Business and Policy June 2025 – Sheep

30 May 2025UK EU Strategic Partnership

On the 19th of May, an agreement on a new strategic partnership was reached on the between the UK and the EU. The agreement will simplify the red tape associated with trading agrifood between the UK and EU.

While the finer details are yet to be understood; this should see an alignment on food safety and live animal regulations to name a few, which should then reduce the complexities that have been in place since Brexit.

Sheep Trade

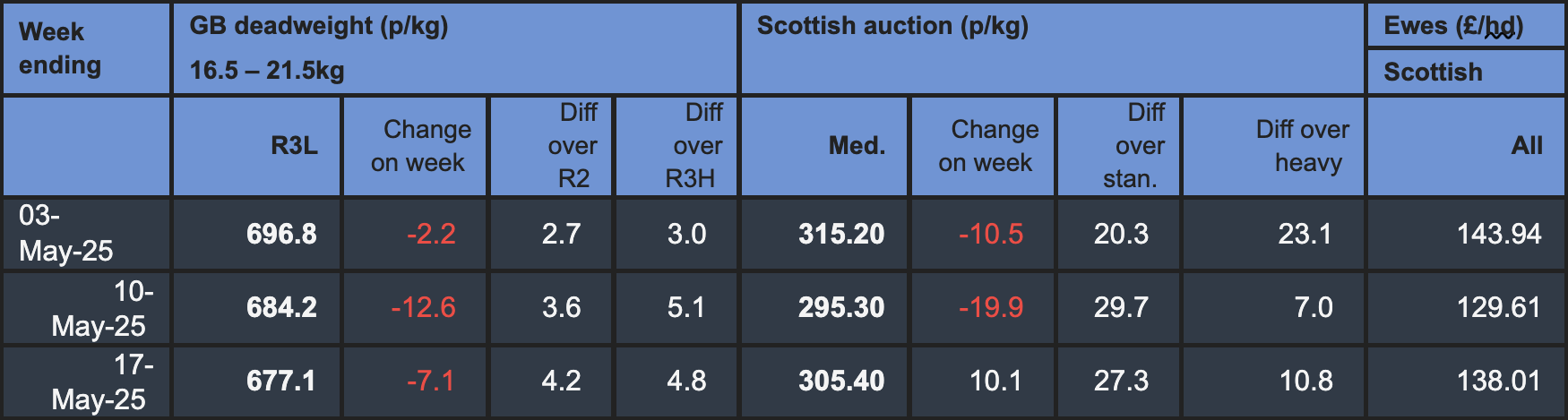

The lamb trade continues to be subdued compared to spring 2024. For the week ending 17th May, the SQQ stood at 665p/kg, considerably back on the year, and the first time this year that the price has dipped below the 5-year average. This is largely due to the strong supply of lambs carried over from 2024 which has prevented the price soaring.

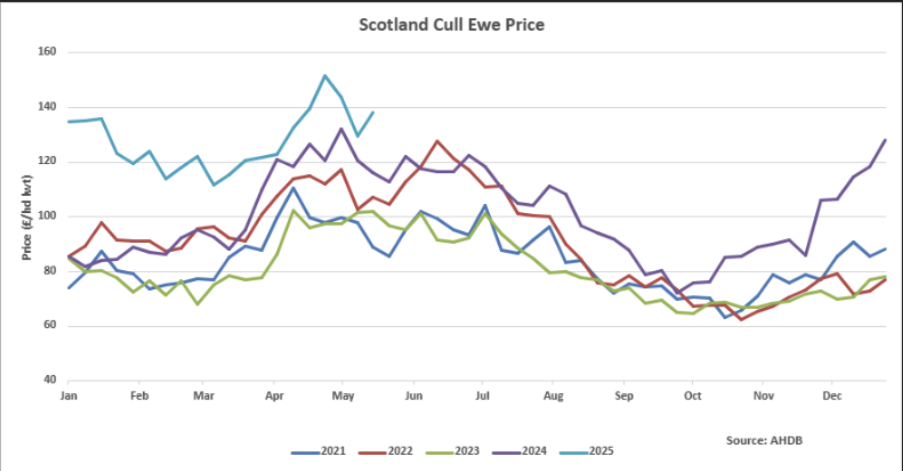

The cull ewe market has seen some extraordinary highs this year, largely due to a shortage of supply from a smaller breeding flock, lower rate of replacements being retained from the 2024 lamb crop, and a potential move to later lambing, which has changed the marketing pattern slightly for cull ewes.

Since January, we have witnessed record breaking highs in the ewe trade, the highest week having a Scottish average per head of £151.56 at the end of April. The latest data available (week ending 17th May), the average price stood at £138.01, some £21.74/head premium to last year.

Export Market

For the first quarter of the year (Jan-March) exports from the UK rose by 1% on the year, while imports of sheep meat rose by 5%, with increases seen from Australia, New Zealand, Ireland and Iceland.

Protein Consumption

The Cargill 2025 Protein Profile Report has recently been released. In this, it shows how 61% of consumers in 2024 increased their protein intake; this was compared against 48% of consumers increasing their protein intake in 2019.

Social media, and the growing popularity of protein snacks, look to be key drivers. 52% of these consumers have tried a new food after seeing it on social media platforms such as TikTok and Instagram. On these platforms social subcultures are generated with people promoting current trends e.g. carnivore diet, high protein routines and exploring fusion foods from various cultures. Social media and websites show to be the second most influential approach to consumers, with their family and friends being the first.

The report shows that many are looking to eat at home, rather than eating out, and that protein is delivering on taste, value and convenience when doing this. The Gen Z generation (born 1997-2012 so aged 13-28) choose bold flavours from many different cultures, while the boomer generation (born 1946 – 1964, so aged 61-79) are more traditional in their meal choices, looking for classic foods of high quality. The versatility of protein means it can tick both the classic and innovation boxes that the two different age groups favour.

Why is this important to the sheep sector? There are marketing opportunities to pull out of this data. Convenient high-quality meals is a huge opportunity, creating a following and social media trends for lamb dishes, looking at multicultural flavour and different ways of cooking classic dishes. In terms of looking at protein snacks, with beef jerky gaining prominence, is there an opportunity for a lamb jerky?

Deadweight prices may be provisional. Auction price reporting week is slightly different to the deadweight week. Source: AHDB and IAAS

Standard weight 32.1 – 39.0kg; Medium weight 39.1 – 45.5kg; Heavy 45.6 – 52.0kg

Note: From 11th May, prices transition to new season lambs

Kirsten Williams; 07798617293

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service