Business and Policy June 2025 – Beef

30 May 2025Young bull numbers impacting on prices

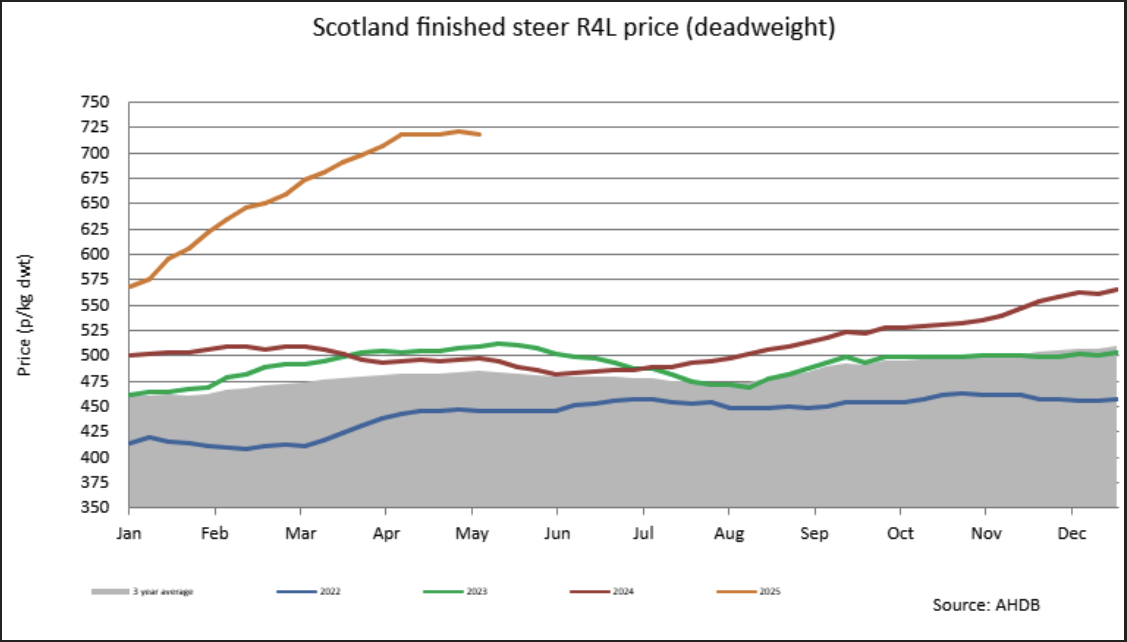

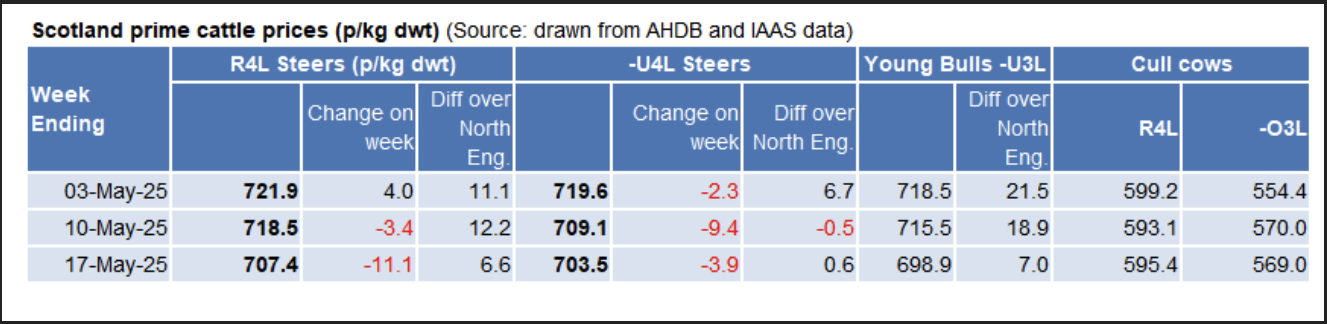

Deadweight steers in Scotland averaged 715p/kg in mid-May, up by £2.20p/kg compared with the same week last year. However, as predicted, slaughter availability has seen an uplift in May which has contributed to processors dropping prices. For two consecutive weeks, finished beef prices have dropped back by over 10p/kg/dwt. At the time of writing (27th May), prices are currently being quoted around 675p/kg/dwt for R4L grades. The consequence of several short weeks linked to bank holidays, increased cattle coming forward and the availability of young bulls, has meant that there are currently plenty of cattle about, which has led to processors dropping prices. However, prices remain well above the five-year average.

Looking ahead, reports suggest that prices could drop further in the coming weeks as more young bulls come available. These price drops are concerning for those having purchased expensive stores as they have seen a fall of approximately £160 in deadweight price per head. Traditionally, prime cattle availability drops in the summer months, with a lift in the beef price usually seen in August and September when numbers are especially tight.

Data from the British Cattle Movement Service in January highlighted that Scottish cattle supplies are likely to tighten more significantly in the second half of the year, as a reduced calf crop from 2023-24 starts to filter into the market. Looking further ahead, declining suckler numbers in 2024 signal reduced availability for 2026 and beyond, which is concerning given the current demand for beef and population growth in the UK and globally.

