Business and Policy June 2025 – Cereals & Oilseeds

30 May 2025Global Supply Risks Mount

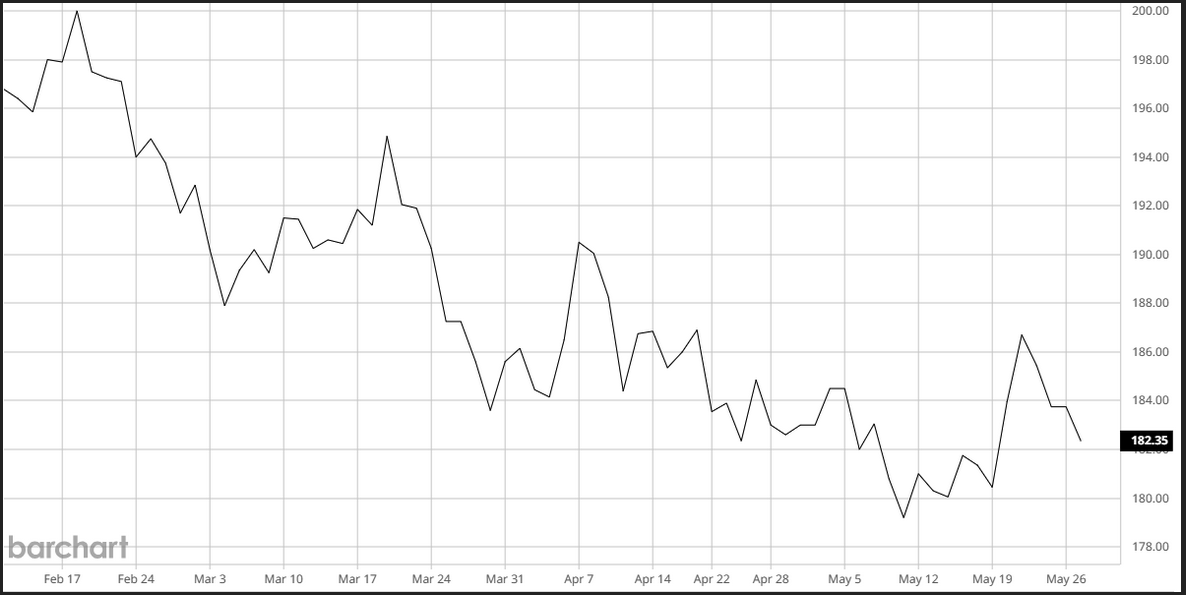

The Nov ’25 feed wheat futures prices rallied over the last two weeks, hitting a one-month high of £186/t on the 22nd May amid growing supply concerns and renewed demand, particularly from China. The rally was largely driven by a combination of adverse weather, short covering by speculative funds, and potential shifts in global trade dynamics. Despite this bullish momentum, prices have wavered since that date as markets remain cautious about the rally’s sustainability and more recent market falls have put the market back today to where it was a month ago at £182/ton.(Fig 1)

Weather still remains the dominant driver however, with threats to global wheat production emerging across several major growing regions:

- Northern Europe is experiencing persistent spring dryness, with insufficient rainfall in key regions such as northern France, Germany, Denmark, and Poland. Although showers are returning, substantial improvement is still needed to protect yield potential.

- Russia, the world’s largest wheat exporter, is grappling with a prolonged drought and frost damage in top-producing areas like Rostov. The situation echoes 2023, when similar conditions slashed regional output by 38%.

- The US is reporting a drop in winter wheat conditions. USDA ratings fell to 52% ‘good-to-excellent’ – still relatively strong, but below analyst expectations. This raises fresh doubts about final yields.

- China faces extreme heat in Henan province, a key wheat-growing region. This could drive higher import demand if domestic crop losses materialise.

- Ukraine and the EU face production downgrades due to weather stresses, and the USDA’s May forecast of record global production (808MT) now appears optimistic. ODA projects potential global output cuts of up to 10MT, tightening ending stocks.

These risks are leading traders to question official USDA production forecasts, which include 136MT for Europe, 83MT for Russia, and 142MT for China. A downward revision across the Northern Hemisphere could significantly support prices. Here in the UK, both on-farm wheat stocks and merchant-held stocks are down 20% and 15% respectively compared to last year, potentially supportive to new crop values.

