Business and Policy May 2025 – Beef

1 May 2025Prices top £7 per kilo

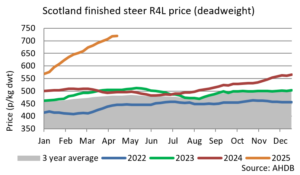

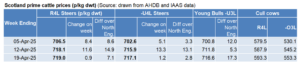

An unprecedented beef trade continues, with finished prices surpassing £7/kg, for the first time, as demand for beef continues to be outstripped by supply. At the start of April finished deadweight beef prices were sitting at 705p/kg, compared with 516p/kg in November, a reflection of the demand for beef. Finished prices are currently sitting more than £2/kg above the same week last year. For week ending April 19 Scottish R4L grade steers were sitting at 719p/kg/dwt, +9p from the week previous (+13p from the start of the month), over 60% higher compared with the 5-year average.

Since the start of the year beef prices have risen by 25%, with prices continuing to trend upwards in recent weeks despite shorter weeks over the Easter period. Consumer demand remains high for beef, coupled with a shortage of beef cattle which is leading to price surges as processors battle to secure supplies. Prices are predicted to remain stable in the coming weeks, although several processors have hinted towards prices levelling out as young bulls (sitting at 716p/kg/dwt currently +16p from start of April) come forward help to fill the gap in cattle availability. Consumer demand will remain the main driver behind prices.

Consumer demand and trade impacts

Now that prices have broken the £7/kg barrier, many are questioning the affordability of beef going forward as prices at these levels have yet to be tried and tested on consumers. When will these record farmgate prices filter down to the shelves? That is the question many are now wondering. Retailers have up until now not pushed prices up significantly, however reports suggest that price hikes are ahead for the coming months.

Unrelenting finished prices and demand for beef, with feed prices at affordable levels continues to support a flying store cattle trade. Bigger, heavier stores and long keep grazing types are all trading at record levels, with many cattle selling £400 a head more than this time last year, as favourable weather and good grass growth has also contributed to demand. Usually at this time of year demand is highest for grazing cattle, but the strong finished price has led to demand for the heavier stores.

As we move into summer, the weather will likely be a crucial decider in the demand for stores and subsequent pricing. Feed barley supplies are tightening faster than expected with finishers pushing cattle whilst the cattle trade is high, so this will likely have a bearing on store cattle prices.

Cull cow trade continues to exceed all expectations, driven by UK demand for manufacturing beef. For week ending 19 April, prices were sitting at 593p/kg/dwt + 14p from the start of the month and nearly £2/kg more than the same week in 2024. As we move into BBQ season, with plenty good weather forecast and several bank holiday weekends, demand for manufacturing beef is expected to remain high.

Three weeks ago, President Trump announced changes to tariffs, with an additional baseline 10% tariff rate applied to all UK imports. Key things to note include that the US represents only a small proportion of current UK beef exports. In 2024 just over 2,000 tonnes of product (mainly offal and boneless beef) was exported. The additional 10% on top of the current 26.4% would further increase the price of UK beef, which potentially could lend to a being a barrier to trade. Looking ahead how other nations react will depend on the full impact for the UK.

Farm Business Survey beef farms

In the year to May 2024 reported on here in the Scottish Farm Business Survey we see a 30% drop in net profit for these specialist beef farms compared to the previous year. Scrutinising the sample, this translates into 40% of these farms with net profit of less than £10 000, a further 30% of farms with net profit between £10 000 and £30 000, and only 1 in 20 with net profit greater than £100 000. This matters, as this is the amount of money left to pay the business owners for their time, and for reinvestment in the business. This fall in sector profitability was largely due to lower beef and cropping output in these businesses, and a 6% fall in total support payments, even though total input costs had fallen by 16%.

In this challenging backdrop the recent significantly higher prices for store and finished cattle will be a welcome boost to the sector.

However, there is always good news, with the top performing 25% of specialist beef farmers having net profit at 24% of their output, leaving a respectable margin to pay themselves and for reinvestment in their business.

Sarah Balfour, sarah.balfour@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service