MMN January 2025 – Cereals Update

10 January 2025UK Cereals Market Update and Global Impacts

Globally, and since the high prices of 2022, wheat markets have followed a bearish trend for more than two years. However, markets are cyclic. Low prices do not last forever, and a change of trend can occur at any time. Weather, geopolitics and currencies are all having more and more influence on our markets. This will certainly continue in 2025, with unpredictable positive and negative impacts on prices.

There are reasons to believe that wheat prices could move higher in 2025. The main reasons being slower Black Sea supplies, stronger demand for EU origins and tightening world stocks. The USDA recently published the global wheat consumption figures as well as the wheat end stocks which stand at 258Mt, which is 10Mt down on last year and wheat consumption is at a record level usage of 803Mt.

Southern Russia has had a long dry summer and autumn which has led to a drop in soil moisture. This has resulted in delays in planting and 37% of their winter crops have not germinated or are in poor condition compared with just 4% last season. Just 31% are rated as in good condition, the worst on record compared with 74% last year. Slower Black Sea exports along with accelerating EU exports will be a trigger point for wheat and indeed the firming of wheat prices as 2024 closed out reflected the uncertainties about the impact of adverse weather on crops in key producing countries.

The UK continues to import wheat at pace, up 80% in 2024, with the majority originating from the EU, notably from Germany, Denmark, Poland and France. Conversely only about a half of the volume of barley has been exported this season so far compared to last year, as the tightness of the domestic wheat market reduces export appeal.

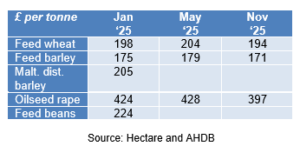

Barley prices have been on a downward trend since October and the price discount to wheat has narrowed. Animal feed usage is expected to be higher due to its relative price to wheat, although the price gap is reducing but demand by brewers maltsters and distillers is also lower. Aside from wheat and barley movements, maize imports are running 19% higher against the seasonal five-year average.

As for harvest 2025, Scotland looks to see a diminished wheat area once again, down 3% on 2024 and the smallest area for five years. The swing to spring cropping continues with the spring barley area expected to increase 2% to 274,000ha, the largest area for over 10 years. Winter barley and oats are anticipated to increase in area too, up 3% and 12% respectively whilst the demise of oilseed rape is set to continue, falling 25% in area compared to 2024.

mark.bowsher-gibbs@sac.co.uk; 0131 603 7533

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service