Demand-Side Developments

On the demand side, China’s return to global wheat markets has ignited fresh optimism. While it’s unclear whether recent purchases are a short-term move or the start of a longer trend, there is growing speculation that upcoming US-China trade talks could include significant commitments to purchase US and French wheat, corn, and soybeans. Such a deal would be highly bullish for global markets.

Additionally, Algeria and Saudi Arabia have re-entered the market with large wheat tenders, taking advantage of relatively low prices. This renewed demand underscores a broader pattern: low prices are attracting buyers, shifting sentiment from bearish to more balanced.

Malting Barley & Feed Barley

New crop malting barley prices remain firm, buoyed by dry weather across key UK growing areas and northern France and Scandinavia. Consumer demand, however, remains weak, keeping the market wide and values nominal. The feed barley market remains quiet, with old crop trade largely concluded and new crop activity hampered by a lack of farmer participation. Export activity is virtually at a standstill, with UK barley remaining uncompetitive internationally. While dryness offers price support, limited consumer interest is putting a cap on gains and with the price differential between wheat and barley narrowing, demand will reduce further.

Rapeseed Market Mixed Amid Geopolitical and Weather Uncertainty

Rapeseed markets have been volatile, with weather and geopolitics creating an uncertain outlook:

- Dry conditions in northern Europe and Russia are starting to add weather premium back into the market.

- US planting concerns are also supportive. Rain is forecast across parts of the Midwest, potentially delaying soybean and corn sowing.

- In Canada, planting is ahead of schedule despite dry conditions, with 50–55% of crops now in the ground.

- Crude oil volatility—driven by geopolitical tensions, US-Iran nuclear discussions, and fluctuating inventories is influencing biofuel-linked oilseed markets.

On the French futures exchange, rapeseed prices are finding support above €480/t, though any meaningful price rise will depend on further downgrades to crop expectations or sustained weather issues. A choppy trade pattern is expected to continue until more clarity emerges on European yields and North American plantings.

Oats: Tight Farmer Selling Supports Prices

The European oat market is stable, supported by dry weather and minimal farmer selling. Key oat-growing regions in the UK, Germany, and Scandinavia have received well below-average rainfall, raising concerns about crop potential. More consistent rainfall is needed to relieve stress.

In the UK, drought concerns in areas like East Anglia and the Midlands are prompting consumers to secure supply early. Merchants, however, are hesitant to offer new crop volumes given the uncertainty and old crop stocks, being some 50% higher than was the case 12 months ago, are buffering price sensitivity .

Overall Outlook

The grain market is increasingly weather driven, with Northern Hemisphere dryness emerging as the dominant theme. Coupled with a potential rebound in Chinese demand and the unwinding of speculative short positions, markets are on edge for further bullish developments. However, any sustained rally will require fresh catalysts—whether from worsening weather, stronger trade flows, or confirmation of tighter stocks.

Mark Bowsher-Gibbs, mark.bowsher-gibbs@sac.co.uk ; 07385 399 513

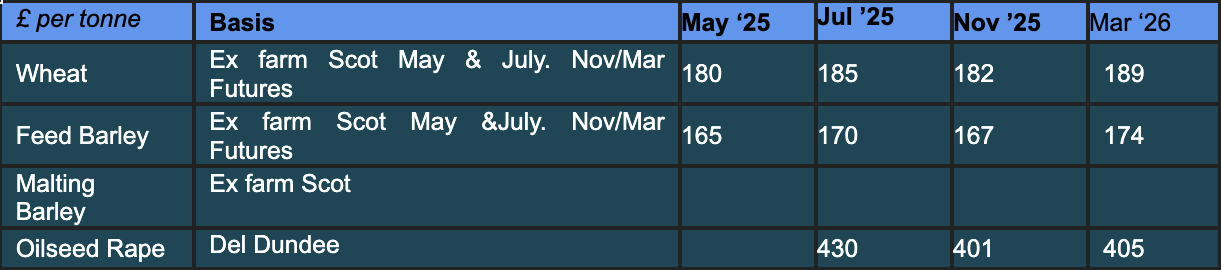

Indicative grain prices week beginning 26/05/2025 Source: SAC//United oilseeds/AHDB/Hectare)

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service