Business and Policy February 2026 – Beef

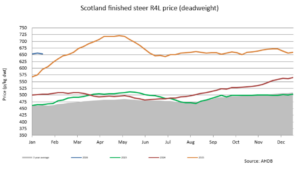

2 February 2026New Year Prices Remain Historically High

Finished beef prices have started strongly and as of mid-January for week ending 24 January R4L grades were sitting at 650p/kg/dwt. Although prices remain historically high, prices have continued to trend downwards in recent weeks, with processors reducing prices by 4-6p/kg/dwt.

Carcass imbalance remains a concern for processors as consumers opt for cheaper cuts and manufacturing beef products like mince etc. With steak cuts proving difficult to shift, the price gap between prime cattle and cull cows is becoming less.

Looking forward, it is anticipated with tax and fertiliser bills to be paid and reports of feed and forage stocks dwindling in some areas, that finished prices will continue to be pressured and will continue to ease downwards as increased numbers come forward.

Cull Cows

Cull cow prices have shown a seasonal rebound as sales of mince drive demand with consumers opting for lower value cuts post-Christmas as credit card bills look for payment.

It is expected that the cull cow trade should remain fairly stable in the short-term, although with milk prices continuing to fall will potentially see an increase in dairy cows coming forward, which will influence prices to an extent.

Store Cattle

Keen demand for store cattle continues leading to store cattle prices remaining elevated, with many markets reporting store cattle to be well up on the year. However, the drop is that finished cattle prices are expected to filter through to the store price.

Irish Beef Outlook

AHDB have recently released data relating to beef production in Ireland. Beef production fell in 2025 by 6% in comparison to 2024 and is forecasted to fall in 2026 by a further 4%. Irish beef prices also reached record highs last year, reaching 664p/kg/dwt at the beginning of April.

Reduced beef production in Ireland will affect exportable volumes in 2026 and will likely reduce shipments to the UK. Irish beef prices are greatly influenced by their key export markets, the UK being one.

Spring Bull Sales

Record farmgate prices in 2025 has no doubt boosted confidence amongst suckler farmers and with store prices holding firm, there is confidence ahead of the February Stirling Bull sales. More than 700 pedigree bulls, across nine breeds are expected over the two week sale period; the highest number forward since 2022. Suckler cow numbers have, however, significantly contracted since 2022 and many are questioning whether there will be homes for all these bulls. Time will tell…

Sarah Balfour, sarah.balfour@sac.co.uk

Scotland prime cattle prices (p/kg dwt) (Source: drawn from AHDB and IAAS data

| Week Ending | R4L Steers (p/kg dwt) | -U4L Steers | Young Bulls -U3L | Cull cows | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Change on week | Diff over North Eng. | Change on week | Diff over North Eng. | Diff over North Eng. | R4L | -O3L | ||||

| 03-Jan-26 | 654.1 | -5.1 | -5.2 | 649.3 | -2.4 | -0.3 | 642.9 | 0.7 | 542.5 | 521.9 |

| 10-Jan-26 | 656.3 | 2.2 | -3.3 | 649.2 | -0.1 | -3.4 | 646.3 | 4.2 | 546.4 | 519.3 |

| 17-Jan-26 | 653.2 | -3.1 | -1.3 | 648.4 | -0.8 | 0.0 | 633.8 | -0.4 | 545.0 | 521.2 |

| 24-Jan-26 | 650.5 | -2.4 | -2.4 | 647.4 | -1.0 | -0.8 | 633.4 | -8.2 | 552.0 | 527.8 |

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service