Business and Policy September 2025 – Beef

29 August 2025Falling consumer demand and imported beef impacting on finished prices

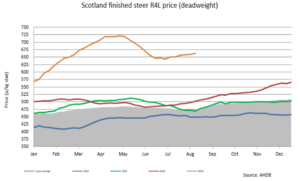

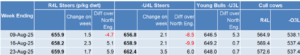

After a volatile spring, trade for prime cattle rose last month following a period of lower slaughterings, helping to rebalance the market. The start of August saw finishers quietly filled with cautious optimism following several weeks of stable deadweight prices with prices edging upwards. However, at the time of writing (26/08) prices are sitting at 645/650p/kg/dwt, with several processors having dropped prices by 5p/kg this week, reportedly due to lack of demand. While recent market statistics from Kantar/AHDB highlight consumer demand has dropped by 7.4% in 12 weeks, it cannot be a coincidence that imported beef is appearing on more supermarket shelves.

Dry weather impacting on numbers coming forward

So far, 2025 has been characterised by record prices on the back of the continuation of tightening cattle supplies. While AHDB data recently showed UK July slaughterings (161,900 head) to be unchanged compared to June, slaughter numbers are down 8% year on year equating to ~14,000 head of cattle; with low cattle availability being an issue throughout the UK and Europe.

Irish deadweight cattle prices have recently marginally overtaken UK prices, following a period where Irish prices were nearly £1/kg behind. Unprecedentedly low cattle supplies are being reported across the Irish sea as processors compete with auction marts. It is reported that Irish cattle slaughter numbers are expected to decrease by 5% to 1.72m head in 2025, down 87,000 head compared to 2024.

The extremely dry weather and low grass availability in parts of the country is hindering cattle supplies coming forward, with some finishers bringing cattle into sheds to ease grazing pressure and reduce the need to feed additional forage outside. Contributing to this decision is the current incredibly low value of barley. It is expected that carcase weights will increase on the back of supportive feed prices.

Looking ahead, it is anticipated that once the English and Welsh schools return in September, demand for beef will increase. As prime cattle slaughter levels across the past three months have been lower than expected, with dry weather impacting on grass availability, a degree of catch up is expected, supporting slaughter numbers for September. However, with the peak selling period for young bulls now over, cattle supplies are still expected to tighten relative to autumn 2024.

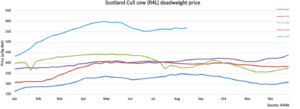

Lower slaughter numbers supporting cull cow prices

Cull cow prices have stabilised around 6% below their Spring peak but remain strong, continuing to run closer to prime prices than usual, reflecting low seasonal slaughter numbers and demand for manufacturing grade beef.

AHDB reports the UK year-to-date cow kill (Jan – Jul) stands at 320,000 head, a fall of 18,000 from the previous year. Prices rose significantly in mid-September last year, coinciding with ‘Back to School,’ but will this happen again this year?

Store cattle demand still strong despite dry weather

Store cattle continue to trade strongly. Although prices have eased slightly since the May peak, store values remain historically high, with many markets reporting sale averages of 420p/kg. Due to lack of availability south of the border coupled with TB risks and Bluetongue restrictions, English buyers are continuing to support Scottish store sales. However, with grass availability variable across the country, demand for smaller grazing stores has been affected at some markets.

With feed barley trading at low prices, it is anticipated that finishers will look to increase numbers, and those with arable crops likely to buy additional store cattle to feed.

As the autumn suckled calf sales move closer, several auctioneers I have spoken to recently expect high prices to be paid for calves linked to feed prices being less, and there simply being fewer calves coming forward year on year. With fewer beef bred calves available south of the border, a good level of demand for good quality beef bred suckled calves from English buyers is expected.

Looking ahead

Farmers continue to show resilience despite current market challenges, with several producers looking to increase cow numbers. However, the difficulty is the huge sums of money now associated with cattle enterprises, which means that it is virtually impossible to invest in breeding stock at the current prices.

Sarah Balfour, sarah.balfour@sac.co.uk

Scotland prime cattle prices (p/kg dwt) (Source: drawn from AHDB and IAAS data)

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service