regulations were reviewed the committee should ensure all shareholders have a copy, many date from 1997.

The committee should then assess the activities of the committee in recent years and develop proposals for removing and adding any elements which would benefit the running of the grazing.

It is suggested that the Crofting Commission’s new template for grazing regulations is used to create an amended set for submission to the Crofting Commission.

A copy of the new proposed regulation should be made available to shareholders prior to forwarding to the Crofting Commission.

When an amended regulation is approved by the Crofting Commission a copy should be issued to each shareholder. The operational date of the new regulation will normally be fixed by the Commission.

The common grazings is considering renewables

OPTIONS AND CONSIDERATIONS

There are a few options for this type of development on Common Grazings.

Perhaps the most obvious is the section 50B of the crofting act, “Use of common grazing for other purposeful use”. This allows a crofter to propose to the grazings committee that part of the grazings is used for something other than grazing or woodland. It is a new and so far, little used process.

More commonly the crofters have worked in conjunction with the landlord using section 19A “Schemes for development” to take forward a renewable project. This entails the landlord making an application to the Land Court specifying the physical and financial details of the project. The act includes a requirement that the crofters benefit to an equivalent amount as they would have if the land being utilised had been resumed.

Some of the renewable projects already in place have used section 5(3) to restrict the tenant’s rights by agreement with the Crofting Commission and the Land Court to provide protection for the project in the future. Without the agreement being approved it is unlikely to be binding on successive tenants.

There are probably other informal arrangements and agreements in place which are effectively contracts between landlords, tenants and developers but their security on croft land may questionable.

For some developers only resumption of the land under section 20 is considered secure enough for them to invest. This would be led by the landlord in the usual manner.

The complexity of these developments arises from the number of parties concerned, landlord, developers, planners, environmentalists, grid contollers and whether all or only some of the shareholders support the proposal.

The common grazings is considering forestry

OPTIONS AND CONSIDERATIONS

The committee should seek professional guidance at an early stage; this may incur costs and therefore fundraising from shareholders.

The committee need to establish how many shareholders wish to participate in a forestry scheme and they are obliged to take forward an application even if only one shareholder makes the proposal.

The committee must seek the consent of the owner. 119. (a) (g) (h) (j) (m)

The committee must issue a notice to all shareholders clearly showing the allocation of expenditure and confirming the intended use and allocation of any arising income.

The committee must maintain a separate account of all transactions relating to the forestry.

A new shareholder wishes to graze a horse on the common grazings

OPTIONS AND CONSIDERATIONS

First check current grazings regulations for horse souming or statement of equivalent animal types. Some regulations contain a statement as to the numbers of cattle to sheep and may include an equivalent for a horse. If this is in the regulation it appears likely that the shareholder can utilise their souming as they wish regarding the type of livestock being grazed.

If the grazings is not up to its full souming the committee could permit the addition of the horse without any other action.

If the full souming for the grazings is being utilised the committee would require to alter the souming of the horse owner to accommodate the horse. This change should be notified to the Crofting Commission.

If the horse belongs to a non shareholder and is taking up unused souming the committee may levy a charge on the horse owner and utilise the money for grazings purposes.

A non-shareholder wants to join the committee

OPTIONS AND CONSIDERATIONS

It is permitted for a non shareholder to be appointed to the committee but they would not have voting rights in matters where shareholder votes are counted.

Committees may find it useful to have professionals on the committee who have knowledge or skills pertaining to grazings activities, a vet or an accountant for example.

The way in which the appointment is made may be important to avoid conflict among shareholders.

Splitting the payment for the township bull when some shareholders have cattle and others do not

OPTIONS AND CONSIDERATIONS

The Crofting Commission suggest a pragmatic approach is taken for this.

Only shareholders with cattle will normally contribute.

Liability insurance may be an issue for a hired in bull.

Scope for a new cattle owner to join the ‘bull group’ should be possible.

Method of charging shareholders needs to be agreed, per cow or per share (souming).

