Business and Policy December 2025 – Beef

2 December 2025Festive Demand

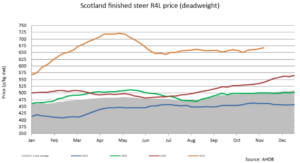

And here we are in December! However, finishers hoping for increased seasonal demand and a price uplift could be lacking festive cheer. ‘Static’ best describes the beef trade currently, with deadweight prices marginally lifting over the past few weeks but certainly not lifting as much as expected for the Christmas trading period. Prices quoted for week ending 22 November were in the region of 670p/kg/dwt, up 4.2p/kg from the previous week.

Christmas orders are now coming to an end, so it is unlikely that prices will increase significantly now. Reports suggested that processors started to cut back on Christmas kill earlier this year; instead, opting to buy barren cows which were considered better value.

Christmas Marketing Campaigns

TV adverts have become synonymous with the countdown to Christmas, and this year Quality Meat Scotland (QMS) aims to build on the continued success of the ‘When You Know, You Know’ platform inspiring consumers over the festive period to enjoy quality red meat standard, no matter what your budget.

Food focused Christmas TV ads are proven to push sales, with retailers highly focused on their campaigns which have become for consumers, a real highlight over the festive period.

Cull Cow Trade

Usually at this time of year, trade for cull cows becomes less as processors focus on prime cattle. However, food price inflation is impacting beef sales as consumers opt for processing beef. Notably, there is a stronger trade for cow beef compared with prime cattle. Trade for cull cows has lifted weekly by approximately 5p per kg with prices sitting at around 570p/kg/dwt as demand for mince continues. However, it is anticipated that prices are likely to come under pressure due to increased supplies, as more dairy cows come forward, because of rapidly falling milk prices as dairy farmers to look reduce costs, and opt to sell older cows. Due to increased supplies, it is anticipated that in the coming weeks trade for cull cows will drop by 5-10p/kg.

Food Inflation Rate

Although, the overall UK inflation rate has fallen for the first time since March to 3.6%, food price inflation has increased – with prices on average 4.9% more expensive than they were in October last year.

Farmgate beef prices have never been so high, but the consequence of which is being felt by shoppers. Beef prices have risen more than 50% in the past five years. Rising prices have led to a shift in the mix of cuts purchased by consumers as shoppers look to economise.

Interestingly, and encouragingly for the beef sector is the behaviours of younger consumers. Despite purchasing less volume per trip, down to 0.79kg per trip; data released by QMS has found that the ‘Under 35s’ are beginning to shop for red meat more frequently.

Also, in Scotland, QMS research has found that younger consumers, aged 18-24 are the most likely age group to visit butchers in the next 12 months, with 61% of 18 – 24-year-olds planning a trip to their local butcher as their interest in quality and provenance grows, highlighting red meats continuing relevance for the next generation.

Sarah Balfour, sarah.balfour@sac.co.uk

Scotland prime cattle prices (p/kg dwt)

| Week Ending | R4L Steers (p/kg dwt) | -U4L Steers | Young Bulls -U3L | Cull cows | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Change on week | Diff over North Eng. | Change on week | Diff over North Eng. | Diff over North Eng. | R4L | -O3L | |||||

| 1-Nov-25 | 660.3 | 1.3 | -4.4 | 661.1 | 0.2 | -0.5 | 652 | -20.1 | 577.5 | 549.6 | |

| 8-Nov-25 | 664.3 | 4 | -5.4 | 665.8 | 4.7 | -6.7 | 652.4 | -19.5 | 574.1 | 548.2 | |

| 15-Nov-25 | 667.2 | 2.9 | -11.5 | 668.5 | 2.7 | -6.7 | 657.4 | -33.1 | 576.3 | 555 | |

| 22-Nov-25 | 671.1 | 4.2 | -2.3 | 671.7 | 3.2 | 0 | 658.4 | -4.7 | 581.6 | 554.2 | |

Source: drawn from AHDB and IAAS data

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service