Business and Policy November 2025 – Sheep

31 October 2025October Trade Round-Up

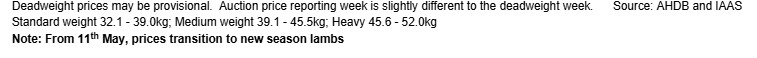

The volume of prime lambs coming forward for slaughter rose in October, with slaughter figures for the week ending the 18th of October to be 3% higher than last year. The price is reflecting the increased volume of lambs coming forward, with prices decreasing slightly each week. While September ended with an SQQ of 682.5p/kg; the latest week reported (w/e18th of October) shows the SQQ at 662p/kg; 0.43p/kg ahead of the same week last year.

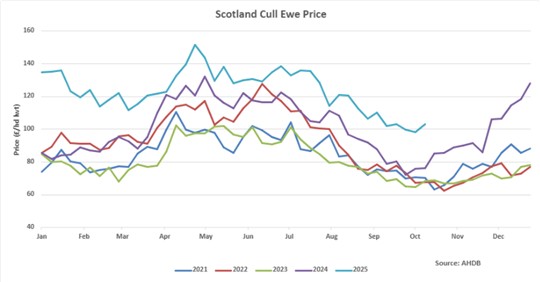

Moving to the cull trade, the premium has remained throughout the year, due to a shortage of supply. For the week ending 18th of October, the average Scottish cull ewe stood at £103.11 per head, while the same week last year, the average was £17.85 less at £85.26 per head. Typical trends show cull ewe prices expected to rise to the end of the year, as supply shortens and we could see some further premiums in this area to Christmas.

European Lamb Export and Import

Data is available for European lamb slaughter numbers from January through to July of this year. This shows the extent of the production decreases in Europe.

| Country | Thousand Slaughtered Head 2024 | Slaughter Change 2024 – 2025 |

|---|---|---|

| Spain | 7,900 | -2.3% |

| Romania | 6,332 | -7.3% |

| Greece | 3,855 | -4.8% |

| France | 3,497 | -7.7% |

Imports of sheep meat into Europe from January – July 2025 have increased by 20% on the year. This shows an increase of 16,200 tonnes to 99,400 tonnes. Of this total, the UK has supplied 47% which equates to 46,600t, while New Zealand has supplied 46%, equating to an increase on the year of 19% from the UK and 16% from New Zealand.

When we look at exports from Europe, these have increased on the year by 7%, which is surprising given the decrease in production. The greatest volume has been exported to Algeria, who have a large demand for sheep meat throughout religious festivals, and are suffering from low production from a lack of rainfall, and extremely high temperatures. While Europe have routed more lamb to Algeria, the UK exports have decreased by 4%, largely due to less being available, and a low domestic demand in the UK.

UK Lamb Demand

Over the last number of years, fewer people are eating out and are instead choosing to eat at home due to affordability. It has been shown that the value and purchases of meat in the shoppers’ cart to be increasing with this trend. Chicken remains the most popular and versatile meat, however there are opportunities for lamb in product diversification.

Shopper trends show Asian, Indian and Mexican cooking increasing. With this comes an increased use of chicken, beef and lamb. Shoppers are seeking an experience with their meals - innovative different dishes that are quick and easy to cook.

Diversification of the type of steak being bought is shown, with in the last 12 weeks, lamb steaks increasing in volume of 25.1%, this is the highest price, lamb cut, at an average of £17.31/kg. While burgers remain one of the cheapest cuts at £8.44/kg; these show a 0.8% reduction in volume over the last 12 weeks. However, the price/kg has risen 11.7% on the year. In the last 12 weeks, lamb has shown a decrease in volume sales of 16.7% or 2,990 tonnes begging the question: Is there a way as an industry that we can tap into food trends such as ‘Experience world cuisine’?!

Global Prices

There has not been much movement in world lamb prices over the last month, these are shown below. The gap between the Southern Hemisphere and the EU remains large. New season lamb is starting to increase in volume in Australia. With the additional supply, their price will no doubt see fluctuations to the end of the year.

| Country | w/e 13/09/25 | w/e 11/10/25 | Difference in Month |

|---|---|---|---|

| New Zealand | €5.25 | €5.30 | +0.05 |

| Australia | €6.55 | €6.36 | -0.19 |

| GB | €7.63 | €7.66 | +0.03 |

| France | €8.69 | €8.71 | -0.02 |

| Spain | €9.50 | €9.40 | -0.10 |

*Source: Bordbia

Kirsten Williams; 07798617293

| Week ending | GB deadweight (p/kg) | Scottish auction (p/kg) | Ewes (£/hd) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 16.5 – 21.5kg | Scottish | |||||||||

| R3L | Change on week | Diff over R2 | Diff over R3H | Med. | Change on week | Diff over stan. | Diff over heavy | All | ||

| 04-Oct-25 | 684.1 | 12.7 | -4.4 | -2.7 | 305.80 | -4.1 | 7.3 | 5.8 | 99.73 | |

| 11-Oct-25 | 680.6 | -3.5 | -2.1 | -2.8 | 300.20 | -5.6 | 2.8 | 3.9 | 98.31 | |

| 18-Oct-25 | 669.2 | -11.4 | -0.9 | -2.5 | 300.30 | 0.1 | 10.3 | 6.3 | 103.11 | |

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service