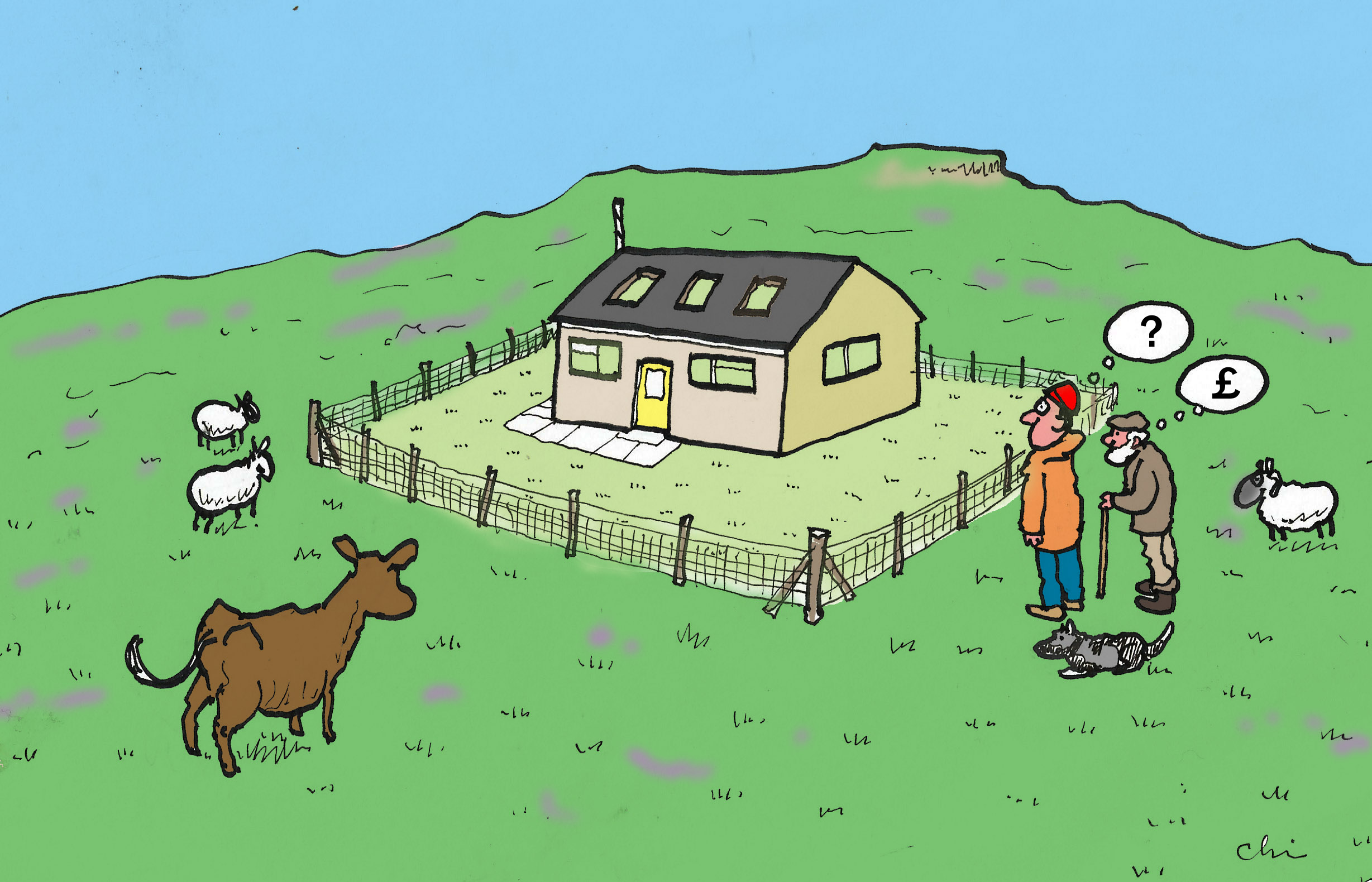

An unexpected building appears on the Common Grazing

Removal of an area of common grazings (or croft) from crofting tenure through the Scottish Land Court.

Options and considerations.

- Shareholders should be aware that it is not compulsory for the landlord to resume land prior to sale.

- For grazings with less than 10 shareholders the S L C will issue a notice of a resumption application to each shareholder inviting responses.A landlord applying to resume land where there are more than 10 shareholders may, with the permission of the S L C, advertise the details of the resumption in a locally circulating newspaper. The advert will invite shareholders to respond to the S L C.Committees for larger grazings should therefore monitor newspapers locally although, hopefully a good relationship with landlords would ensure resumptions were not missed.If there is a committee and a clerk in office, they will normally receive a copy of the resumption application.

- It should be understood that an owner of common grazings land who is not collecting rent is still burdened by other crofters’ rights like apportionments or forestry applications.The owner would also be responsible for paying crofters compensation if they applied to resume any of their croft land.

- It is advantageous for landlords and crofters to maintain a close relationship and discuss proposed resumptions prior to the submission of an application to the S L C.The use of minutes of consent signed by shareholders can facilitate the processing of resumptions by the S L C. It is necessary for all the shareholders to agree the terms of the minutes of consent for them to be effective in support of a resumption.It is advisable for committees/shareholders to watch for unexpected signs or activities on the grazings.

- Compensation payments to shareholders are distributed in proportion to each shareholders’ right in the common grazings. This is usually calculated on the current souming of each shareholder.It is worth noting that no compensation is due where a share is vacant. (A share is vacant when there is no registered tenant)

- The normal procedure for payment of compensation is from the landlord (or their agent) to the clerk who distributes it to the shareholders.There is an option for individual shareholders to request payment directly to them, not via the clerk.It may be prudent for committees to consider any likely future or past work for which shareholders have a financial liability at the time of a resumption and notify shareholders of the sums involved.Where a good relationship with a landlord exists, it may be possible to propose resumptions as a way of raising funds for work on the grazings.

- If the resumption relates to a registered common grazings it is the responsibility of the landlord to register that resumption with Registers of Scotland. A failure to do so within 3 months of the resumption being approved by the S L C means it will not come into effect and a fresh application would be required.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service