Business and Policy November 2025 – Beef

3 November 2025Festive Demand

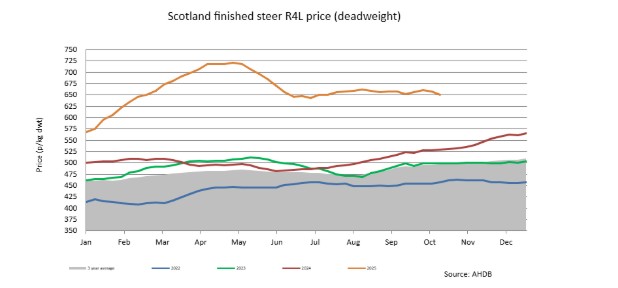

We are now in the last quarter of the year, with only 3-4 weeks left of Christmas supermarket orders as processors plan their Christmas kill schedules. Prime cattle prices have held firm throughout September and the first half of October, despite a seasonal lift in weekly slaughter, pointing to resilient demand. While prices sit around 9% below their spring peak, they remain around 25% higher than this time last year, supported by lower production in 2025. For week ending 18 October, Scottish steer prices were up 7p/kg on the previous month, sitting at 650p/kg/dwt for R4L grades, with Angus sired cattle at 665p/kg/dwt. GB deadweight steers averaged 647.7p/kg up 134p/kg above the same week last year.

The question many are now asking is what is going to drive the Christmas demand? Cattle supplies, consumer demand, or carcase weights? While numbers on farm in July pointed towards a continuing tight supply throughout the remainder of 2025, low slaughterings during the summer adds uncertainty as availability may not prove to be as tight as previously expected. In Scotland, prime cattle throughput remained below 2024 levels in September, and the latest slaughter figures indicate cattle throughputs have remained low in October. It is anticipated that prime cattle prices will rise in the coming weeks in preparation for increasing prime cattle requirements for the festive period. A lift in finished price will be an encouraging sign for producers during a time of limited margins. However, reports suggest that processors are trying to not increase prices too quickly as many are concerned over consumer demand.

Limited Consumer Demand

Increased farmgate prices in 2025 have led to supermarkets increasing beef prices which is impacting on consumer spending and demand. Red meat price inflation in Scotland has accelerated in 2025, reaching 13.7% in September, driven primarily by the beef sector.

Increased sales of pork were expected and not uncommon throughout October aka ‘Porktober’ as butchers and retailers pushed pork sales with chops, mince and steak all recording increased sales. What is interesting is that in the 12 weeks up to the 7th of September spending on pork increased by 1.3% and with volumes up 2.2%. Some of this growth reflects shoppers switching from beef to pork as beef prices continue to surge, making pork a more affordable alternative.

Fears are now growing that beef imports are undermining UK producers. Worryingly, increased levels of imported Australian beef are now appearing on shelves as supermarkets extend ranges of beef including rump and sirloin steaks labelled ‘Australia Made’, reportedly 5-10% cheaper than UK beef. Reports suggest that Uruguayan beef will soon be appearing on supermarket shelves.

Price Rewards

Producers are finally being rewarded for their hard work and the input costs associated with suckler cows. Weaned calves have averaged over £5/kg this autumn, with many producers receiving between £400 to £600 per head more than last year. To put this in perspective a pen of 17 Charolais cross heifers at the annual Skye sale of weaned calves averaging 248 kg liveweight made £1,380 per head, equating to 556p/kg. With weaned 6-month-old calves realising up to £1,500 with the strongest of beef types commanding a higher price, several markets are commenting that buyers are looking instead to buy dairy beef bred cross calves. In previous years, these calves were selling for £300 per head. Now these calves are making £700 to £800, the majority being sired by Angus and British Blue bulls with British Blue sired calves at a premium.