After questioning the sustainability of beef price trends in supermarkets since the start of the year, consumers are now being faced with price increases. The latest retail reports show retail prices have increased by 25% in 8 weeks, with sirloin steak seeing increases of 35% and roasting joints have risen by 17%. These increases mean that consumers are shying away from purchasing premium cuts which will also be contributing to finished prices falling. However, overall, consumer demand for beef remains strong, with data from Kantar highlighting that, in April, primary beef sales recorded a 1% increase, with diced beef recording a volume growth of 5% due to an increase in buyers, and buyer frequency.

Strong demand for manufacturing beef

Demand for manufacturing beef remains strong as consumers are encouraged by good BBQ weather. Kantar data shows increases of 3.1% and 0.6% for beef sausages and mince, respectively.

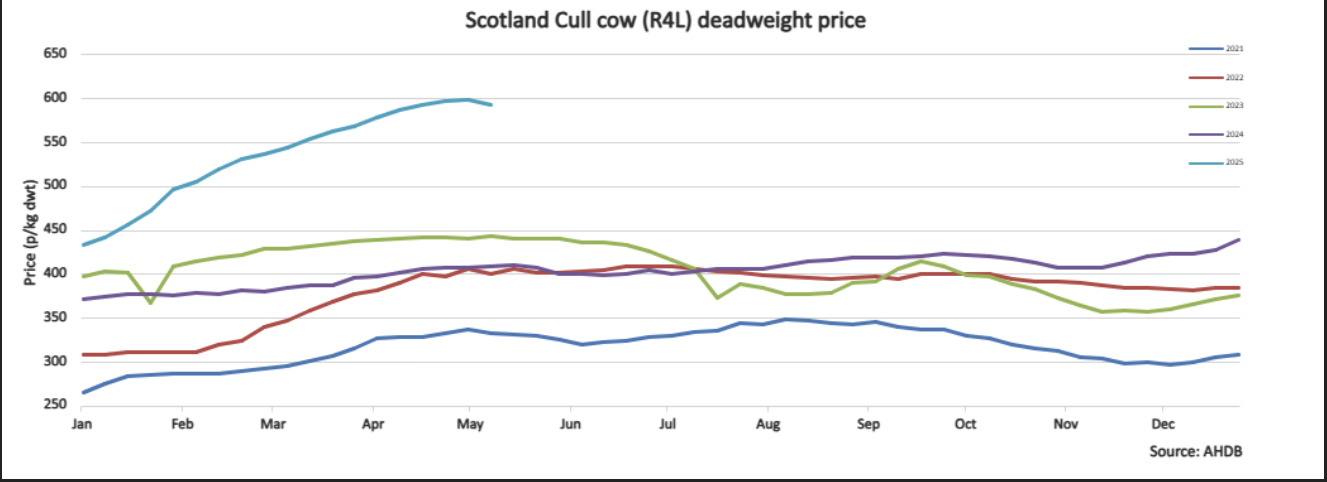

Trade for cull cows has remained elevated since the start of the year highlighting a tight manufacturing beef market. At the end of April, a 400kg carcase at 590p/kg equated to £2,360 and increase of £560 since December 2024. In the live market sale ring, it has been common to see cull cows achieving over £2,600. However, cow prices recently have also taken a drop. Reports suggest one of the drivers behind this is the volume of dairy cows currently coming forward due to tightening grass on many dairy farmers. At the time of writing, prices are sitting at around 590/595p/kg/dwt.

In the coming months, seasonal demand will influence trade for cull cows as we move further into BBQ season. Processors will be very conscious that greater demand for cheaper cuts such as burgers could create carcass balance issues.

Store Cattle Trade Back

In line with finished price, store cattle prices have also fallen back in recent weeks. The dry weather and lack of grass growth is now filtering into the store ring with recent market reports showing lower store prices. However, store cattle trade remains strong with many producers receiving 150p – 200p/kg liveweight more than the same time in 2024. Continental types have seen higher returns. Record store prices since the start of the year with store cattle reaching £6/kg liveweight in some parts in the past month, mean that, despite finishers also receiving record prices, margins have barley improved as sale values has also increased in the store ring.

Room for more?

Quality Meat Scotland (QMS) recently highlighted that two more cows per herd per year could realise Scotland’s economic potential by 2030. However, given the current elevated prices of breeding cattle, increasing cow numbers will prove to be extremely costly. Prices would need to stabilise to maintain confidence and incentivise producers to increase cow numbers.

Breeding cattle throughout May have met a flying trade, with all markets reporting increased prices for commercial outfits, with increased buyers ringside. Young cows with calves at foot have seen price increases as much as £1,000 up from 2024. Aberdeen & Northern Marts recently reported a sale average of £4,397 up £1,200 from 2024. Bulling heifers are now at levels over £2,700.

With prices at these levels, livestock farmer’s finances are under pressure, with huge volumes of money now tied up in cattle, making managing cash flows tricky.

Sarah Balfour, sarah.balfour@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service