Agribusiness News March 2025 – Beef

28 February 2025Beef prices rocket

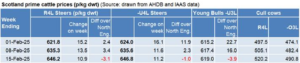

Finished beef prices have again risen throughout February. Only a few months ago, prices were breaking records at £5/kg/dwt, however, prices have since rocketed above £6/kg/dwt. Prices are now up by more than 25% on the year and over 50% higher than the five-year average, sitting around 645-650p/kg/dwt, with Aberdeen Angus cattle maintaining a 10p to 20p premium. Finishers have never experienced a market with price rises such as these, with weekly price lifts of between 10 to 15p/kg/dwt and £200 to £300 a head since the start of the year.

While this return is needed for producers, current market volatility, is not what the industry needs. There are fears beef cattle finishing will become a boom or bust industry. Remember finishers were selling cattle in the summer for 475p/kg/dwt, which had cost 335p/kg live in the spring of 2024, which at the time were record breaking averages. Scottish deadweight prices have risen from a low of 470p/kg/dwt in June, to smashing £6/kg by some margin. How can farmers budget when the market continues to show such volatility?

Demand

Demand for beef has continued this month with Valentine’s Day driving sales for steaking cuts. Simply supply is not meeting the demands. There are fewer cattle out there, and the higher prices reflect this. Production is reaching its seasonal high, with peak slaughter age of 21 months and the dominance of spring calving, which is seeing processors battle to secure supplies.

The challenge looking ahead to this year is supply, with AHDB forecasting UK beef production to fall by 5%. The number of cattle available for slaughter this year in Scotland is also expected to reduce with smaller calf crops from 2023 & 2024 filtering through.

Dream store cattle prices

Demand for store cattle remains high with no let-up, with many markets reporting store cattle prices rising by £50 a head per week over the past month. These prices are encouraging for suckler producers, however, to incentivise farmers to continue with keeping suckler cows or increase herds, price stability is needed to support beef production. There are concerns that current store prices are unsustainable. The money tied up with trading cattle is now colossal, with finishers suffering from the inflated store trade and many will be questioning margins, at these levels. If the current finished prices drop, many will be considerably out of pocket.

Consensus for the foreseeable future is that store cattle prices will remain at these levels; demand for store cattle is expected to increase in the coming weeks, as we head towards the grazing season, which is contributing to the price rise of younger stores.

Manufacturing Beef Demand

High cull cow prices continue, at abattoirs and in the live-ring, with prices surpassing £5/kg deadweight, currently sitting at 520p/kg/dwt. There is high demand for manufacturing beef, with AHDB reporting an increase of 2% for mince sales in January compared to 2024 alongside an increase of frequency of purchase. It is likely that demand for manufacturing beef will remain high, as consumers continue to look for quick and convenient meal options. Recent Kantar data highlighted the average preparation time for an evening meal reduced from 34 minutes in 2021 to 31 minutes in 2024.

Cow numbers however are running short, AHDB reports show UK cow slaughterings in 2024 up by 1.8% compared with 2023. Scotland’s critical mass is at a level where we cannot really lose more. Suckler herd contraction is expected to remain despite current farmgate prices, with pressure from production costs, changing government support, and market volatility.

Sarah Balfour, sarah.balfour@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service