Business and Policy May 2025 – Sheep

1 May 2025Trade and festivals

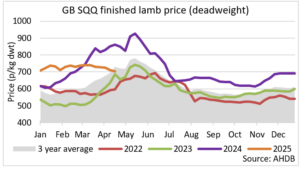

The prime lamb trade has slightly decreased over the last month to a SQQ of 702.9p/kg, which is 157.6p/kg back on the same week last year (w/e 19/04/25). Last year Ramadan and Easter landed in the same period, allowing for tailored supermarket promotions, this year Easter was three weeks after Ramadan, resulting in reduced customer demand at this point. The next festival to watch for is Eid al Adha (Qurbani) which is set to start on the 6th June for three days. The timing of slaughter is important for this festival, which begins on the first day of Eid after the sunrises and Eid prayers have been given.

Impact of US tariffs on the sector

On the 5th April a baseline tariff of 10% on the majority of imports to America commenced. With additional reciprocal tariffs to a number of countries. The UK has a baseline tariff of 10% on any goods imported to the US, as do other sheep meat trading countries – Australia and New Zealand.

America is currently the 2nd largest global importer of sheep meat and offal in terms of volume, with 150,000 tonnes being imported in 2024 (AHDB/HMRC). Just under three quarters of this volume came from Australia in 2024. New Zealand largely made up the balance, with only 48t coming from the UK (AHDB/HMRC).

Looking at global prices, the 10% tariff is probably not going to distort this flow of trade too much, as America would struggle to source this level of volume from elsewhere, especially at the current Southern hemisphere price. An example of this is for the week ending 12/04/25, Australian lamb was trading at €4.09/kg, New Zealand at 4.47/kg, UK at €8.26, while Spanish lamb was at €8.69 and French lamb was at €10.92/kg (all expressed in Euro to allow comparison – source: Bordbia). If 10% is added onto the Australian and New Zealand product, it remains cheaper to many other countries’ offering. Trading on a global market, often sees fluctuations in price with exchange rates, as well as supply and demand. The impact of this tariff to sheep meat trading to the US is likely to be minor.

However, it is likely for Australia to look at other world markets, where they do have a free trade agreement (FTA) e.g. UK. Since this began on the 23rd May 2023 the quota allowed under the FTA has not been reached. For 2025 this allows for 36,111 tonnes to be imported, this number will rise to 75,000 tonnes by year 10. In 2024, the allowance was 30,556 tonnes, while 19,300 tonnes were imported. This is an opportunity for Australia, who is currently having record numbers of lambs being processed on a weekly basis.

Scottish Farm Business Survey Results

The Scottish Government have published the results from the Scottish Farm Business Survey (SFBS). The data for this is sourced from 400 farms in Scotland, and covers the period from May 2023-2024.

A standout in the data is LFA sheep farms, where for the first time in 12 years, none of these farms have been profitable without government subsidy. Delving further into these figures, 45% of these farms demonstrated net profit of less than £5,000. Only one in five of these farms had a net profit greater than £20,000. Interesting in a year of high prices, although this LFA sheep sample includes some extremely hard hills with high predation, climatic conditions and high lamb losses, resulting in low rearing rates.

This shows, the role of support payments for the sheep sector is extremely relevant with their contribution or overall business output being well over 50% across this sample.

Kirsten Williams; 07798617293

| Week ending | GB deadweight (p/kg) | Scottish auction (p/kg) | Ewes (£/hd) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 16.5 – 21.5kg | Scottish | ||||||||

| R3L | Change on week | Diff over R2 | Diff over R3H | Med. | Change on week | Diff over stan. | Diff over heavy | All | |

| 5-Apr-25 | 732.6 | -3.3 | 2.9 | 1 | 340.6 | -3.9 | 10.3 | 26.2 | 122.91 |

| 12-Apr-25 | 720.5 | -12.1 | 6.5 | 3 | 328.6 | -12 | 25.5 | 22.4 | 132.4 |

| 19-Apr-25 | 713 | -7.5 | 7.1 | 3.9 | 328 | -0.6 | 15.5 | 24 | 139.5 |

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service