Business and Policy October 2025 – Arable

3 October 2025Market Overview

Grain and oilseed markets enter the final quarter of the year under the weight of ample global supply, volatile macroeconomics, and uneven demand recovery. Early autumn weather across the UK has generally been favourable, with rains aiding crop establishment and winter wheat drilling underway. However, despite good agronomic conditions, markets remain under pressure from record harvests, aggressive Black Sea exports, and shifting currency dynamics.

Globally, the USDA’s September report confirmed record US maize and soyabean crops and comfortable global wheat stocks. Ordinarily, this would be bearish, but markets have resisted further losses, buoyed by a weaker US dollar, stronger biofuel demand expectations, and speculation over a potential US–China trade deal that could lift agricultural purchases. At the same time, dry conditions in southern Russia and parts of Ukraine have injected a small risk premium into prices, though it is too early to assess any serious crop damage there.

Currency movements add another layer of complexity. The US dollar has fallen to a four-year low following Federal Reserve rate cuts, making US exports more competitive but weighing on EU and UK prices. A potential rebound in the dollar, particularly if a US–China deal materialises, could provide some price support for European exporters.

European and UK Factors

In Europe, wheat production has been revised higher to 136 Mt thanks to improved yields, though maize harvest estimates have been trimmed due to drought. EU wheat exports are running behind last year with 3.2 Mt shipped so far compared with 5.05 Mt at this time in 2024. While German exporters face less incentive to send high-quality wheat to the UK given the strong domestic crop. Rapeseed production across the EU is exceeding 20 Mt, keeping prices in check, despite an expected uptick in crushing demand for 2025–26.

The UK is experiencing mixed fortunes; domestic grain prices remain tethered to near-import parity. Farmer selling has been cautious as prices sit near multi-month lows. The AHDB pegs UK wheat production at 12.34 Mt with average yields of 7.6 t/ha, better than last year’s 7.3 t/ha but still below the 10-year average of 8.1 t/ha.

Oilseed rape acreage across the UK is down 17% year on year taking the area to a 40-year low of around 242,000 ha. In a Scottish context, acreage for this year’s harvest saw a less marked decline of 11% compared to 2024. Good yields across Scotland this year, however, will likely boost confidence in the crop going forward and potentially increase the acreage sown for 2026 harvest.

Crop-Specific Markets

Wheat

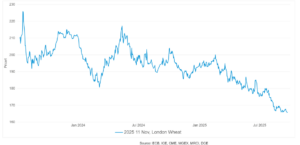

UK wheat prices remain subdued, (Fig 1) with London November 2025 futures at £166/t and May 2026 futures at £178/t, reflecting heavy global supply and competitive Black Sea exports. Russia’s harvest is estimated at around 87 Mt, allowing for exports up to 44 Mt despite a delayed start. Russian export prices around $225/t are forcing other exporters to match discounts. Quality issues in Poland, Germany, Russia, and Ukraine have increased the proportion of feed-grade wheat, though Canada’s high-grade stocks are down 22% year on year at 4.1 Mt.

EU wheat shipments to the UK have halved from last year to just 154,000 t, as the UK’s own quality crop reduces import needs. Ukraine’s wheat harvest is projected at 21.9 Mt, up 10% from earlier estimates, but exports are lagging last year’s pace. Australia’s crop is expected to ease slightly to 33.8 Mt yet remains 22% above the 10-year average.

Overall, global wheat supply remains abundant, capping rallies even as weather risks and currency offer short-term support.

Fig 1. London Nov’ 25 feed wheat Futures- 12 months to September 2025

Feed Barley

Feed barley markets are pressured by ample Scottish supply and increased farmer selling, though overall, trade volumes remain light. Prices are supported by strong relative value against other feed grains, but northern markets face downward pressure as surplus Scottish grain flows down into northern England.

Export opportunities to Ireland are being discussed for the New Year, but pre-Christmas coverage is already high, limiting near-term demand. If broader grain prices continue their downtrend, feed barley is likely to trade sideways to lower in the coming weeks.

Malting Barley

Malting barley markets remain sluggish, burdened by weak demand and quality downgrades that push more grain into feed channels. EU malting values have fallen sharply, eroding any premium over feed barley in some areas. A large carryover from last year further dampens maltster and distiller interest, with most buyers already well covered. Export markets are heavily discounted, and while new-crop values retain a modest premium, unfavourable farm margins are expected to reduce the planting intentions for next year. Short-term prospects remain poor unless demand revives later in the season.

Oilseed Rape

UK rapeseed markets face a double squeeze of weak demand and heavy global supply. Rapeseed for November delivered into Montrose is being quoted at £398/t. Lower global demand, sluggish crushing activity, and strong Canadian rapeseed supply all limit the upside, although any rebound in US biofuel mandates or a weaker sterling could lend short-term support.

Oats

The Scandinavian harvest is nearly complete, with quality generally good and Finnish production expected to match last year’s 1.2 Mt. European milling demand is quiet, and feed oat prices continue to fall under seller pressure.

Limited farmer selling in the UK is keeping milling oat prices supported as buyers seek to avoid losing supply to the feed sector. However, persistently low prices are discouraging growers from planting oats for the next crop year, raising the possibility of tighter future supply.

Mark Bowsher-Gibbs, mark.bowshergibbs@sac.co.uk

| £ per tonne | . | Oct ‘25 | Nov’25 | Mar ’26 | Nov ‘26 |

|---|---|---|---|---|---|

| Wheat | Ex farm Scot Oct. Nov/Mar/Nov 26 Futures | 166 | 173 | 182 | |

| Feed Barley | Ex farm Scot Oct. Nov/Mar/Nov 26 Futures | - | |||

| Malting Barley | Ex farm contracted price | - | - | - | |

| Milling Oats | Ex farm contracted price | ||||

| Oilseed Rape | Del Berwick | 403 | 407 | - |

Indicative grain prices 24th September 2025 (Source: SAC//United oilseeds/AHDB/Hectare)

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service