Strong Trade for Stores

Demand for store cattle continues to be strong with current store price levels squeezing finishing margins. Aberdeen & Northern Marts in Thainstone recently reported that store cattle sold throughout September increased by 45% on the year, grossing more than £600 per head compared with 2024. Heavier stores and 12 months old plus cattle continue to average around 400-420p/kg. Looking forward, it is unlikely that store cattle prices will fall, with barley and feed prices being less, and cattle numbers short.

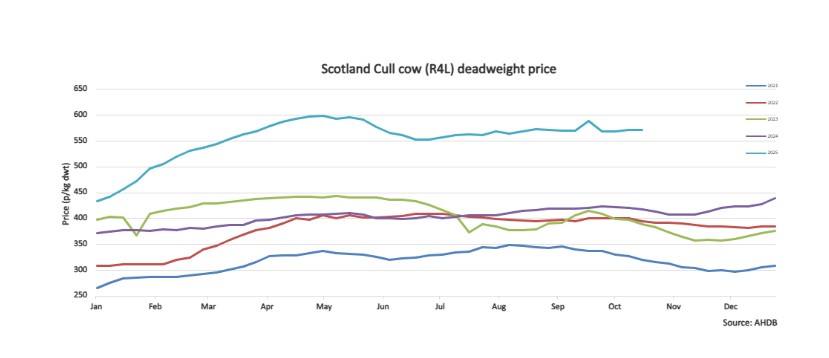

Cull Cow Trade

Despite a seasonal uplift in slaughter, cow prices remain stable, highlighting the demand for manufacturing beef. Prime beef is nearly £1/kg dearer, making cow beef very attractive to retailers. Cull cow prices remain steady despite greater numbers coming forward (GB slaughter levels were11% higher on the previous week for week ending the 18th of October 18; approximately 6% below the spring peak but 35-40% higher than last year, signalling a stronger market for cow beef than for prime beef. AHDB recently revealed that 46% of beef sold is currently destined to be a burger! It is anticipated that cull cow prices will remain constant in the short-term.

Breeding Cattle

The strong calf trade is a real incentive for breeders. However, many feel that these price increases have come too late for most herds, with many suckler cows having been culled.

Cow kill data at Scottish abattoirs points to a slowdown in herd contraction in the second half of the year. Figures from QMS show that in July 2025 there were 381,700 beef-sired females aged 30 months and over on Scottish holdings. A 2.2% decline from a year earlier, representing a slowdown in the rate of decline – the lowest since January 2024. While Scotland’s breeding herd continues to contract, albeit at a slower rate, the decline in suckler herds in England and Wales has continued to outpace the decline in Scotland, meaning that demand for Scottish suckler bred calves is likely to remain high.

Breeding cattle at sales has been extremely strong with markets commenting on the demand for autumn calving cows, with prices paid for autumn calving heifers buoyant, surpassing all expectations. The recent autumn Stirling bull sales, with a total of 222 bulls sold saw all breed averages rise, with commercial buyers driving demand, investing in top quality genetics, no doubt on the back of strong weaned calf sale prices. The Simmental and Limousin breeds saw sale averages increase by £3,636 and £3,026 respectively on last year’s sale prices. Charolais bulls met a 95% clearance rate, with over 20 bulls achieving five-figure prices.

Scotland prime cattle prices (p/kg dwt) (Source: drawn from AHDB and IAAS data)

| Week Ending | R4L Steers (p/kg dwt) | -U4L Steers | Young Bulls -U3L | Cull cows | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Change on week | Diff over North Eng. | Change on week | Diff over North Eng. | Diff over North Eng. | R4L | -O3L | |||||

| 4-Oct-25 | 660.3 | 4.0 | 9.9 | 657.7 | 3.1 | -4.4 | 648.5 | 16.5 | 568.9 | 543.6 | |

| 11-Oct-25 | 657.6 | -2.7 | 2.4 | 655.7 | -2.0 | 2.6 | 649.6 | 7.1 | 571.6 | 542.9 | |

| 18-Oct-25 | 650.5 | -7.1 | -8.8 | 660.5 | 4.8 | -2.6 | 650.2 | 11.9 | 571.2 | 542.9 | |

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service