MMN March 2025 – Cereals Update

11 March 2025UK Cereals Market Update and Global Impacts

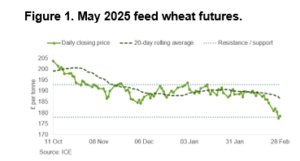

Wheat prices remain lacklustre to say the least. Over the last three weeks May ‘25 feed wheat futures values (Figure 1) have fallen £15/t to sit at £174.55/t (as of 5th March). Nov ‘25 futures have, over the same period, lost £9/t and are currently at £188/t (as of 5th March). The retreat in values reflects the more favourable weather seen across the US, South America and the Black Sea, and whilst the weather is a key factor, geopolitical tensions and economic uncertainty are also contributing factors. Add in to this the impact of US tariffs and trade is disrupted further.

Looking at historical trends in the domestic market, it is not abnormal for prices to fall under pressure at this point in the season. Correspondingly, the seasonality of UK feed futures has typically been stable in the second quarter of the calendar year in recent years, of course excluding the 2021/22 season. In 2023/24, UK feed wheat futures showed a tendency to rise after reaching low levels in the first quarter. As such, it is possible that as we understand more about harvest ‘25 and head into the new season, we could see some support in prices over the summer should fundamentals such as geopolitical developments and climate-related risks allow.

Malting barley markets remain steady, with old crop prices supported by a large carry into the new season and a narrow premium over feed, though demand remains slow. The focus now shifts to spring planting, which will determine future premiums.

Total cereals usage by the brewing, malting and distilling sector is forecast to decline this season on year earlier levels (currently down 7.6%). This decline is due to a downturn in demand and is partly driven by the increase in the cost of living, as well as the longer-term trend of fewer younger people choosing to consume alcohol.

Feed barley prices are under slight pressure as futures weaken and buyers step back. However, replacement at lower levels is challenging, limiting further downside. Domestically, barley remains competitively priced against other feed grains.

For 2025, AHDB’s Early Bird Survey (EBS) of planting intentions, carried out in November, suggested the winter and spring barley areas could fall by 1% and 13% respectively on the year. This could mean that we head into the next marketing year with a smaller domestic crop. However, currently, 2024/25 ending stocks are expected to be well above average, and as such, it is unlikely supplies will be particularly tight next season.

Current ex-farm prices are as follows:

| £ per tonne | Mar '25 | Jul '25 | Nov '25 |

|---|---|---|---|

| Feed wheat | 180 | 184 | 188 |

| Feed barley | 165 | 175 | 180 |

| Malt. dist. barley | 185 | ||

| Oilseed rape | 420 | 423 | 391 |

| Feed beans | 210 |

Source: Hectare and United Oilseeds

mark.bowsher-gibbs@sac.co.uk; 0131 603 7533

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service