Business and Policy May 2025 – Sector Focus: US Tariffs

2 May 2025Recent events

On the 2nd April, Donald Trump, the US president, announced a new tariff regime on imports to the US, including a baseline 10% on almost all foreign imports, with some countries and goods facing higher rates. The schedule proposed a 20% tariff on EU imports, 25% from Canada and Mexico, and currently 145% on China, and 25% tariffs on all imports of steel, aluminium, automobiles and auto parts. The tariff battle with China has effectively caused a total cease in trade.

In response, the US stock market plummeted, with estimates of a $6.6 trillion loss in market value across 2 days, and concerns that it would trigger a significant, global recession. In the face of pressure, on the 10th April a 90-day suspension on additional ‘reciprocal’ tariffs (i.e. beyond the 10% for most countries) was announced, to allow time for trade negotiations.

Impacts of tariffs on UK agri-food exports

The USA has historically been one of the largest export markets for UK goods (as well as services), totalling £59 billion in value in 2024. Of this, 5.5% are food and drink exports, with whisky comprising a large proportion of drink export value as the most significant export product by value (see Figure 1).

Figure 1: UK export value to the US, 2024, £m (Source: ONS)

| COMMODITY | 2024 (£m) | % |

|---|---|---|

| 1 Beverages & tobacco | 1944.91 | 3.28% |

| 03 Fish & shellfish | 322.41 | 0.54% |

| 09 Miscellaneous foods | 201.49 | 0.34% |

| 04 Cereals | 179.3 | 0.30% |

| 07 Coffee, tea, cocoa etc | 172.81 | 0.29% |

| 4 Animal & vegetable oils & fats | 156.07 | 0.26% |

| 02 Dairy products & eggs | 106.32 | 0.18% |

| 00 Live animals | 50.57 | 0.09% |

| 05 Vegetables & fruit | 41.87 | 0.07% |

| 06 Sugar | 40.84 | 0.07% |

| 08 Animal feeding stuffs | 36.4 | 0.06% |

| 01 Meat & meat preparations | 34.41 | 0.06% |

| T Total | 59302 | 100% |

Directly, the largest anticipated impact of tariffs will be a reduced market to the US, with costs passed on to US consumers. As a result, Scottish producers have been exploring alternative markets. With the UK having a 10% tariff versus a 20% tariff for European countries, this may increase the competitive advantage for other agri-food exports to the US however.

Outside of food and agriculture, the UK’s largest exports to the US are machinery and transport equipment, pharmaceuticals, and business and management services. While these may have limited direct impact on agriculture in the UK, an economic downturn in these sectors is likely to have repercussions for the country as a whole.

Impact of tariffs on global commodities & agriculture

Wider reaching implications of tariffs are likely to impact global commodity markets, and therefore agriculture indirectly, in a more significant way. The tariff regime risks throwing many established commodity markets out of balance, through the reduction or boycotting of significant US exports such as machinery, oil and fertilisers, and the risk of retaliatory tariffs increasing prices. As seen following the beginning of the war in Ukraine, supply chain disruptions and economic trade sanctions on Russia caused price spikes and volatility in oil and fertiliser markets.

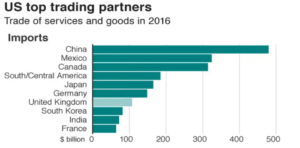

Figure 2: Imports to the UK from the US. Source US Census Bureau

What happens next?

According to the World Trade Organisation, the continuation or escalation of US tariffs risks a steep decline of global trade with North America. The WTO has also revised global goods trade statistics for 2025, from a 2.7% growth to a 0.2% decline. However, it is also expected that, as a result, other regions will and are moving quickly to reorient trade relations with alternative countries, and are likely to see trade growth. This is particularly the case in the Asian and European blocs. China has been a major exporter of electronics, machinery & mechanical appliances, sports equipment, plastics, steel, textiles & clothes to the US, but also has a large trade surplus with other western countries, and increasing exports to the Global South (developing countries).

While the US is attempting to encourage other countries to move away from trade with China, blanket tariffs on all countries are likely to do the opposite, uniting countries to coordinate responses and create new markets, bypassing the US. Until the 90-day period for negotiating trade agreements is up, however, the scale of impact remains uncertain.

Anna Sellars, anna.sellars@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service